Concept explainers

United Snack Company sells 50-pound bags of peanuts to university dormitories for

a. What is the break-even point in bags?

b. Calculate the profit or loss on 7,000 bags and on 20,000 bags.

c. What is the degree of operating leverage at 19,000 bags and at 24,000 bags? Why does the degree of operating leverage change as the quantity sold increases?

d. If United Snack Company has an annual interest expense of

e. What is the degree of combined leverage at both sales levels?

a.

To calculate: The BEP of the bags for United Snack Company.

Introduction:

Break-even point (BEP):

It is a point of sale at which a company is in a no profit and no loss situation. The value of BEP is derived by dividing total fixed cost by the difference of revenue per unit and variable cost per unit.

Answer to Problem 13P

The BEP of United Snack company is 14,100 bags.

Explanation of Solution

Computation of the BEP of United Snack Company:

b.

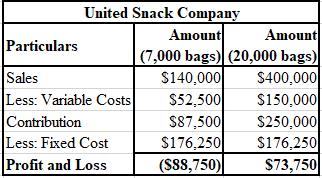

To calculate: The profit or loss for United Snack Company at 7,000 bags as well as 20,000 bags.

Introduction:

Profit or Loss:

It refers to the gain or loss arising from the commercial transactions during a specified period of time and is used to assess the company’s financial performance.

Answer to Problem 13P

Calculation of the profit and loss on 7,000 bags and 20,000 bags for United Snack Company:

Explanation of Solution

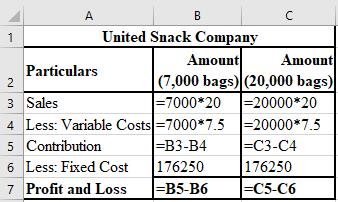

The formulae used for the computation of profit or loss at 7,000 as well as 20,000 bags:

Working Notes:

Computation of variable cost per unit:

c.

To calculate: The DOL for both 19,000 and 24,000 bags of United Snack Company and also explain the reason behind the change of DOL with the increase in quantity sold.

Introduction:

Degree of Operating Leverage (DOL):

It is a multiple measurement ratio which determines the quantity of change in operating income of the company with the change in sales value.

Answer to Problem 13P

DOL of United Snack Company for 19,000 bags is 3.88 times and for 24,000 bags is 2.42 times.

The reason behind this change of DOL is that the leverage has gone down and is far away from BEP. Hence, we can say that the leverage has decreased and the organisation is operating on a greater profit base.

Explanation of Solution

Calculation of DOL for 19,000 bags:

Calculation of DOL for 24,000 bags:

d.

To calculate: The DFL of United Snack Company.

Introduction:

Degree of financial leverage (DFL):

It is a multiple measurement ratio which determines the quantity of change in operating income of the company with the change in sales value.

Answer to Problem 13P

The DFL of United Snack Company for 19,000 bags is 1.32 times and for 24,000 bags is 1.53 units.

Explanation of Solution

Calculation of DFL for 19,000 bags:

Calculation of DFL for 24,000 bags:

Working Notes:

Calculation of EBIT of 19,000 bags:

Calculation of EBIT of 24,000 bags:

e.

To calculate: The DCL of United Snack Company.

Introduction:

Degree of combined leverage (DCL):

It is a multiple measurement ratio which determines the quantity of change in operating income of the company with the change in sales value.

Answer to Problem 13P

The DCL of United Snack Company of 19,000 bags is 5.14 times and for 24,000 bags is 2.76 times.

Explanation of Solution

Computation of DCL of 19,000 bags:

Computation of DCL of 24,000 bags:

Want to see more full solutions like this?

Chapter 5 Solutions

EBK FOUNDATIONS OF FINANCIAL MANAGEMENT

- If data is not clear in image or image blurr then comment i will write values . No use chatgpt . I will give unhelpfularrow_forwarddon't use ai . if image is blurr then tell mearrow_forwardBrightwoodę Furniture provides the following financial data for a given enod: Sales Aount ($) Per Unit ($) 150,000 33 Less Variable E. - L96,000 13 Contribwaon Margin c 10 Less Fixed Expenses 35,000 et Income 25,000 a. What is the company's CM ratio? b. If quarterly sales increase by $5,200 and there is no change in fixed expenses, by how much would you expect quarterly net operating income to increase?arrow_forward

- Charlotte Metals' operating activities for the year are listed below: Beginning inventory $950,600 Ending inventory Purchases Sales revenue $420,700 $825,900 $1,601,850 Operating expenses $720.70 What is the cost of goods sold (COGS) for the year?arrow_forwardNo AIarrow_forwarddata is unclear then commentarrow_forward

- Solve plzarrow_forwardAnswer correctly otherwise unhelpfularrow_forwardYou've collected the following information from your favorite financial website. 52-Week Price Dividend Hi 77.40 Lo Stock (Dividend) Yield % PE Ratio Close Price Net Change 10.43 Acevedo .36 2.6 6 13.90 -.24 55.81 33.42 Georgette, Incorporated 1.54 3.8 10 40.43 -.01 131.04 70.05 YBM 2.55 2.9 10 89.08 3.07 50.24 35.00 13.95 Manta Energy .80 5.2 6 20.74 Winter Sports .32 1.5 28 15.43 ?? -.26 .18 According to analysts, the growth rate in dividends for YBM for the next five years is expected to be 21 percent. Suppose YBM meets this growth rate in dividends for the next five years and then the dividend growth rate falls to 5.75 percent, indefinitely. Assume investors require a return of 14 percent on YBM stock. According to the dividend growth model, what should the stock price be today? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)arrow_forward

- 1. Waterfront Inc. wishes to borrow on a short-term basis without reducing its current ratio below 1.25. At present its current assets and current liabilities are $1,600 and $1,000 respectively. How much can Waterfront Inc. borrow?arrow_forwardQuestion 3Footfall Manufacturing Ltd. reports the following financialinformation at the end of the current year:Net Sales $100,000Debtor’s turnover ratio (based onnet sales)2Inventory turnover ratio 1.25Fixed assets turnover ratio 0.8Debt to assets ratio 0.6Net profit margin 5%Gross profit margin 25%Return on investment 2%Use the given information to fill out the templates for incomestatement and balance sheet given below:Income Statement of Footfall Manufacturing Ltd. for the year endingDecember 31, 20XX(in $)Sales 100,000Cost of goodssoldGross profitOther expensesEarnings beforetaxTax @50%Earnings aftertaxBalance Sheet of Footfall Manufacturing Ltd. as at December 31, 20XX(in $)Liabilities Amount Assets AmountEquity Net fixed assetsLong termdebt50,000 InventoryShort termdebtDebtorsCashTOTAL TOTALarrow_forwardSolve correctly and no aiarrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning