Concept explainers

Comprehensive:

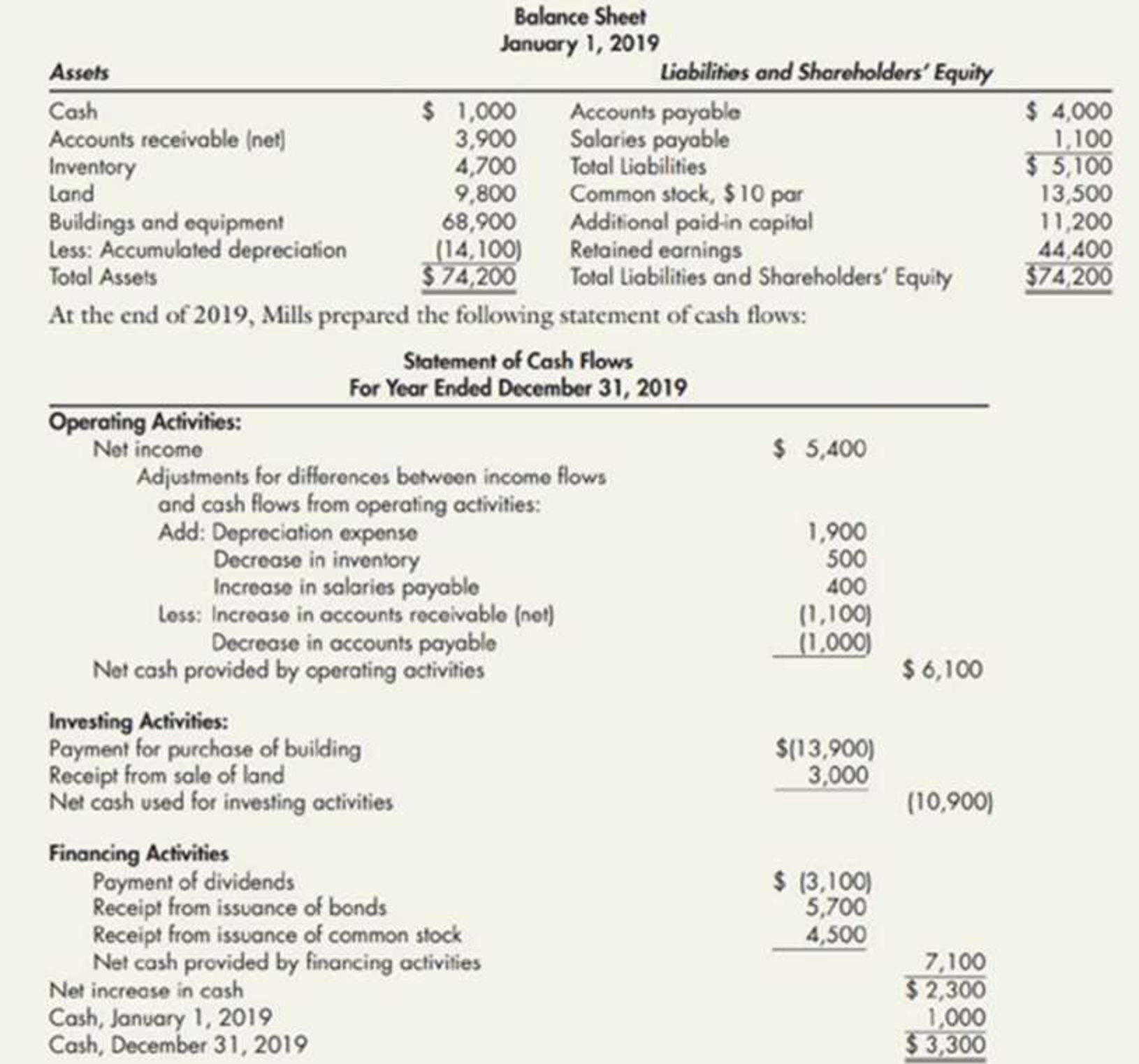

Additional information related to the statement of cash flows:

- 1. The long-term bonds have a face value of $6,000 and were issued on December 31, 2019.

- 2. The building was purchased on December 30, 2019.

- 3. The land was sold at its original cost.

- 4. The common stock which was sold totaled 300 shares and had a par value of $10 per share.

Required:

Next Level Prepare a classified balance sheet for Mills as of December 31, 2019. (Hint. Review the information on the statement of cash flows and the balances in the beginning balance sheet accounts to determine the impact on the ending balance sheet accounts.)

Prepare a classified balance sheet of Company M for the year ended December 31, 2019.

Explanation of Solution

Classified balance sheet: The main elements of balance sheet assets, liabilities, and stockholders’ equity are categorized or classified further into sections, and sub-sections in a classified balance sheet. Assets are further classified as current assets, long-term investments, property, plant, and equipment (PPE), and intangible assets. Liabilities are classified into two sections current and long-term. Stockholders’ equity comprises of common stock and retained earnings. Thus, the classified balance sheet includes all the elements under different sections.

Prepare a classified balance sheet of Company M for the year ended December 31, 2019 as follows:

| Company M | ||

| Balance Sheet | ||

| For Year Ended December 31, 2018 | ||

| Assets: | Amount ($) | Amount ($) |

| Current Assets: | ||

| Cash (1) | 3,300 | |

| Accounts receivable (net) (2) | 5,000 | |

| Inventory (3) | 4,200 | |

| Total current assets | 12,500 | |

| Property, Plant, and Equipment: | ||

| Land (4) | 6,800 | |

| Buildings and equipment (5) | 82,800 | |

| Less: Accumulated depreciation (6) | (16,000) | |

| Total property, plant, and equipment | 73,600 | |

| Total Assets | 86,100 | |

| Liabilities: | ||

| Current Liabilities: | ||

| Accounts payable (7) | 3,000 | |

| Salaries payable (8) | 1,500 | |

| Total current liabilities | 4,500 | |

| Long-Term Liabilities: | ||

| Bonds payable | 6,000 | |

| Less: Discount on bonds payable (9) | (300) | |

| Total long-term liabilities | 5,700 | |

| Total Liabilities (a) | 10,200 | |

| Shareholders’ Equity: | ||

| Contributed Capital: | ||

| Common stock, $10 par (10) | 16,500 | |

| Additional paid-in capital (11) | 12,700 | |

| Total contributed capital | 29,200 | |

| Retained earnings (12) | 46,700 | |

| Total Shareholders’ Equity (b) | 75,900 | |

| Total Liabilities and Shareholders’ Equity | 86,100 | |

Table (1)

Working note (1):

Compute the amount of cash:

Working note (2):

Compute the amount of accounts receivable:

Working note (3):

Compute the amount of inventory:

Working note (4):

Compute the value of land:

Working note (5):

Compute the value of building and equipment:

Working note (6):

Compute the amount of accumulated depreciation:

Working note (7):

Compute the amount of accounts payable:

Working note (8):

Compute the amount of salaries payable:

Working note (9):

Compute the amount of discount on bonds payable:

Working note (10):

Compute the amount of common stock:

Working note (11):

Compute the amount of additional paid-in capital:

Working note (12):

Compute the amount of retained earnings:

Want to see more full solutions like this?

Chapter 5 Solutions

EBK INTERMEDIATE ACCOUNTING: REPORTING

- The completed Payroll Register for the February and March biweekly pay periods is provided, assuming benefits went into effect as anticipated. Required: Using the payroll registers, complete the General Journal entries as follows: February 10 Journalize the employee pay. February 10 Journalize the employer payroll tax for the February 10 pay period. Use 5.4 percent SUTA and 0.6 percent FUTA. No employees will exceed the FUTA or SUTA wage base. February 14 Issue the employee pay. February 24 Journalize the employee pay. February 24 Journalize the employer payroll tax for the February 24 pay period. Use 5.4 percent SUTA and 0.6 percent FUTA. No employee will exceed the FUTA or SUTA wage base. February 28 Issue the employee pay. February 28 Issue payment for the payroll liabilities. March 10 Journalize the employee pay. March 10 Journalize the employer payroll tax for the March 10 pay period. Use 5.4 percent SUTA and 0.6 percent FUTA. No employees will exceed the FUTA or SUTA wage base.…arrow_forwardPlease given step by step explanation general accounting questionarrow_forwardDon't use ai solution please given answer general accountingarrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning