Concept explainers

Super-Variable Costing Income Statement LO4—6

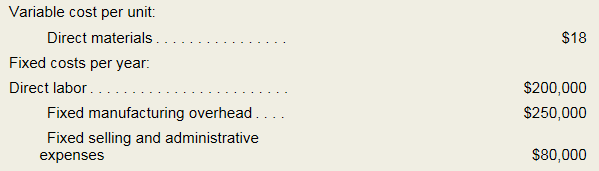

Zola Company manufactures and sells one product. The following information pertains to the company’s first year of operations:

The company does not incur any variable

Required:

- Assume the company uses super-variable costing:

- Compute the unit product cost for the year.

- Prepare an income statement for the year.

Concept introduction:

Income statement:

The income statement tells about the revenues earned and expenses incurred by the company in a specific period of time. It is also known as operations statement, earnings statement, revenue statement or profit, and loss statement.

- Calculate the unit product cost.

- Prepare an income statement for the given year.

Answer to Problem 4A.1E

- The unit product cost is $18.

- The income statement of Company Z is as follows:

| Company Z | |||

| Income Statement | |||

| Particulars | Amount (Unit)(a) | Units(b) | Total amount(c = a × b) |

| Sales | $50 | 20000 | $1,000,000 |

| Less: Variable cost | ($18) | 20000 | ($360,000) |

| Contribution margin (a) | $640,000 | ||

| Less: Fixed costs | |||

| Direct labor | $200,000 | ||

| Fixed manufacturing cost | $250,000 | ||

| Fixed selling and administration expenses | $80,000 | ||

| Total fixed costs (b) | $530,000 | ||

| Net operating income (c = a -b) | $110,000 | ||

Table: (1)

Explanation of Solution

(a)

Calculate the unit product cost:

The company uses the variable costing method. Under the variable costing method, the variable cost is considered as the product cost. In the given case, the variable cost of the product is $18.

Thus, the unit product cost is $18.

(b)

Prepare an income statement for the given year:

| Company Z | |||

| Income Statement | |||

| Particulars | Amount (Unit)(a) | Units(b) | Total amount(c = a × b) |

| Sales | $50 | 20000 | $1,000,000 |

| Less: Variable cost | ($18) | 20000 | ($360,000) |

| Contribution margin (a) | $640,000 | ||

| Less: Fixed costs | |||

| Direct labor | $200,000 | ||

| Fixed manufacturing cost | $250,000 | ||

| Fixed selling and administration expenses | $80,000 | ||

| Total fixed costs (b) | $530,000 | ||

| Net operating income (c = a -b) | $110,000 | ||

Table: (2)

Want to see more full solutions like this?

Chapter 4A Solutions

MANAGERIAL ACCOUNTING F/MGRS.

- A company sells small motors as a component part to automobiles. The Model 101 motor sells for $850 and has per-unit variable costs of $400 associated with its production. The company has fixed expenses of $90,000 per month. In August, the company sold 425 of the Model 101 motors. A. Calculate the contribution margin per unit for the Model 101. B. Calculate the contribution margin ratio of the Model 101. C. Prepare a contribution margin income statement for the month of August.arrow_forwardProblem 5 (Super-Variable Costing and Variable Costing Unit Product Costs and Income Statements) Lyns Company manufactures and sells one product. The following information pertains to the company's first year of operations: Variable cost per unit: Direct materials Fixed costs per year: 130 P7,500,000 P4,200,000 P1,100,000 Direct labor Fixed manufacturing overhead Fixed selling and administrative expenses The company does not incur any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, Lyns produced 60,000 units and sold 52,000 units. The selling price of the company's product is P400 per unit. Required: 1. Assume the company uses super-variable costing: a. Compute the unit product cost for the year. b. Prepare an income statement for the year. 2. Assume the company uses a variable costing system that assigns P125.00 of direct labor cost to each unit produced: a. Compute the unit product cost for the year. b.…arrow_forwardQ. No. 2: Martinez Company's relevant range of production is 15,000 units to 25,000 units. When it produces and sells 17,500 units, its average costs per unit are as follows: Average Cost per Unit ($) Selling Price Direct materials Direct labor. Variable manufacturing overhead Fixed manufacturing overhead. Fixed selling expense Fixed administrative expense Sales commissions Variable administrative expense 50 10 6. 5. 3 2 2.5 Required: a. For financial accounting purposes, what is the total amount of product costs incurred to make 17,500 units? b. If 18,500 units are produced and sold, calculate the variable cost per unit and total for units produced and sold? c. If 19,000 units are produced, what is the average fixed manufacturing cost per unit produced? d. if 19,500 units are produced, what is the total amount of manufacturing overhead cost incurred to support this level of production? What is this total amount expressed on a per unit basis?arrow_forward

- Need help with this accounting questionarrow_forwardm.4arrow_forwardSuper-Variable Costing and Variable Costing Unit Product Costs and Income Statements Ogilvy Company manufactures and sells one product. The following information pertains to each of the company’s first three years of operations: The company does not incur any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, Ogilvy produced 60,000 units and sold 60,000 units. During its second year of operations, it produced 60,000 units and sold 55,000 units. In its third year, Ogilvy produced 60,000 units and sold 65,000 units. The selling price of the company’s product is $45 per unit. Required: 1. Assume the company uses super-variable costing: a. Compute the unit product cost for Year 1, Year 2, and Year 3. b. Prepare an income statement for Year 1, Year 2, and Year 3. 2. Assume the company uses a variable costing system that assigns $9 of direct labor cost to each unit produced: a. Compute the unit product cost for Year 1,…arrow_forward

- Super-Variable Costing and Variable Costing Unit Product Costs and Income Statements Kelly Company manufactures and sells one product. The following information pertains to each of the company’s first two years of operations: The company does not incur any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, Kelly produced 50,000 units and sold 40,000 units. During its second year of operations, it produced 50,000 units and sold 60,000 units. The selling price of the company’s product is $50 per unit. Required: 1. Assume the company uses super-variable costing: a. Compute the unit product cost for Year 1 and Year 2. b. Prepare an income statement for Year 1 and Year 2. 2. Assume the company uses a variable costing system that assigns $10 of direct labor cost to each unit produced: a. Compute the unit product cost for Year 1 and Year 2. b. Prepare an income statement for Year 1 and Year 2. 3. Prepare a reconciliation…arrow_forwardWant the Correct answerarrow_forwardPlease do not give solution in image format thank youarrow_forward

- ssarrow_forwardGive true answer this accounting questionarrow_forwardces Ас Graw Hill ! Q A Required information [The following information applies to the questions displayed below.] Martinez Company's relevant range of production is 7,500 units to 12,500 units. When it produces and sells 10,000 units, its average costs per unit are as follows: Direct materials Direct labor N Variable manufacturing overhead Fixed manufacturing overhead Fixed selling expense Fixed administrative expense Sales commissions Variable administrative expense 7. If 8,000 units are produced, what is the average fixed manufacturing cost per unit produced? Average fixed manufacturing cost per unit @ 2 W S #3 X 2.2 E D $ 4 8 B N J 2023-01...0.40 PM 2023-01...2.52 PM 2022-12 A 1 ( ( 9 * K M ) 0 O 3 P commarrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning