Concept explainers

Comprehensive: Income Statement and

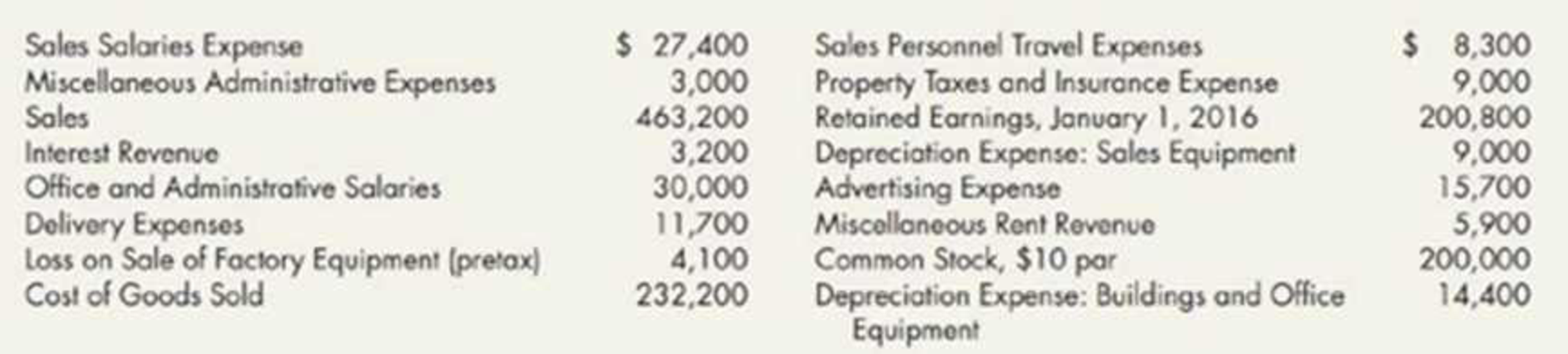

The following information is also available but is not reflected in the preceding accounts:

- a. The company sold Division E (a major component of the company) on August 2, 2019. During 2019, Division E had incurred a pretax loss from operations of $16,000. However, because the acquiring company could vertically integrate Division E into its facilities, Milwaukee Manufacturing was able to recognize a $42,000 pretax gain on the sale.

- b. On January 2, 2019, without warning, a foreign country expropriated a factory of Milwaukee Manufacturing which had been operating in that country. As a result of that expropriation, the company has incurred a pretax loss of $30,000.

- c. The common stock was outstanding for the entire year. A cash dividend of $1.20 per share was declared and paid in 2019.

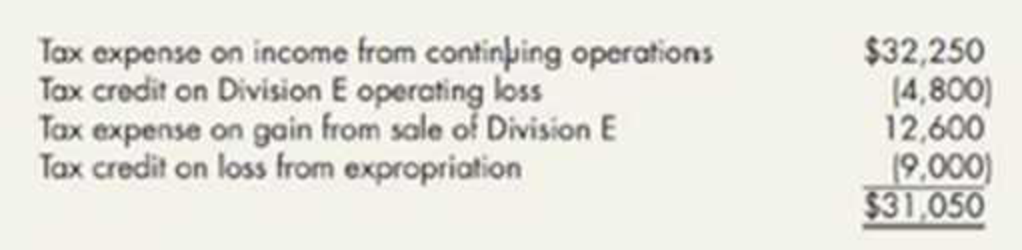

- d. The 2019 income tax expense totals $31,050 and consists of the following:

Required:

- 1. As supporting documents for Requirement 2, prepare separate supporting schedules for selling expenses and for general and administrative expenses (include

depreciation expense where applicable in these schedules). - 2. Prepare а 2019 multiple-step income statement for Milwaukee Manufacturing.

- 3. Prepare a 2019 retained earnings statement.

- 4. Next Level What was Milwaukee Manufacturing’s return on common equity for 2019 if its average shareholders’ equity during 2019 was $500,000? What is your evaluation of this return on common equity if its “target” for 2019 was 15%?

- 5. Next Level Discuss how Milwaukee Manufacturing’s income statement in Requirement 2 might be different if it used IFRS.

1.

Prepare a separate schedule for both selling and general and administrative expenses of Company M for the year ended December 31, 2019.

Explanation of Solution

Expenses: Expenses are costs incurred for the operations of a business. The costs incurred for generating revenues are rent expense, depreciation expense, general and administrative expenses, selling expenses, and utilities expense.

Prepare a separate schedule for both selling and general and administrative expenses of Company M for the year ended December 31, 2019 as follows:

| Company M | |

| For Year Ended December 31, 2019 | |

| Schedule 1: Selling Expenses | |

| Particulars | Amounts ($) |

| Sales salaries expense | $27,400 |

| Delivery expenses | 11,700 |

| Sales personnel travel expenses | 8,300 |

| Depreciation expense: sales equipment | 9,000 |

| Advertising expense | 15,700 |

| Total selling expenses | $72,100 |

| Schedule 2: General and Administrative Expenses | |

| Depreciation expense: buildings and office equipment | $14,400 |

| Office and administrative salaries | 30,000 |

| Property taxes and insurance expense | 9,000 |

| Miscellaneous administrative expenses | 3,000 |

| Total general and administrative expenses | $56,400 |

Table (1)

2.

Prepare a multi-step income statement of Company M for the year ended December 31, 2019.

Explanation of Solution

Multi-step income statement: The income statement represented in multi-steps with several subtotals, to report the income from principal operations, and separate the other expenses and revenues which affect net income, is referred to as multi-step income statement.

Prepare a multi-step income statement of Company M for the year ended December 31, 2019 as follows:

| Company M | ||

| Income Statement | ||

| For Year Ended December 31, 2019 | ||

| Particulars | Amounts ($) | Amounts ($) |

| Sales | 463,200 | |

| Less: Cost of goods sold | (232,200) | |

| Gross profit | 231,000 | |

| Less: Operating expenses: | ||

| Selling expenses (Schedule 1) | 72,100 | |

| General and administrative expenses (Schedule 2) | 56,400 | |

| Total operating expenses | (128,500) | |

| Operating income | 102,500 | |

| Less: Other items: | ||

| Interest revenue | 3,200 | |

| Miscellaneous rent revenue | 5,900 | |

| Loss from expropriation | (30,000) | |

| Loss on sale of factory equipment | (4,100) | (25,000) |

| Pretax income from continuing operations | 77,500 | |

| Less: Income tax expense (1) | (23,250) | |

| Income from continuing operations | 54,250 | |

| Results from discontinued operations: | ||

| Loss from operations of discontinued Division E (2) | (11,200) | |

| Gain on sale of Division E (3) | 29,400 | 18,200 |

| Net income (a) | 72,450 | |

| Number of common shares (b) | 20,000 shares | |

| Earnings per Common Share | $3.62 | |

Table (2)

Working note (1):

Compute the amount of income tax expense:

Working note (2):

Compute the loss from operations of discontinued Division E:

Working note (3):

Compute the Gain on sale of Division E:

3.

Prepare a retained earnings statement of Company M for the year ended December 31, 2019.

Explanation of Solution

Retained earnings: Retained earnings are that portion of profits which are earned by a company but not distributed to stockholders in the form of dividends. These earnings are retained for various purposes like expansion activities, or funding any future plans.

Prepare a retained earnings statement of Company M for the year ended December 31, 2019 as follows:

| Statement of Retained Earnings | |

| For Year Ended December 31, 2019 | |

| Particulars | Amount ($) |

| Retained earnings as on January 1,2019 | $200,800 |

| Add: Net income | 72,450 |

| 273,250 | |

| Less: Cash dividends (4) | (24,000) |

| Retained earnings as on December 31, 2019 | $249,250 |

Table (3)

Working note (4):

Compute the amount of cash dividend:

4.

Ascertain the return on common equity of Company M for 2019 and comment.

Explanation of Solution

Return on equity (ROE): This financial ratio evaluates a company’s efficiency in using stockholders’ equity to generate net income. So, ROE is a tool used to measure the performance of a company.

Ascertain the return on common equity of Company M for 2019 as follows:

Working note (5):

Compute the average shareholder’s equity:

The return on shareholders’ equity of Company M for the year 2019 is 17.0%, which is above the target of 15%. However, Company M had results from discontinued operations in 2019. The target return falls short to 12.8%

5.

State the manner in which the income statement of Company M given in requirement 2 gets differs, if it uses IFRS.

Explanation of Solution

The presentation and the content of the income statement might differ as follows:

- Either the single-step or multiple-step format could have been used.

- The term “Turnover” could have been used instead of sales.

- The expenses might be classified by their nature rather than their function.

- To adjust the depreciation expense, if it has revalued its property.

Want to see more full solutions like this?

Chapter 5 Solutions

INTERM.ACCT.:REPORTING...-CENGAGENOWV2

- The fiscal 2010 financial statements for Neptune, Inc report revenues of $14,892,615, net operating profit after tax of $987,625, net operating assets of $6,124,587. The fiscal 2009 balance sheet reports net operating assets of $5,995,633. What is Neptune s 2010 net operating profit margin?arrow_forwardPlease help with accounting question is solvearrow_forwardAccounting question is solvearrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning