Concept explainers

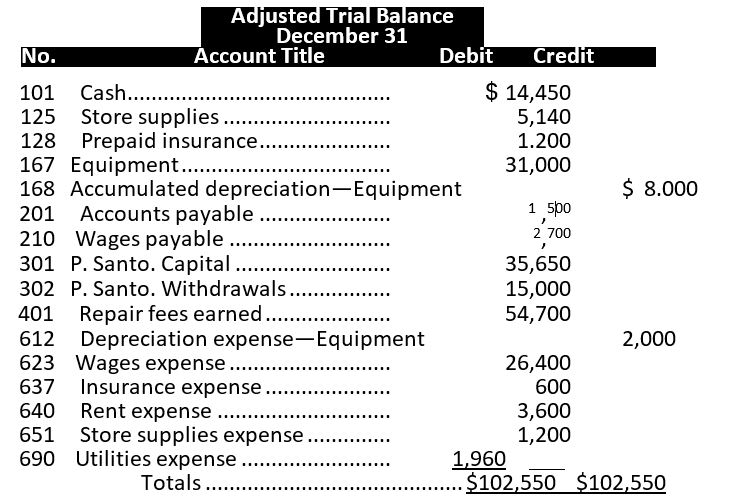

Problem 4-5B Preparing trial balances, closing entries, and financial statements C3 P2 P3

Santo Company's adjusted

Required

1. Prepare an income statement and a statement of owner's equity for the year and a classified

Capital account balance was $35.650 on December 31 of the prior year.

Check (1) Ending capital balance, $39,590

2. Enter the adjusted trial balance in the first two columns of a six-column table. Use the middle two columns for closing entry information and the last

two columns for a post-closing trial balance. Insert an Income Summary account (No. 301) as the last item in the trial balance.

(2)P-C trial balance totals, $51,790

3. Enter closing entry information in the sk-column table and prepare

Want to see the full answer?

Check out a sample textbook solution

Chapter 4 Solutions

FUNDAMENTAL ACCOUNTING PRINCIPLES

- Martin Manufacturing prepared a fixed budget of 85,000 direct labor hours, with estimated overhead costs of $425,000 for variable overhead and $120,000 for fixed overhead. Martin then prepared a flexible budget of 78,000 labor hours. How much are total overhead costs at this level of activity?arrow_forwardHow can I solve this financial accounting problem using the appropriate financial process?arrow_forwardPlease explain the solution to this general accounting problem with accurate principles.arrow_forward

- Can you solve this general accounting question with accurate accounting calculations?arrow_forwardCan you help me solve this general accounting problem with the correct methodology?arrow_forwardUse this information to determine the dollar amount of the FY 2023 Beginning work in process inventory.arrow_forward

- general accountingarrow_forwardJennifer Industries allocates overhead based on direct labor costs. Assume Jennifer expects to incur a total of $875,000 in overhead costs and $625,000 in direct labor costs. Actual overhead costs incurred totaled $890,000, and actual direct labor costs totaled $640,000. Jennifer's predetermined overhead rate is: a. 140.00% of direct labor cost. b. 128.13% of direct labor cost. c. 138.90% of direct labor cost. d. 130.95% of direct labor cost.arrow_forwardCan you solve this general accounting question with the appropriate accounting analysis techniques?arrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning