Loose Leaf for Fundamentals of Accounting Principles and Connect Access Card

22nd Edition

ISBN: 9781259542169

Author: John J Wild

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 4, Problem 5E

Exercise 4-5

Determining effects of closing entries

C1

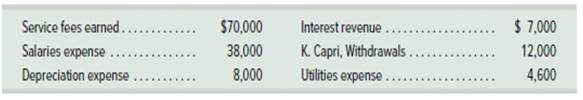

Capri Company began the current period with a $20,000 credit balance in the K. Capri, Capital account. At the end of the period, the company’s adjusted account balances include the following temporary accounts with normal balances.

1. After closing the revenue and expense accounts, what is the balance of the Income Summary account?

2. After all closing entries are journalized and posted, what is the balance of the K. Capri, Capital account?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

I don't need ai answer general accounting question

The manufacturing overhead cost for the current year will be?

The predetermined manufacturing overhead rate per direct labor hour is?

Chapter 4 Solutions

Loose Leaf for Fundamentals of Accounting Principles and Connect Access Card

Ch. 4 - Prob. 1DQCh. 4 - Prob. 2DQCh. 4 - Prob. 3DQCh. 4 - Prob. 4DQCh. 4 - Prob. 5DQCh. 4 - Prob. 6DQCh. 4 - 7. Why are the debit and credit entries in the...Ch. 4 - Prob. 8DQCh. 4 - Prob. 9DQCh. 4 - Prob. 10DQ

Ch. 4 - Prob. 11DQCh. 4 - 12. How do reversing entries simplify...Ch. 4 - If a company recorded accrued salaries expense of...Ch. 4 - Prob. 14DQCh. 4 - Prob. 15DQCh. 4 - Prob. 16DQCh. 4 - Prob. 17DQCh. 4 - Prob. 1QSCh. 4 - Prob. 2QSCh. 4 - Prob. 3QSCh. 4 - Prob. 4QSCh. 4 - Prob. 5QSCh. 4 - Prob. 6QSCh. 4 - Prob. 7QSCh. 4 - Prob. 8QSCh. 4 - Prob. 9QSCh. 4 - Prob. 10QSCh. 4 - Prob. 11QSCh. 4 - Prob. 12QSCh. 4 - Exercise 4-1

Extending adjusted account balances...Ch. 4 - Prob. 2ECh. 4 - Prob. 3ECh. 4 - Prob. 4ECh. 4 - Exercise 4-5 Determining effects of closing...Ch. 4 - Prob. 6ECh. 4 - Prob. 7ECh. 4 - Prob. 8ECh. 4 - Exercise 4-9 Preparing closing entries and a...Ch. 4 - Prob. 10ECh. 4 - Prob. 11ECh. 4 - Prob. 12ECh. 4 - Prob. 13ECh. 4 - Prob. 14ECh. 4 - Prob. 15ECh. 4 - Prob. 16ECh. 4 - Prob. 17ECh. 4 - Prob. 1APSACh. 4 - Prob. 2APSACh. 4 - Prob. 3APSACh. 4 - Prob. 4APSACh. 4 - Prob. 5APSACh. 4 - Prob. 6APSACh. 4 - Prob. 1BPSBCh. 4 - Prob. 2BPSBCh. 4 - Prob. 3BPSBCh. 4 - Prob. 4BPSBCh. 4 - Prob. 5BPSBCh. 4 - Prob. 6BPSBCh. 4 - Prob. 4SPCh. 4 - Prob. 1GLPCh. 4 - Prob. 2GLPCh. 4 - Prob. 3GLPCh. 4 - Prob. 4GLPCh. 4 - Prob. 1BTNCh. 4 -

BTN 4-2 Key figures for the recent two years of...Ch. 4 - Prob. 3BTNCh. 4 - Prob. 4BTNCh. 4 - Prob. 5BTNCh. 4 - Prob. 6BTNCh. 4 - Prob. 7BTNCh. 4 - Prob. 8BTNCh. 4 - Prob. 9BTN

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Answer? Financial accountingarrow_forwardHello tutor please provide this question solution general accountingarrow_forwardPlease help me correct my mistakes. for the T account of 2022 and 2023, the ONLY options for accounts names are blank, bad debt expense, collections, credit sales and write offs Jayco Inc. started its operations in 2022. Its sales during 2022, all on account, totalled $700,000. The company collected $500,000 in cash from customers during the year and wrote off $8,000 in uncollectible accounts. The company set up an allowance for doubtful accounts at December 31, 2022, its fiscal year-end, and determined the account balance to be $14,000. The unadjusted balances of selected accounts at December 31, 2023 are as follows: Accounts receivable $ 300,000 Allowance for doubtful accounts (debit) 10,000 Sales revenue (including 80 percent in sales on account) 800,000 Aging of the accounts receivable on December 31, 2023, resulted in an estimate of $11,000 in potentially uncollectible accounts. Required: 1. Prepare the journal entries to record all the…arrow_forward

- BC VERSO gal polica 9 € ABC 4. 140×240 cm GARDE HY16-01 • Vrtni luk materijal: čelik i plastika za penjačice 12.99 € 140x240 CM TO BEAUTIFY YOUarrow_forwardThe magnitude of operating leverage for Roshan Enterprises is 3.2 when sales are $200,000 and net income is $40,000. If sales decrease by 5%, net income is expected to decrease by what amount?arrow_forwardWant to this question answer general Accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning  Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY