MANAGERIAL ACCOUNTING FOR MANGER CONNEC

6th Edition

ISBN: 9781266809132

Author: Noreen

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 4A, Problem 4A.5P

Super-Variable Costing, Variable Costing, and Absorption Costing Income Statements LO4—2, LO4—6

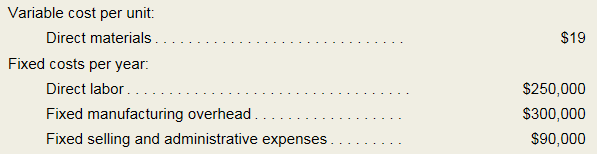

Bracey Company manufactures and sells one product. The following information pertains to the company’s first year of operations:

The company does not incur any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, Bracey produced 20,000 units and sold 18,000 units. The selling price of the company’s product is $55 per unit.

Required:

- Assume the company uses super-variable costing:

- Compute the unit product cost for the year.

- Prepare an income statement for the year.

- Assume the company uses a variable costing system that assigns $12.50 of direct labor cost to each unit produced:

- Compute the unit product cost for the year.

- Prepare an income statement for the year.

- Assume the company uses an absorption costing system that assigns $12.50 of direct labor cost and $15.00 of fixed

manufacturing overhead cost to each unit produced: - Compute the unit product cost for the year.

- Prepare an income statement for the year.

- Prepare a reconciliation that explains the difference between the super-variable costing and variable costing net operating incomes. Prepare another reconciliation that explains the difference between the super-variable costing and absorption costing net operating incomes.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The rate return on assets for 2012 was ?

High value Hardware began

Sub. General accounting

Chapter 4A Solutions

MANAGERIAL ACCOUNTING FOR MANGER CONNEC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- How much would you expect quarterly net operating income to increase?arrow_forwardAcp Distributors purchased a cooling system for its storage warehouse at a cost of $92,500. The cooling system has an estimated residual value of $7,000 and an estimated useful life of 10 years. What is the amount of the annual depreciation computed by the straight-line method?arrow_forwardNonearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Pricing Decisions; Author: Rutgers Accounting Web;https://www.youtube.com/watch?v=rQHbIVEAOvM;License: Standard Youtube License