Concept explainers

Exercise 4-7

Preparing a work sheet and recording closing entries

P1 P2

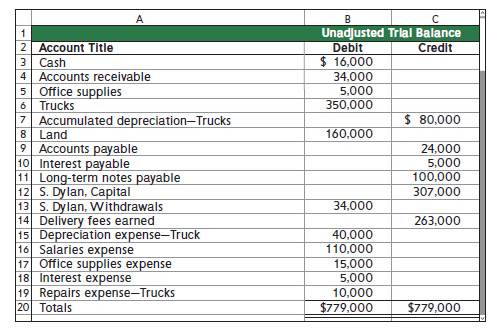

The following unadjusted

1. Use the following information about the company’s adjustments to complete a 10-column work sheet.

a. Unrecorded

b. The total amount of accrued interest expense at year-end is $6,000.

C. The cost of unused office supplies still available at year-end is $2,000.

2. Prepare the year-end closing entries for this company, and determine the capital amount to be reported on its year-end

Check Adj trial balance totals. $820.000: Net income. $39.000

Want to see the full answer?

Check out a sample textbook solution

Chapter 4 Solutions

Loose Leaf for Fundamental Accounting Principles

- I need help finding the accurate solution to this general accounting problem with valid methods.arrow_forwardWhat is the operating cycle?arrow_forwardIf Ryder Capital can give up one unit of future consumption and increase its current consumption by 0.94 units, what must be its real rate of interest?arrow_forward

- I am searching for the most suitable approach to this financial accounting problem with valid standards.arrow_forwardI am looking for the correct answer to this general accounting problem using valid accounting standards.arrow_forwardI am looking for the correct answer to this financial accounting question with appropriate explanations.arrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub