Pearson eText for Governmental and Nonprofit Accounting -- Instant Access (Pearson+)

11th Edition

ISBN: 9780137561667

Author: Robert Freeman, Craig Shoulders

Publisher: PEARSON+

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 4, Problem 5P

(GL and SL Entries) Prepare in proper form the

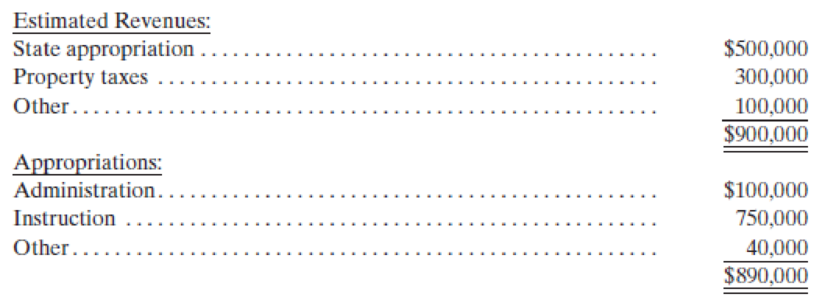

- 1. The annual operating budget (GAAP basis) provides for:

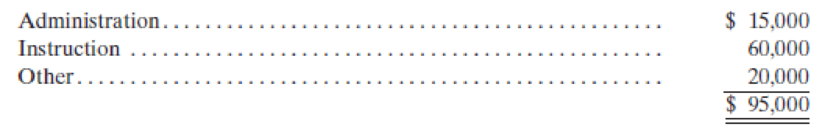

- 2. 2. Purchase orders and contracts for goods and services were approved at estimated costs of:

- 3. Property taxes were levied, $320,000, of which $15,000 are estimated to be uncollectible.

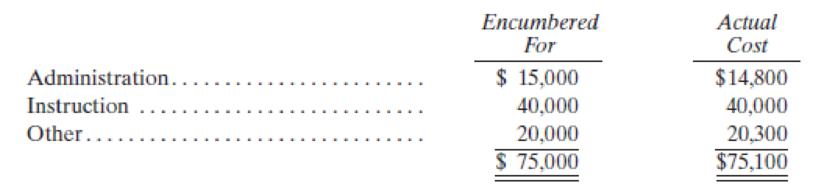

- 4. Most of the goods and services ordered in transaction 2 arrived and the invoices were approved and vouchered for payment:

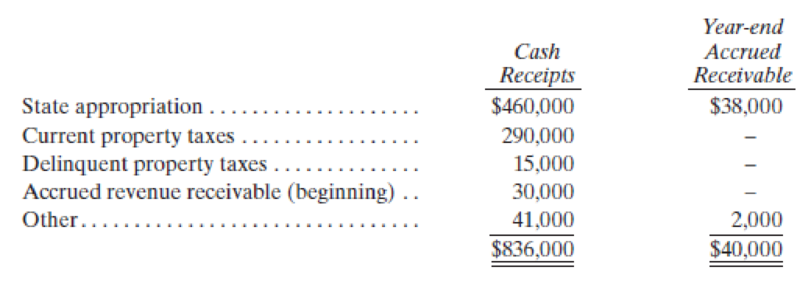

- 5. Cash receipts and year-end revenue accruals were:

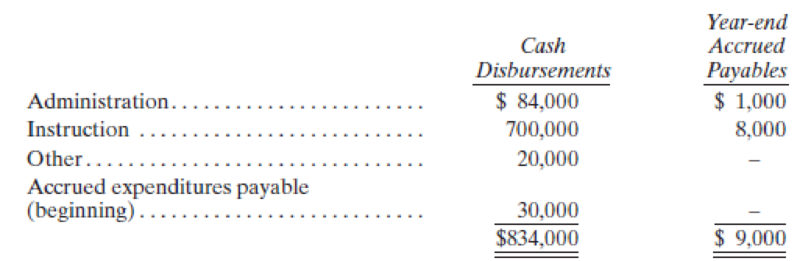

- 6. Cash disbursements, including payment of payroll and other unencumbered expenditures, and year-end expenditure accruals were:

- 7. Interfund transfers were ordered (not yet paid) as follows: (a) $25,000 to the Debt Service Fund to be used to pay general long-term debt principal and interest, and (b) $40,000 from an Internal Service Fund that is being discontinued.

- 8. It was discovered that $1,500 charged to Instruction (in transaction 6) should be charged to Transportation, which is financed through the General Fund.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What is the company's plantwide overhead rate? Accounting

Hendrix Corporation had annual sales of $75 million, which occurred evenly throughout the 365 days of the year. Its accounts receivable balance averaged $3 million. How long, on average, does it take the firm to collect on its sales? Answer

Kichi company had the following information

Chapter 4 Solutions

Pearson eText for Governmental and Nonprofit Accounting -- Instant Access (Pearson+)

Ch. 4 - Prob. 1QCh. 4 - What characteristics of expenditures distinguish...Ch. 4 - How does the purchase of a capital asset affect...Ch. 4 - Prob. 4QCh. 4 - Explain what is meant by General Ledger control...Ch. 4 - List and explain the five fund balance reporting...Ch. 4 - Prob. 7QCh. 4 - Prob. 8QCh. 4 - Prob. 9QCh. 4 - Prob. 11Q

Ch. 4 - Prob. 12QCh. 4 - Define the following interfund transaction terms...Ch. 4 - What are the most likely circumstances to cause...Ch. 4 - Explain the purpose, nature, and effect of the...Ch. 4 - Which of the following is a characteristic of a...Ch. 4 - Prob. 1.2ECh. 4 - Assume that Nathan County has levied its...Ch. 4 - Refer to the previous question. What amount of tax...Ch. 4 - Assume the following transactions that affected...Ch. 4 - Prob. 1.6ECh. 4 - The GAAP-based statements that are required to be...Ch. 4 - A city levies property taxes of 500,000 for its...Ch. 4 - At year end a school district purchases...Ch. 4 - A state borrowed 10,000,000 on a 9-month, 9% note...Ch. 4 - Charges for services rendered by a countys General...Ch. 4 - Prob. 2.5ECh. 4 - In the Statement of Revenues, Expenditures, and...Ch. 4 - The minimum expenditure classifications required...Ch. 4 - Which fund balance category is affected by having...Ch. 4 - Prob. 3.2ECh. 4 - Prob. 3.3ECh. 4 - The GAAP fund balance classifications are...Ch. 4 - The fund balance category that can have either a...Ch. 4 - The fund balance category used to reflect a...Ch. 4 - The fund balance category that must be zero if...Ch. 4 - Enabling legislation requiring that resources be...Ch. 4 - Prob. 4.3ECh. 4 - Prob. 4.4ECh. 4 - Prob. 4.5ECh. 4 - Prob. 5ECh. 4 - (Expenditure Accounting Entries) Record the...Ch. 4 - (Statement of Revenues, Expenditures, and Changes...Ch. 4 - (Fund Balance Classification) Your firm is...Ch. 4 - (Interfund Transactions and Errors) (a) Prepare...Ch. 4 - (General FundTypical Transactions) Prepare all...Ch. 4 - Prob. 3PCh. 4 - Prob. 4PCh. 4 - (GL and SL Entries) Prepare in proper form the...Ch. 4 - (Debt-Related Transactions) Prepare the general...Ch. 4 - (Closing Entries and Financial Statements) The...Ch. 4 - (Statement of Revenues, Expenditures, and Changes...Ch. 4 - Statement of Revenues, Expenditures, and Changes...Ch. 4 - Fund Balance Reporting (Fund Balance Reporting)...Ch. 4 - Prob. 1CCh. 4 - (Financial Statement PreparationCity of Savannah,...

Additional Business Textbook Solutions

Find more solutions based on key concepts

1-1. Define marketing and outline the steps in the marketing process. (AASCB: Communication)

Marketing: An Introduction (13th Edition)

(Interest rate determination) You’re looking at some corporate bonds issued by Ford, and you are trying to det...

Foundations Of Finance

The Warm and Toasty Heating Oil Company used to deliver heating oil by sending trucks that printed out a ticket...

Essentials of MIS (13th Edition)

Much of risk management consists of reducing risky behavior. What kinds of risky behavior have you observed amo...

Understanding Business

CHAPTER CASE

S&S Air’s Mortgage

Mark Sexton and Todd Story, the owners of S&S Air, Inc., were impressed by the ...

Essentials of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

Real options and its types. Introduction: The net present value is the variation between present cash inflows v...

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What is the gross profit margin?arrow_forwardHendrix Corporation had annual sales of $75 million, which occurred evenly throughout the 365 days of the year. Its accounts receivable balance averaged $3 million. How long, on average, does it take the firm to collect on its sales?arrow_forwardWhat was the dollar amount of under allocated or overallocated manufacturing overhead ?arrow_forward

- 5 POINTSarrow_forwardFalse Value Hardware began 2013 with a credit balance of $31,900 in the allowance for sales returns account. Sales and cash collections from customers during the year were $680,000 and $640,000, respectively. False Value estimates that 5% of all sales will be returned. During 2013, customers returned merchandise for credit of $23,000 to their accounts. False Value's 2013 income statement would report net sales of: a. $657,000. b. $646,000. c. $648,100. d. $671,100.arrow_forwardCapitalisation methodarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

What is Budgeting? | Budgetary control | Advantages & Limitations of Budgeting; Author: Educationleaves;https://www.youtube.com/watch?v=INnPo0QPXf4;License: Standard youtube license