Concept explainers

JOURNALIZE AND

REQUIRED

- 1. Journalize the adjusting entries on page 5 of the general journal.

- 2. Post the adjusting entries to the general ledger. (If you are not using the working papers that accompany this text, enter the balances provided in this problem before posting the adjusting entries.)

1.

Prepare adjusting entries for the given transactions.

Explanation of Solution

Adjusting entries:

Adjusting entries are those entries which are recorded at the end of the year, to update the income statement accounts (revenue and expenses) and balance sheet accounts (assets, liabilities, and stockholders’ equity) to maintain the records according to accrual basis principle.

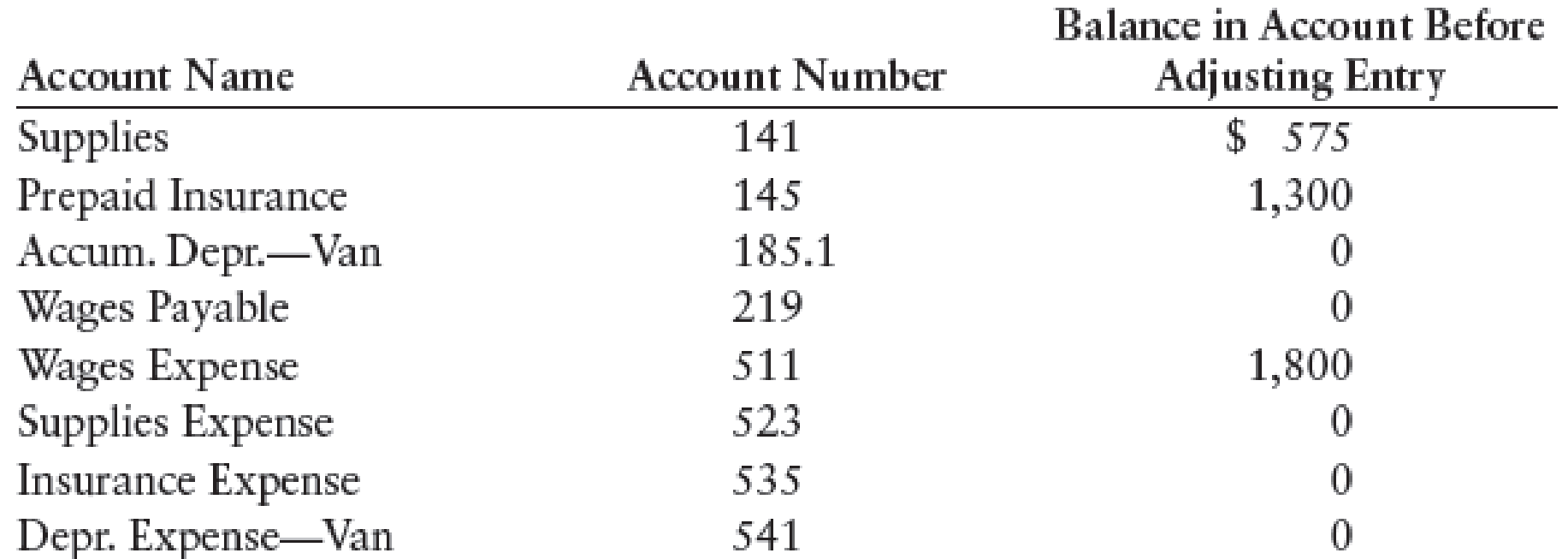

Prepare adjusting entries for the ending inventory on supplies on November 30, $185.

| Date | Account Titles and explanation | Post. Ref. | Debit ($) | Credit ($) | |

| November 30 | Supplies expense | 523 | 390 | ||

| Supplies | 141 | 390 | |||

| (To record the additional amount of supplies that must be used) | |||||

Table (1)

- Supplies expense (Expense) is a component of stockholder’s equity and there is an increase in the value of expense. Hence, debit the supplies expense by $390.

- Supplies are an asset and there is decrease in the value of an asset. Hence, credit the supplies by 390.

Prepare adjusting entries for the unexpired insurance as of November 30, $800.

| Date | Account Titles and explanation | Post. Ref. | Debit ($) | Credit ($) |

| November 30 | Insurance expense | 535 | 500 | |

| Prepaid insurance | 145 | 500 | ||

| (To record the insurance expense during the end of the year.) |

Table (2)

- Insurance expense (Expense) is a component of stockholder’s equity and there is an increase in the value of expense. Hence, debit the insurance expense by $500.

- Prepaid insurance is an asset and there is decrease in the value of an asset. Hence, credit the prepaid insurance by $500.

Prepare adjusting entries for the depreciation expense on van, $300.

| Date | Account Titles and explanation | Post. Ref. | Debit ($) | Credit ($) |

| November 30 | Depreciation expense | 541 | 300 | |

| Accumulated depreciation | 185.1 | 300 | ||

| (To record the depreciation expense at the end accounting of the year.) |

Table (3)

- Depreciation expense (Expense) is a component of stockholder’s equity and there is an increase in the value of expense. Hence, debit the depreciation expense by $300.

- Accumulated depreciation is a contra asset and it has increased. Therefore, credit the accumulated depreciation by $300.

Prepare adjusting entries for the wages earned but not yet paid as of November 30, $190.

| Date | Account Titles and explanation | Post. Ref. | Debit ($) | Credit ($) |

| November 30 | Wages expense | 511 | 190 | |

| Wages payable | 219 | 190 | ||

| (To record the wages earned but not yet paid to the employees at the end of the year.) |

Table (4)

- Wages expense (Expense) is a component of stockholder’s equity and there is an increase in the value of expense. Hence, debit the wages expense by $190.

- Wages payable is a liability and there is an increase in the value of the liability. Hence, credit the wages payable by $190.

2.

Explanation of Solution

Post the adjusting entries to the general ledger.

| Supplies Account No: 141 | |||||||

| Date | Item | Post ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| November | 1 | Unadjusted | 575 | ||||

| 30 | Adjusting | 390 | 185 | ||||

(Table 5)

| Prepaid insurance Account No: 145 | |||||||

| Date | Item | Post ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| November | 1 | Unadjusted | 1,300 | ||||

| 30 | Adjusting | 500 | 800 | ||||

(Table 6)

| Accumulated Depreciation- Van Account No:185.1 | |||||||

| Date | Item | Post ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| November | 30 | Adjusting | 300 | 300 | |||

(Table 7)

| Wages Payable Account No: 219 | |||||||

| Date | Item | Post ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| November | 30 | Adjusting | 190 | 190 | |||

(Table 8)

| Wages Expense Account No: 511 | |||||||

| Date | Item | Post ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| November | 1 | Unadjusted | 1,800 | ||||

| 30 | Adjusting | 190 | 1,990 | ||||

(Table 9)

| Supplies expense Account No: 523 | |||||||

| Date | Item | Post ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| November | 30 | Adjusting | 390 | 390 | |||

(Table 10)

| Insurance Expense Account No: 535 | |||||||

| Date | Item | Post ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| November | 30 | Adjusting | 500 | 500 | |||

(Table 11)

| Depreciation expense-Van Account No: 541 | |||||||

| Date | Item | Post ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| November | 30 | Adjusting | 300 | 300 | |||

(Table 12)

Want to see more full solutions like this?

Chapter 5 Solutions

Bundle: College Accounting, Chapters 1-27, Loose-Leaf Version, 22nd + CengageNOWv2, 2 terms Printed Access Card

- The following data were taken from the records of Splish Brothers Company for the fiscal year ended June 30, 2025. Raw Materials Inventory 7/1/24 $58,100 Accounts Receivable $28,000 Raw Materials Inventory 6/30/25 46,600 Factory Insurance 4,800 Finished Goods Inventory 7/1/24 Finished Goods Inventory 6/30/25 99,700 Factory Machinery Depreciation 17,100 21,900 Factory Utilities 29,400 Work in Process Inventory 7/1/24 21,200 Office Utilities Expense 9,350 Work in Process Inventory 6/30/25 29,400 Sales Revenue 560,500 Direct Labor 147,550 Sales Discounts 4,700 Indirect Labor 25,360 Factory Manager's Salary 63,400 Factory Property Taxes 9,910 Factory Repairs 2,500 Raw Materials Purchases 97,300 Cash 39,200 SPLISH BROTHERS COMPANY Income Statement (Partial) $arrow_forwardNo AIarrow_forwardL.L. Bean operates two factories that produce its popular Bean boots (also known as "duck boots") in its home state of Maine. Since L.L. Bean prides itself on manufacturing its boots in Maine and not outsourcing, backorders for its boots can be high. In 2014, L.L. Bean sold about 450,000 pairs of the boots. At one point during 2014, it had a backorder level of about 100,000 pairs of boots. L.L. Bean can manufacture about 2,200 pairs of its duck boots each day with its factories running 24/7.In 2015, L.L. Bean expects to sell more than 500,000 pairs of its duck boots. As of late November 2015, the backorder quantity for Bean Boots was estimated to be about 50,000 pairs. Question: Assume that a pair of 8" Bean Boots are ordered on December 3, 2015. The order price is $109. The sales tax rate in the state in which the boots are order is 7%. L.L. Bean ships the boots on January 29, 2016. Assume same-day shipping for the sake of simplicity. On what day would L.L. Bean recognize the…arrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub