From Recording Transactions to Preparing Accrual and Deferral Adjustments and Reporting Results on the

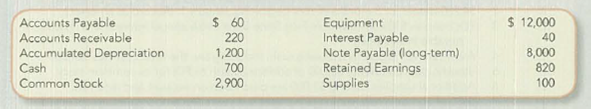

House of Tutors, Inc. (HTI) is a company that runs a tutoring service for high school and university students. The company reported the following amounts in its post-closing

The company encountered the following events during September:

- a. HTI provided 100 hours of regular hourly tutoring at the rate of $20 per hour, all of which was collected in cash.

- b. HTI paid tutors at the hourly rate of $ 10 per hour. On September 28, HTI paid for 90 hours of tutor time and promised to pay the remaining hours worked.

- c. HTI hosted an all-night review session on September 29 for people cramming for midterm exams, at a special price of $10 per attendee. Rather than collect cash at the time of the review session, HTI will send bills in October to the 75 people who attended the review session.

- d. At the beginning of the night-long review session, HTI paid $200 cash to its tutors for wages. Nc additional salaries and wages will be paid for the review session.

- e. HTI collected $200 cash on account from students who received tutoring during the summer.

- f. HTI also collected $250 cash from a high school for a tutoring session to be held in October.

- g. HTI determined that

depreciation for September should be $100. - h. Although HTI adjusted its accounts on August 31, it has not yet paid the $40 monthly interest owed on the promissory note, for either August or September. The note is due in three years.

- i. HTI has only $40 of supplies left at September 30.

- j. HTI’s income taxes are approximately 30% of income before tax.

Required:

- 1. Prepare HTI’s journal

entries and adjusting journal entries. - 2. Prepare HTI’s income statement and statement of

retained earnings for the month ended September 30. - 3. Prepare HTI’s classified balance sheet at September 30.

1.

To prepare: The journal entries and adjusting journal entries for Incorporation HT.

Explanation of Solution

Journal:

Journal is the method of recording monetary business transactions in chronological order. It records the debit and credit aspects of each transaction to abide by the double-entry system.

Adjusting journal entries:

Adjusting entries are the journal entries which are recorded at the end of the accounting period to correct or adjust the revenue and expense accounts, to concede with the accrual principle of accounting.

Prepare the journal entry and adjusting entries of Incorporation HT:

|

Date |

Account Title and Explanation | Debit ($) | Credit ($) | |

| a. | Cash (A+) | 2,000 | ||

| Service revenue (R+) (SE-) | 2,000 | |||

| (To record the cash received for the service provided) | ||||

| b. | Salaries and wages expense (E+) (SE-) | 1,000 | ||

| Cash (A-) | 900 | |||

| Salaries and wages payable (L+) | 100 | |||

| (To record the payment of salaries and wages payable ) | ||||

| c. | Accounts receivable (A+) | 750 | ||

| Service revenue (R+) (SE+) | 750 | |||

| (To record the service provided on account) | ||||

| d. | Salaries and wages expense (E+) (SE-) | 200 | ||

| Cash (A–) | 200 | |||

| (To record the payment of salaries and wages expense) | ||||

| e. | Cash (A+) | 200 | ||

| Accounts receivable (A-) | 200 | |||

| (To record the amount of cash received) | ||||

| f. | Cash (A+) | 250 | ||

| Unearned Revenue (L+) | 250 | |||

| (To record the cash collected from the customers for the service yet to provide ) | ||||

| g. | Depreciation expense (E+) (SE-) | 100 | ||

| Accumulated depreciation-Equipment (xA+) (A-) | 100 | |||

| (To record the accumulated depreciation on equipment) | ||||

| h. | Interest expense (E+) (SE-) | 40 | ||

| Interest payable (L+) | 40 | |||

| (To record the interest payable) | ||||

| i | Supplies expense (E+) (SE-) | 60 | ||

| Supplies (A-) | 60 | |||

| (To record the supplies expense incurred) | ||||

| j. | Income tax Expense (E+, SE–)(4) | 405 | ||

| Income tax payable (L+) | 405 | |||

| (To record the utilities expenses incurred) | ||||

Table (1)

2.

To prepare: The income statement of Incorporation HT for the month ended 30th September.

Explanation of Solution

Income statement:

The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Prepare the income statement of Incorporation HT:

| Incorporation HT | ||

| Income Statement | ||

| For the month end 30th September | ||

| Particulars | Amount ($) | Amount($) |

| Revenues: | ||

| Service Revenue(1) | 2,750 | |

| Total revenue | 2,750 | |

| Expenses: | ||

| Salaries and Wages Expense(2) | 1,200 | |

| Depreciation Expense | 100 | |

| Supplies Expense | 60 | |

| Interest Expense | 40 | |

| Income Tax Expense(4) | 405 | |

| Total Expenses | 1,805 | |

| NET INCOME | 945 | |

Table (2)

Working note:

- 1. Calculate the service revenue:

The service revenue includes the amount earned from the (a) and (c) in the requirement 1.

(1)

- 2. Calculate the salaries and wages expense:

The salaries and wage expense includes the amount from the (b) and (d) in the requirement 1.

(2)

- 3. Calculate the income before income tax:

(3)

Calculate the income tax expense:

- 4. The amount for all other temporary account balances is derived from only one journal entry in the Requirement 1.

To prepare: the statement of retained earnings for the month ended 30th September.

Explanation of Solution

Statement of retained earnings:

This is an equity statement which shows the changes in the stockholders’ equity over a period of time.

Prepare the statement of retained earnings of Incorporation HT:

| Incorporation HT | ||

| Statement of Retained Earnings | ||

| For the month end 30th September | ||

| Particulars | Amount($) | Amount ($) |

| Retained Earnings, Beginning | 820 | |

| Net Income | 945 | |

| Dividends | (0) | |

| Retained Earnings, Ending | 1,765 | |

Table (3)

Hence, the statement of retained earnings is prepared and the ending balance of the retained earnings is $1,765

3.

To prepare: the classified balance sheet for Incorporation HT as on 30th September.

Explanation of Solution

Classified balance sheet:

This is the financial statement of a company which shows the grouping of similar assets and liabilities under subheadings.

Prepare the classified balance sheet:

| Incorporation HT | ||

| Balance Sheet | ||

| As on 30th September | ||

| Particulars | Amount ($) | Amount($) |

| Assets | ||

| Current Assets: | ||

| Cash | 2,050 | |

| Accounts Receivable | 770 | |

| Supplies | 40 | |

| Total Current Assets | 2,860 | |

| Non-Current assets: | ||

| Equipment | 12,000 | |

| Accumulated Depreciation–Equipment | (1,300) | |

| Equipment, net of accumulated depreciation | 10,700 | |

| Total Assets | $13,560 | |

| Liabilities and stockholders’ equity | ||

| Current Liabilities: | ||

| Accounts Payable | 60 | |

| Salaries and Wages Payable | 100 | |

| Unearned Revenue | 250 | |

| Interest Payable | 80 | |

| Income Tax Payable | 405 | |

| Total Current Liabilities | 895 | |

| Non-current liabilities: | ||

| Note Payable (long–term) | 8,000 | |

| Total Liabilities | 8,895 | |

| Stock holders’ equity: | ||

| Common Stock | 2,900 | |

| Retained Earnings | 1,765 | |

| Total Stockholders’ Equity | 4,665 | |

| Total Liabilities and Stockholders’ Equity | 13,560 | |

Table (4)

Note:

- The amount for cash is derived from the journal entries a, b, d, e and f.in requirement 1.

- Accounts receivable includes the amount from the journal entries c and e in requirement 1.

- Other account balances are derived from the beginning balances which are in the journal entries from requirement 1.

Hence, the classified balance sheet for Incorporation HT is prepared and the total assets and total liabilities and stockholders’ equity is $13,560.

Want to see more full solutions like this?

Chapter 4 Solutions

Fundamentals Of Financial Accounting

- I need help with this General accounting question using the proper accounting approach.arrow_forwardPlease explain the solution to this general accounting problem with accurate principles.arrow_forwardKindly help me with this General accounting questions not use chart gpt please fast given solutionarrow_forward

- I am searching for the correct answer to this Financial accounting problem with proper accounting rules.arrow_forwardI am looking for the correct answer to this Financial accounting question with appropriate explanations.arrow_forwardEcho Tone Technologies reports annual sales of $90,000, and it expects sales to increase to $135,000 next year. The company has a degree of operating leverage (DOL) of 4.2. By what percentage should net income increase? A. 70% B. 189% C. 150% D. 210%arrow_forward

- Please provide the accurate answer to this general accounting problem using valid techniques.arrow_forwardNo chatgpt Which account will appear in the post-closing trial balance?A. Rent ExpenseB. Sales RevenueC. DividendsD. Capitalarrow_forwardI need help with this financial accounting question using the proper accounting approach.arrow_forward

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax CollegeCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage