Concept explainers

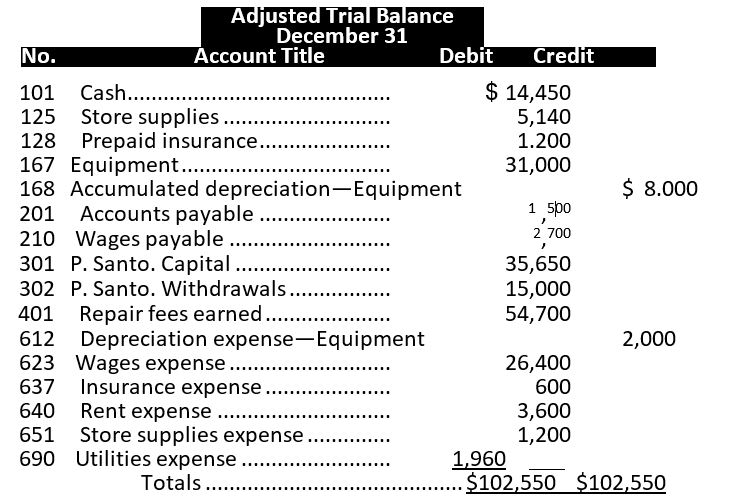

Problem 4-5B Preparing trial balances, closing entries, and financial statements C3 P2 P3

Santo Company's adjusted

Required

1. Prepare an income statement and a statement of owner's equity for the year and a classified

Capital account balance was $35.650 on December 31 of the prior year.

Check (1) Ending capital balance, $39,590

2. Enter the adjusted trial balance in the first two columns of a six-column table. Use the middle two columns for closing entry information and the last

two columns for a post-closing trial balance. Insert an Income Summary account (No. 301) as the last item in the trial balance.

(2)P-C trial balance totals, $51,790

3. Enter closing entry information in the sk-column table and prepare

Want to see the full answer?

Check out a sample textbook solution

Chapter 4 Solutions

Connect Access Card For Fundamental Accounting Principles

- Reffering to fair value of an asset, division, or organization, What exactly is fair value and how is it assessed?arrow_forwardThe following transactions involving intangible assets of Oriole Corporation occurred on or near December 31, 2025. 1.) Oriole paid Grand Company $520,000 for the exclusive right to market a particular product, using the Grand name and logo in promotional material. The franchise runs for as long as Oriole is in business. 2.) Oriole spent $654,000 developing a new manufacturing process. It has applied for a patent, and it believes that its application will be successful. 3.) In January 2026, Oriole's application for a patent (#2 above) was granted. Legal and registration costs incurred were $247,800. The patent runs for 20 years. The manufacturing process will be useful to Oriole for 10 years. 4.) Oriole incurred $168,000 in successfully defending one of its patents in an infringement suit. The patent expires during December 2029. Oriole incurred 5.) $446,400 in an unsuccessful patent defense. As a result of the adverse verdict, the patent, with a remaining unamortized cost of…arrow_forwardNonearrow_forward

- I need help solving this general accounting question with the proper methodology.arrow_forwardI need help with this general accounting question using the proper accounting approach.arrow_forwardPlease provide the correct answer to this general accounting problem using valid calculations.arrow_forward

- Can you explain the correct methodology to solve this general accounting problem?arrow_forwardCan you solve this general accounting question with the appropriate accounting analysis techniques?arrow_forwardCan you solve this general accounting problem using appropriate accounting principles?arrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning