Concept explainers

United Snack Company sells 50-pound bags of peanuts to university dormitories for

a. What is the break-even point in bags?

b. Calculate the profit or loss on 7,000 bags and on 20,000 bags.

c. What is the degree of operating leverage at 19,000 bags and at 24,000 bags? Why does the degree of operating leverage change as the quantity sold increases?

d. If United Snack Company has an annual interest expense of

e. What is the degree of combined leverage at both sales levels?

a.

To calculate: The BEP of the bags for United Snack Company.

Introduction:

Break-even point (BEP):

It is a point of sale at which a company is in a no profit and no loss situation. The value of BEP is derived by dividing total fixed cost by the difference of revenue per unit and variable cost per unit.

Answer to Problem 13P

The BEP of United Snack company is 14,100 bags.

Explanation of Solution

Computation of the BEP of United Snack Company:

b.

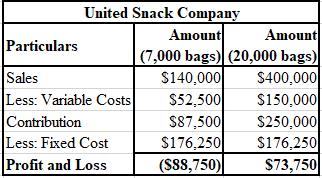

To calculate: The profit or loss for United Snack Company at 7,000 bags as well as 20,000 bags.

Introduction:

Profit or Loss:

It refers to the gain or loss arising from the commercial transactions during a specified period of time and is used to assess the company’s financial performance.

Answer to Problem 13P

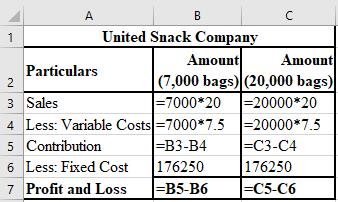

Calculation of the profit and loss on 7,000 bags and 20,000 bags for United Snack Company:

Explanation of Solution

The formulae used for the computation of profit or loss at 7,000 as well as 20,000 bags:

Working Notes:

Computation of variable cost per unit:

c.

To calculate: The DOL for both 19,000 and 24,000 bags of United Snack Company and also explain the reason behind the change of DOL with the increase in quantity sold.

Introduction:

Degree of Operating Leverage (DOL):

It is a multiple measurement ratio which determines the quantity of change in operating income of the company with the change in sales value.

Answer to Problem 13P

DOL of United Snack Company for 19,000 bags is 3.88 times and for 24,000 bags is 2.42 times.

The reason behind this change of DOL is that the leverage has gone down and is far away from BEP. Hence, we can say that the leverage has decreased and the organisation is operating on a greater profit base.

Explanation of Solution

Calculation of DOL for 19,000 bags:

Calculation of DOL for 24,000 bags:

d.

To calculate: The DFL of United Snack Company.

Introduction:

Degree of financial leverage (DFL):

It is a multiple measurement ratio which determines the quantity of change in operating income of the company with the change in sales value.

Answer to Problem 13P

The DFL of United Snack Company for 19,000 bags is 1.32 times and for 24,000 bags is 1.53 units.

Explanation of Solution

Calculation of DFL for 19,000 bags:

Calculation of DFL for 24,000 bags:

Working Notes:

Calculation of EBIT of 19,000 bags:

Calculation of EBIT of 24,000 bags:

e.

To calculate: The DCL of United Snack Company.

Introduction:

Degree of combined leverage (DCL):

It is a multiple measurement ratio which determines the quantity of change in operating income of the company with the change in sales value.

Answer to Problem 13P

The DCL of United Snack Company of 19,000 bags is 5.14 times and for 24,000 bags is 2.76 times.

Explanation of Solution

Computation of DCL of 19,000 bags:

Computation of DCL of 24,000 bags:

Want to see more full solutions like this?

Chapter 5 Solutions

EBK FOUNDATIONS OF FINANCIAL MANAGEMENT

- A firm needs to raise $950,000 but will incur flotation costs of 5%. How much will it pay in flotation costs? Multiple choice question. $55,500 $50,000 $47,500 $55,000arrow_forwardWhile determining the appropriate discount rate, if a firm uses a weighted average cost of capital that is unique to a particular project, it is using the Blank______. Multiple choice question. pure play approach economic value added method subjective approach security market line approacharrow_forwardWhen a company's interest payment Blank______, the company's tax bill Blank______. Multiple choice question. stays the same; increases decreases; decreases increases; decreases increases; increasesarrow_forward

- For the calculation of equity weights, the Blank______ value is used. Multiple choice question. historical average book marketarrow_forwardA firm needs to raise $950,000 but will incur flotation costs of 5%. How much will it pay in flotation costs? Multiple choice question. $50,000 $55,000 $55,500 $47,500arrow_forwardQuestion Mode Multiple Choice Question The issuance costs of new securities are referred to as Blank______ costs. Multiple choice question. exorbitant flotation sunk reparationarrow_forward

- What will happen to a company's tax bill if interest expense is deducted? Multiple choice question. The company's tax bill will increase. The company's tax bill will decrease. The company's tax bill will not be affected. The company's tax bill for the next year will be affected.arrow_forwardThe total market value of a firm is calculated as Blank______. Multiple choice question. the number of shares times the average price the number of shares times the future price the number of shares times the share price the number of shares times the issue pricearrow_forwardAccording the to the Blank______ approach for project evaluation, all proposed projects are placed into several risk categories. Multiple choice question. pure play divisional WACC subjectivearrow_forward

- To invest in a project, a company needs $50 million. Given its flotation costs of 7%, how much does the company need to raise? Multiple choice question. $53.76 million $46.50 million $50.00 million $53.50 millionarrow_forwardWhile determining the appropriate discount rate, if a firm uses a weighted average cost of capital that is unique to a particular project, it is using the Blank______. Multiple choice question. economic value added method pure play approach subjective approach security market line approacharrow_forwardWhat are flotation costs? Multiple choice question. They are the costs incurred to issue new securities in the market. They are the costs incurred to insure the payment due to bondholders. They are the costs incurred to meet day to day expenses. They are the costs incurred to keep a project in the business.arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education