MyLab Accounting with Pearson eText -- Access Card -- for Horngren's Accounting

11th Edition

ISBN: 9780133877571

Author: Tracie L. Miller-Nobles, Brenda L. Mattison, Ella Mae Matsumura

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 4, Problem P4.36BPGB

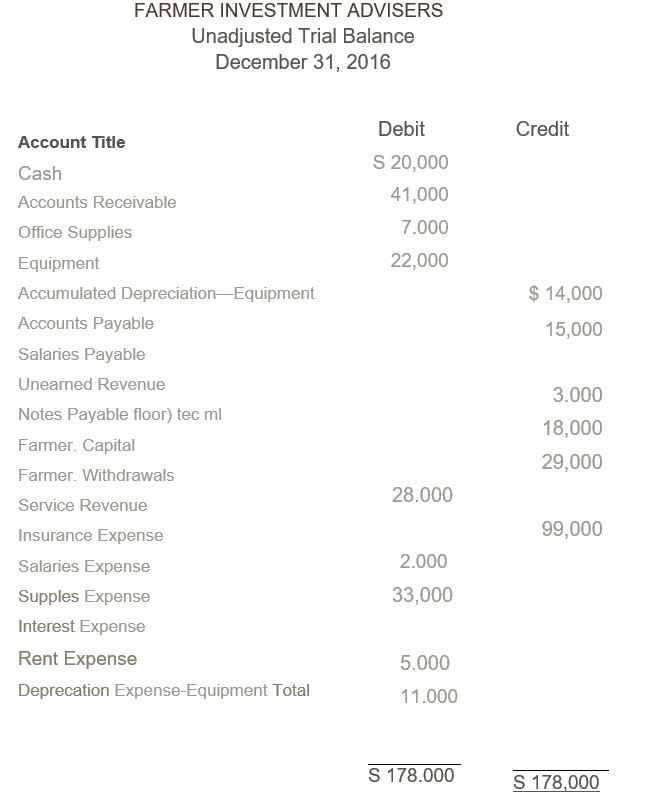

Preparing a worksheet, financial statements, and closing entries

The unadjusted

fnllnws:

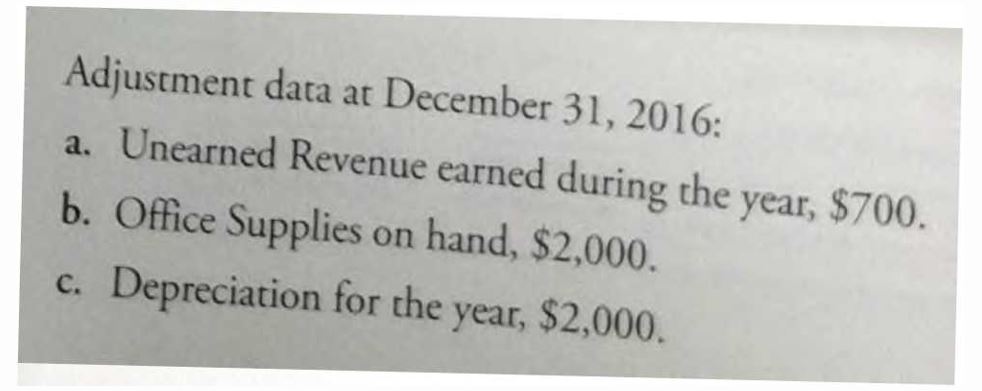

d. Accrued Salaries Expense, $5,000.

e. Accrued Service Revenue, $6,000.

Requirements

- Prepare a worksheet lor Parmer Invest mem Advisers at I )ecembet 3 I 2016.

- Prepare the income statement, the statement of own t q...........d t lassified balance, sheet in account format. Assume that thcie were no contributions made by the owner during the year.

- Prepare closing entries.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Want to this question answer general Accounting

Provide correct answer general accounting question

Correct answer general accounting? ?

Chapter 4 Solutions

MyLab Accounting with Pearson eText -- Access Card -- for Horngren's Accounting

Ch. 4 - Assets are listed on the balance sheet in the...Ch. 4 - Which of the following accounts would be included...Ch. 4 - Which situation indicates a net loss within the...Ch. 4 - Which of the following accounts is not closed?...Ch. 4 - What do closing entries accomplish? Learning...Ch. 4 - Which of the following is not a closing entry?...Ch. 4 - Which of the following accounts may appear on a...Ch. 4 - 8. Which of the following steps of the accounting...Ch. 4 - Clean Water Softener Systems has Cash of $600,...Ch. 4 - Which of the following statements concerning...

Ch. 4 - What document are financial statements prepared...Ch. 4 - What does the income statement report?Ch. 4 - Prob. 3RQCh. 4 - Prob. 4RQCh. 4 - Why are financial statements prepared in a...Ch. 4 - Prob. 6RQCh. 4 - Prob. 7RQCh. 4 - Prob. 8RQCh. 4 - Prob. 9RQCh. 4 - How could a worksheet help in preparing financial...Ch. 4 - If a business had a net loss for the year, where...Ch. 4 - Prob. 12RQCh. 4 - What are temporary accounts? Are temporary...Ch. 4 - What are permanent accounts? Are permanent...Ch. 4 - How is the Income Summary account used? Is it a...Ch. 4 - Prob. 16RQCh. 4 - If a business had a net loss for the year, what...Ch. 4 - What types of accounts are listed on the...Ch. 4 - Prob. 19RQCh. 4 - What is the current ratio, and how is it...Ch. 4 - Prob. 21ARQCh. 4 - Prob. S4.1SECh. 4 - Prob. S4.2SECh. 4 - Prob. S4.3SECh. 4 - Preparing a balance sheet (classified, report...Ch. 4 - Classifying balance sheet accounts Learning...Ch. 4 - Prob. S4.6SECh. 4 - Prob. S4.7SECh. 4 - Prob. S4.8SECh. 4 - Prob. S4.9SECh. 4 - Prob. S4.10SECh. 4 - S412 Identifying accounts included on a...Ch. 4 - Identifying steps in the accounting cycle Learning...Ch. 4 - Prob. S4.13SECh. 4 - Prob. S4.14SECh. 4 - Prob. E4.15ECh. 4 - Classifying balance sheet accounts Learning...Ch. 4 - Prob. E4.17ECh. 4 - Prob. E4.18ECh. 4 - Prob. E4.19ECh. 4 - Prob. E4.20ECh. 4 - Prob. E4.21ECh. 4 - Prob. E4.22ECh. 4 - Preparing a worksheet and closing entries Jadence...Ch. 4 - I 2 I I’rcpai ing t losing end ics I rom an...Ch. 4 - a post-dosing trial balance rics* illic r. s ano a...Ch. 4 - Prob. E4.26ECh. 4 - Prob. E4A.27ECh. 4 - Prob. P4.28APGACh. 4 - 'v"-1 evaluate a company •""' UM"B tl,e r“" ratio...Ch. 4 - Preparing a worksheet, financial statements, and i...Ch. 4 - WIUIAMt Osy ANVILS UrMdjuMvd lr „ ik'Uno. l>cu...Ch. 4 - Completing the accounting cycle from journal...Ch. 4 - Prob. P4.33APGACh. 4 - Prob. P4.34BPGBCh. 4 - Prob. P4.35BPGBCh. 4 - Preparing a worksheet, financial statements, and...Ch. 4 - Prob. P4.37BPGBCh. 4 - Completing d««„„„u„g cycle 6mm inn.n.l cn.ric, .0...Ch. 4 - Prob. P4.39BPGBCh. 4 - Completing the accounting cycle from adjusted...Ch. 4 - Prob. P4.41PSCh. 4 - Prob. 1.1CPCh. 4 - Prob. 1.2CPCh. 4 - Prob. 1.3CPCh. 4 - Prob. 1.4CPCh. 4 - Magness Delivery Service completed the fblowing...Ch. 4 - Prob. 1.6CPCh. 4 - Prob. 1.7CPCh. 4 - Prob. 1.8CPCh. 4 - Prob. 1.9CPCh. 4 - Prob. 2.1CPCh. 4 - Prob. 2.2CPCh. 4 - Prob. 2.3CPCh. 4 - Prob. 2.4CPCh. 4 - Prob. 2.5CPCh. 4 - Prob. 2.6CPCh. 4 - Prob. 2.7CPCh. 4 - Prob. 2.8CPCh. 4 - Prob. 4.1EICh. 4 - Prob. 4.1FCCh. 4 - Prob. 4.1FSC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub

Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q...

Accounting

ISBN:9781305080577

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:South-Western College Pub

IAS 29 Financial Reporting in Hyperinflationary Economies: Summary 2021; Author: Silvia of CPDbox;https://www.youtube.com/watch?v=55luVuTYLY8;License: Standard Youtube License