Concept explainers

Problem 4-5A Preparing trial balances, closing entries, and financial statements C3 P2 P3

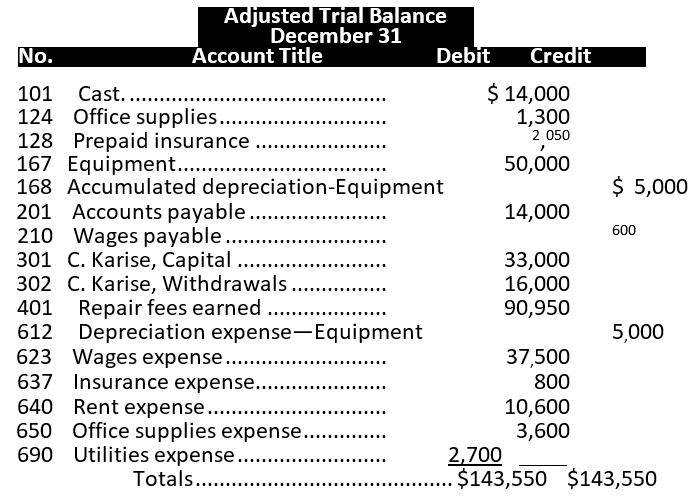

The adjusted

Required

1. Prepare an income statement and a statement of owner's equity for the year and a classified

Capital account balance was$33,000 on December 31 of the prior year.

Check (1) Ending capital balance, $47,750; Net income, $30,750

2. Enter the adjusted trial balance in the first two columns of a sis-column table. Use columns three and four for closing entry information and the last

two columns for a post-closing trial balance. Insert an Income Summary account as the last item in the trial balance.

(2) P-C trial balance totals, $67,350

3. Enter closing entry information in the six-column table and prepare

Want to see the full answer?

Check out a sample textbook solution

Chapter 4 Solutions

Connect Access Card For Fundamental Accounting Principles

- I need help solving this financial accounting question with the proper methodology.arrow_forwardPlease explain the solution to this general accounting problem using the correct accounting principles.arrow_forwardVistar Manufacturing bases its manufacturing overhead budget on budgeted direct labor-hours. The direct labor budget indicates that 8,200 direct labor-hours will be required in July. The variable overhead rate is $4.85 per direct labor-hour. The company's budgeted fixed manufacturing overhead is $125,000 per month, which includes depreciation of $10,500. All other fixed manufacturing overhead costs represent current cash flows. What should be the July cash disbursements for manufacturing overhead on the manufacturing overhead budget?arrow_forward

- Please explain the correct approach for solving this general accounting question.arrow_forwardI am searching for the correct answer to this general accounting problem with proper accounting rules.arrow_forwardIn June, one of the processing departments at Amy Manufacturing had beginning work in process inventory of $45,000 and ending work in process inventory of $21,000. During the month, the cost of units transferred out from the department was $632,000. In the department's cost reconciliation report for June, the total cost to be accounted for under the weighted-average method would be____.arrow_forward

- Can you help me solve this general accounting question using the correct accounting procedures?arrow_forwardI need help with this general accounting question using standard accounting techniques.arrow_forwardCan you help me solve this general accounting problem with the correct methodology?arrow_forward

- Using the information below for sapphirearrow_forwardOakridge Manufacturing applies overhead to jobs using a predetermined rate of 125% of direct labor cost. At year-end, the company had actual overhead costs of $487,500, while applied overhead totaled $512,500. The company's unadjusted cost of goods sold was $1,250,000. If the company closes any over- or underapplied overhead to cost of goods sold, what is the adjusted cost of goods sold? Need helparrow_forwardMartin Manufacturing prepared a fixed budget of 85,000 direct labor hours, with estimated overhead costs of $425,000 for variable overhead and $120,000 for fixed overhead. Martin then prepared a flexible budget of 78,000 labor hours. How much are total overhead costs at this level of activity?arrow_forward

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning  College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,