College Accounting, Chapters 1-9 (New in Accounting from Heintz and Parry)

22nd Edition

ISBN: 9781305666184

Author: James A. Heintz, Robert W. Parry

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 4, Problem 8SEB

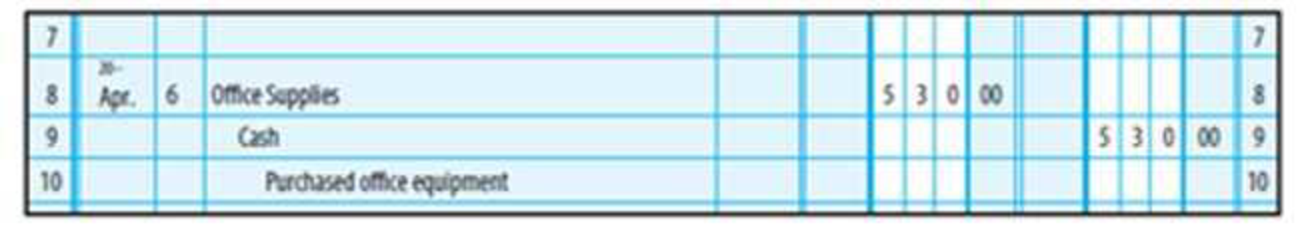

FINDING AND CORRECTING ERRORS Mary Smith purchased $350 worth of office equipment on account. The following entry was recorded on April 6. Find the error(s) and correct it (them) using the ruling method.

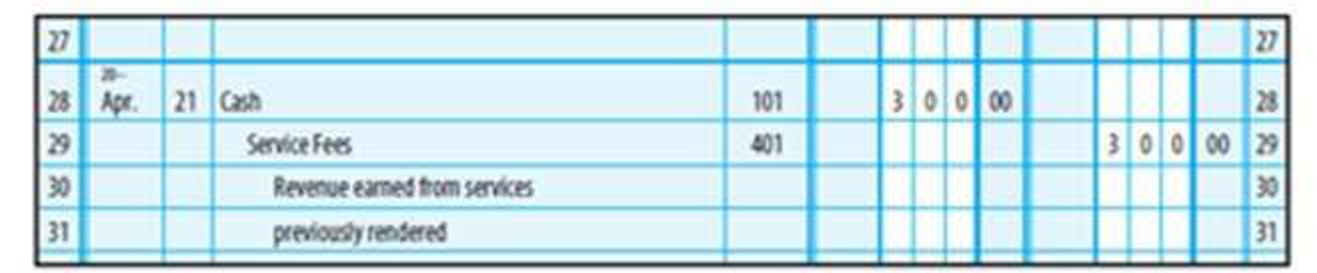

On April 25, after the transactions had been posted, Smith discovered the following entry contains an error. When her customer received services, Cash was debited, but no cash was received. Correct the error in the journal using the correcting entry method.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

16. Candy Company projects the following sales:

BB (Click on the icon to view the projected sales.)

Candy collects sales on account in the month after the sale. The Accounts Receivable balance on January 1 is $12,300, which represents December's sales on account. Candy projects the following cash receipts from customers:

BEE (Click on the icon to view the cash receipts from customers.)

Recalculate cash receipts from customers if total sales remain the same but cash sales are only 5% of the total.

Begin by computing the cash sales and sales on account for each month if cash sales are only 5% of the total.

January

February

March

Cash sales (5%)

Sales on account (95%)

Total sales

$

31,000 $

27,000 $

33,000

Data table

X

I

Data table

- X

January

February

March

January

February

March

Cash sales (10%)

$

3,100 $

27,900

Sales on account (90%)

2,700 $

24,300

3,300

29,700

Cash receipts from cash sales

Cash receipts from sales on account

$

3,100 $

2,700 $

12,300

27,900

3,300

24,300

$

31,000 $…

11. Kapper Company projects 2025 first quarter sales to be $35,000 and increase by 15% per quarter. Determine the projected sales for 2025 by quarter and in total. Round answers to the nearest dollar.

12. Fagg Company manufactures and sells bicycles. A popular model is the XC. The company expects to sell 2,100 XCs in 2024 and 2,000 XCs in 2025. At the beginning of 2024, Friedman has 380 XCs in Finished Goods Inventory and desires to h

of the next year's sales available at the end of the year. How many XCs will Fagg need to produce in 2024?

11. Kapper Company projects 2025 first quarter sales to be $35,000 and increase by 15% per quarter. Determine the projected sales for 2025 by quarter and in total. Round answers to the nearest dollar.

Determine the projected sales for each quarter, then compute the projected sales for 2025.

Base sale amount

Quarter 1

Multiplier for sales

increase

=

Projected sales for the

quarter

L

15. Callarman Company began operations on January 1 and has projected the following selling and administrative expenses:

(Click on the icon to view the selling and administrative expenses.)

Determine the cash payments for selling and administrative expenses for the first three months of operations. (Complete all answer boxes. Enter a "0" for zero amounts.)

Rent Expense

Utilities Expense

Depreciation Expense

Insurance Expense

Total cash payments for selling and administrative expenses

Data tables

January

February

March

Rent Expense

Utilities Expense

Depreciation Expense

Insurance Expense

$1,400 per month, paid as incurred

800 per month, paid in month after incurred

1,000 per month

50 per month, 9 months prepaid on January 1

Print

Done

Chapter 4 Solutions

College Accounting, Chapters 1-9 (New in Accounting from Heintz and Parry)

Ch. 4 - Source documents serve as historical evidence of...Ch. 4 - The chart of accounts lists capital accounts...Ch. 4 - No entries are made in the Posting Reference...Ch. 4 - When entering the credit item in a general...Ch. 4 - When an incorrect entry has been journalized and...Ch. 4 - Prob. 1MCCh. 4 - A revenue account will begin with the number...Ch. 4 - To purchase an asset such as office equipment on...Ch. 4 - When fees are earned and the customer promises to...Ch. 4 - When the correct numbers are used but are in the...

Ch. 4 - Prob. 1CECh. 4 - Prob. 2CECh. 4 - Prob. 3CECh. 4 - Prob. 4CECh. 4 - Trace the flow of accounting information through...Ch. 4 - Name a source document that provides information...Ch. 4 - Prob. 3RQCh. 4 - Prob. 4RQCh. 4 - Where is the first formal accounting record of a...Ch. 4 - Describe the four steps required to journalize a...Ch. 4 - In what order are the accounts customarily placed...Ch. 4 - Explain the primary advantage of a general ledger...Ch. 4 - Explain the five steps required when posting the...Ch. 4 - Prob. 10RQCh. 4 - Explain why the ledger can still contain errors...Ch. 4 - Prob. 12RQCh. 4 - What is a transposition error?Ch. 4 - Prob. 14RQCh. 4 - What is a correcting entry?Ch. 4 - Prob. 1SEACh. 4 - GENERAL JOURNAL ENTRIES For each of the following...Ch. 4 - GENERAL LEDGER ACCOUNTS Set up T accounts for each...Ch. 4 - GENERAL JOURNAL ENTRIES Diane Bernick has opened...Ch. 4 - GENERAL LEDGER ACCOUNTS; TRIAL BALANCE Set up...Ch. 4 - FINANCIAL STATEMENTS From the information in...Ch. 4 - Prob. 7SEACh. 4 - FINDING AND CORRECTING ERRORS Joe Adams bought 500...Ch. 4 - SERIES A PROBLEMS JOURNALIZING AND POSTING...Ch. 4 - JOURNALIZING AND POSTING TRANSACTIONS Jim Andrews...Ch. 4 - CORRECTING ERRORS Assuming that all entries have...Ch. 4 - Prob. 1SEBCh. 4 - GENERAL JOURNAL ENTRIES For each of the following...Ch. 4 - GENERAL LEDGER ACCOUNTS Set up T accounts for each...Ch. 4 - GENERAL JOURNAL ENTRIES Sengel Moon opened The...Ch. 4 - GENERAL LEDGER ACCOUNTS; TRIAL BALANCE Set up...Ch. 4 - FINANCIAL STATEMENTS From the information in...Ch. 4 - Prob. 7SEBCh. 4 - FINDING AND CORRECTING ERRORS Mary Smith purchased...Ch. 4 - JOURNALIZING AND POSTING TRANSACTIONS Benito...Ch. 4 - Prob. 10SPBCh. 4 - CORRECTING ERRORS Assuming that all entries have...Ch. 4 - MANAGING YOUR WRITING You are a public accountant...Ch. 4 - MASTERY PROBLEM Barry Bird opened the Barry Bird...Ch. 4 - CHALLENGE PROBLEM Journal entries and a trial...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Match the budget types to the definitions. Budget Types 5. Financial 6. Flexible 7. Operating 8. Operational 9. Static 10. Strategic Definitions a. Includes sales, production, and cost of goods sold budgets b. Long-term budgets c. Includes only one level of sales volume d. Includes various levels of sales volumes e. Short-term budgets f. Includes the budgeted financial statementsarrow_forward14. Cain Company is a sporting goods store. The company sells a tent that sleeps six people. The store expects to sell 280 tents in 2024 and 360 tents in 2025. At the beginning of 2024, Cain Company has 30 tents in Merchandise Inventory and desires to have 60% of the next year's sales available at the end of the year. How many tents will Cain Company need to purchase in 2024? Begin by selecting the labels, then enter the amounts to compute the budgeted tents to be purchased. Plus: Total tents needed Less: Budgetec Budgeted tents returned Budgeted tents to be sold Desired tents in ending inventory Tents in beginning inventory Zarrow_forwardCalculate Airbnb inventory turnover for the year 2024. ( (COGS) was $1.829 billion for the previous 12 months)(average inventory for 2024 is showing a significant increase, with the company reporting over $491 million) What does inventory turnover tells an investor?arrow_forward

- Cariman Company manufactures and sells three styles of door Handles: Gold, Bronze and Silver. Production takes 50, 50, and 20 machine hours to manufacture 1,000-unit batches of Gold, Bronze, and Silver Handles, respectively. The following additional data apply: Projected sales in units Per Unit data: Gold Bronze Silver 60,000 100,000 80,000 2. Determine the activity cost driver rate for setup costs and inspection costs? 3. Using the ABC system, for the Gold style of Handle: a. Calculate the estimated overhead costs per unit? b. Calculate the estimated operating profit per unit? 4. Explain the difference between the profits obtained from the traditional system and the ABC system. Which system provides a better estimate of profitability? Selling price $80 $40 $60 Direct materials $16 $8 $16 Direct labour $30 $6 $18 Overhead cost based on direct labour hours (traditional system) $24 $6 $18 Hours per 1,000-unit batch: Direct labour hours Machine hours Setup hours Inspection hours 80 20 60…arrow_forwardI need some help with problem B. I have done the work, but I'd like to make sure if I have done the calculations correctly. If you see anything else that is wrong, please let me know.arrow_forwardModule 6 Discussion Discuss the significance of recognizing the time value of money in the long-term impact of the capital budgeting decision. 60 Replies, 59 Unread Σarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Accounting Changes and Error Analysis: Intermediate Accounting Chapter 22; Author: Finally Learn;https://www.youtube.com/watch?v=c2uQdN53MV4;License: Standard Youtube License