To determine: The amount of quarterly check.

The annuity refers to the payments of equal amount to be made after certain periods. These payments are made monthly, semi-annually or annually.

Effective Annual Rate:

The effective annual rate is the rate which is incurred or received on the various investment or loans. The effective annual rate is affected by the increase in compounding years.

Explanation of Solution

Given,

The salary structure is offered for 6 years.

The expected increase in the contract amount is $2,700,000.

The amount of signup bonus is $10 million.

The salary is needed in every 3 months.

The annual interest rate is 5.7% that is compounded on daily basis.

Calculation of the value of the quarterly check:

The formula to calculate the quarterly check amount is,

Substitute $28,069,200 for the present value and 20.19 for the

The monthly savings are $1,390,252.60.

Working note:

Calculation of the effective annual rate:

The effective annual rate is 5.87%.

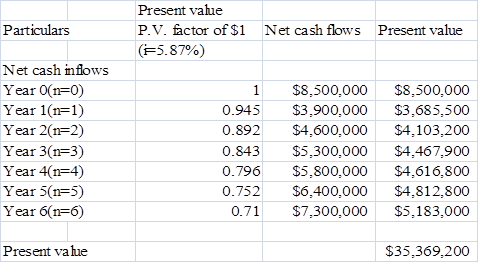

Calculation of the present value of the contract offer:

The present value of the contract offer is $35,369,200.

Computation of the present value of the new contract,

The present value of new contract is $38,069,200.

Calculation of the effective quarterly rate,

The effective quarterly rate is 1.43%.

Calculation of the present value of the quarterly salary,

The present value of quarterly salary is $28,069,200.

Calculation of the

Thus, the amount of quarterly check will be $1,390,252.60.

Want to see more full solutions like this?

Chapter 4 Solutions

Corporate Finance (The Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

- You plan to retire in 4 years with $698,670. You plan to withdraw $X per year for 17 years. The expected return is 17.95 percent per year and the first regular withdrawal is expected in 5 years. What is X? Input instructions: Round your answer to the nearest dollar. $arrow_forwardYou just borrowed $111,682. You plan to repay this loan by making X regular annual payments of $15,500 and a special payment of $44,900 in 10 years. The interest rate on the loan is 13.33 percent per year and your first regular payment will be made in 1 year. What is X? Input instructions: Round your answer to at least 2 decimal places.arrow_forwardYou just borrowed $174,984. You plan to repay this loan by making regular annual payments of X for 12 years and a special payment of $11,400 in 12 years. The interest rate on the loan is 9.37 percent per year and your first regular payment will be made today. What is X? Input instructions: Round your answer to the nearest dollar. $arrow_forward

- You plan to retire in 7 years with $X. You plan to withdraw $54,100 per year for 15 years. The expected return is 13.19 percent per year and the first regular withdrawal is expected in 7 years. What is X? Input instructions: Round your answer to the nearest dollar. 59 $arrow_forwardYou plan to retire in 3 years with $911,880. You plan to withdraw $X per year for 18 years. The expected return is 18.56 percent per year and the first regular withdrawal is expected in 3 years. What is X? Input instructions: Round your answer to the nearest dollar. 99 $arrow_forwardYou have an investment worth $56,618 that is expected to make regular monthly payments of $1,579 for 25 months and a special payment of $X in 8 months. The expected return for the investment is 0.76 percent per month and the first regular payment will be made today What is X? Note: X is a positive number. Input instructions: Round your answer to the nearest dollar. $arrow_forward

- You plan to retire in 8 years with $X. You plan to withdraw $114,200 per year for 21 years. The expected return is 17.92 percent per year and the first regular withdrawal is expected in 9 years. What is X? Input instructions: Round your answer to the nearest dollar. $ EAarrow_forwardYou have an investment worth $38,658 that is expected to make regular monthly payments of $1,130 for 16 months and a special payment of $X in 11 months. The expected return for the investment is 1.46 percent per month and the first regular payment will be made in 1 month. What is X? Note: X is a positive number. Input instructions: Round your answer to the nearest dollar. $arrow_forwardYou just borrowed $373,641. You plan to repay this loan by making regular annual payments of X for 18 years and a special payment of $56,400 in 18 years. The interest rate on the loan is 12.90 percent per year and your first regular payment will be made in 1 year. What is X? Input instructions: Round your answer to the nearest dollar. EA $arrow_forward

- How much do you need in your account today if you expect to make quarterly withdrawals of $6,300 for 7 years and also make a special withdrawal of $25,700 in 7 years. The expected return for the account is 4.56 percent per quarter and the first regular withdrawal will be made today. Input instructions: Round your answer to the nearest dollar. $ 69arrow_forwardYou just bought a new car for $X. To pay for it, you took out a loan that requires regular monthly payments of $2,200 for 10 months and a special payment of $24,100 in 6 months. The interest rate on the loan is 1.07 percent per month and the first regular payment will be made today. What is X? Input instructions: Round your answer to the nearest dollar. 59 $arrow_forward3 years ago, you invested $9,200. In 3 years, you expect to have $14,167. If you expect to earn the same annual return after 3 years from today as the annual return implied from the past and expected values given in the problem, then in how many years from today do you expect to have $28,798? Input instructions: Round your answer to at least 2 decimal places. 1.62 yearsarrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education