Concept explainers

a

Calculate the total cost and cost per unit for each product line and calculate the combined cost of the products.

a

Explanation of Solution

Calculation of total

Hence, the total overhead cost is $960,000.

Calculation of allocation rate:

Hence, the allocation rate per labor hour is $48.

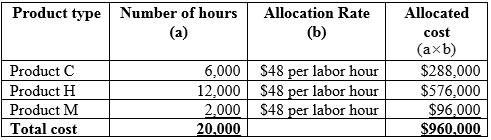

Calculation of overhead cost allocated to each type of product:

Table (1)

Hence, the total allocated cost is $960,000.

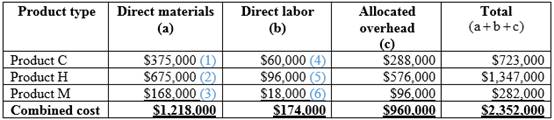

Calculation of total cost of each product line and combined cost of the products:

Table (2)

Hence, the total combined cost is $2,352,000.

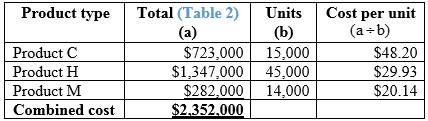

Calculation of cost per unit using traditional cost method:

SS

SS

Table (3)

Hence, the costs per unit for Products C, H, and M are $48.20, 29.93, and 20.14.

Working notes:

Calculation of direct material cost for Product C:

Hence, the direct material cost for Product C is $375,000.

(1)

Calculation of direct material cost for Product H:

Hence, the direct material cost for Product H is $675,000.

(2)

Calculation of direct material cost for Product M:

Hence, the direct material cost for Product M is $168,000.

(3)

Calculation of direct labor cost for Product C:

Hence, the direct labor cost for Product C is $168,000.

(4)

Calculation of direct labor cost for Product H:

Hence, the direct labor cost for home products is $96,000.

(5)

Calculation of direct labor cost for miniature products:

Hence, the direct labor cost for Product M is $18,000.

(6)

b

Calculate the total cost and cost per unit for each product line and calculate the combined cost of the products using ABC analysis.

b

Explanation of Solution

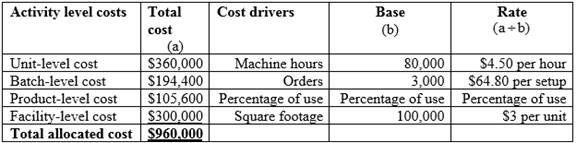

Calculation of allocation rate:

Table (4)

Hence, the total allocated cost is $960,000.

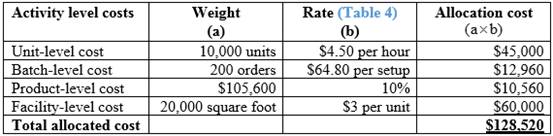

Calculation of allocated cost for Product C:

Table (5)

Hence, the total allocated cost for Product C is $128,520.

Calculation of allocated cost for Product H:

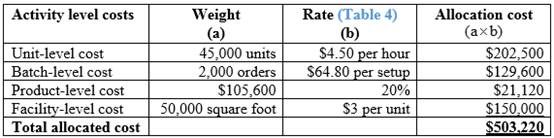

Table (6)

Hence, the total allocated cost for Product H is $503,220.

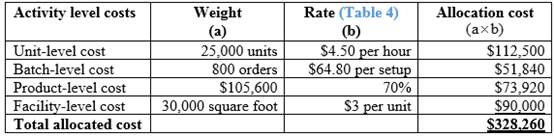

Calculation of allocated cost for Product M:

Table (7)

Hence, the total allocated cost for Product M is $328,260.

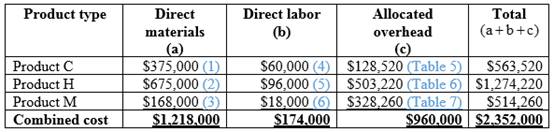

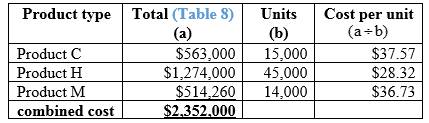

Calculation of total cost of each product line and combined cost of the products:

Table (8)

Hence, the total combined cost is $2,352,000.

Calculation of cost per unit using ABC system:

Table (9)

Hence, the costs per unit for products C, H, and M are $37.57, 28.32, and 36.73.

c

Explain the reason why the combined total cost is the same in both the requirements and is the ABC system more accurate than the traditional system.

c

Explanation of Solution

The ABC system or traditional system does not affect the total amount of allocated cost. Consequently, the total cost will remain the same under all the systems.

ABC system accurately traces the cost of the product than the traditional costing system. There is a difference in cost per unit under traditional system and ABC system. ABC system helps to improve pricing and in making other decisions.

Want to see more full solutions like this?

Chapter 5 Solutions

Fundamental Managerial Accounting Concepts

- Don't use ai given answer general accountingarrow_forwardArdor Ltd. purchased a new equipment that is expected to be used in operations for 6 years for $60,000. The salvage value of the equipment after 6 years is $6,000. Assume the equipment was purchased on the first day of the fiscal year so no partial-year depreciation is needed. Using the Straight-Line Depreciation Method, what is the value of accumulated depreciation at the end of year 4?arrow_forwardGeneral Accountingarrow_forward

- Accountingarrow_forwardI am trying to find the accurate solution to this financial accounting problem with the correct explanation.arrow_forwardKD Industries has 30 million shares outstanding with a market price of $20 per share and no debt. KD has had consistently stable earnings and pays a 35% tax rate. Management plans to borrow $200 million on a permanent basis through a leveraged recapitalization in which they would use the borrowed funds to repurchase outstanding shares. The present value of KD's interest tax shield is closest to a. $130 million b. $200 million c. $400 million d. $70 millionarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education