Concept explainers

Unter Components

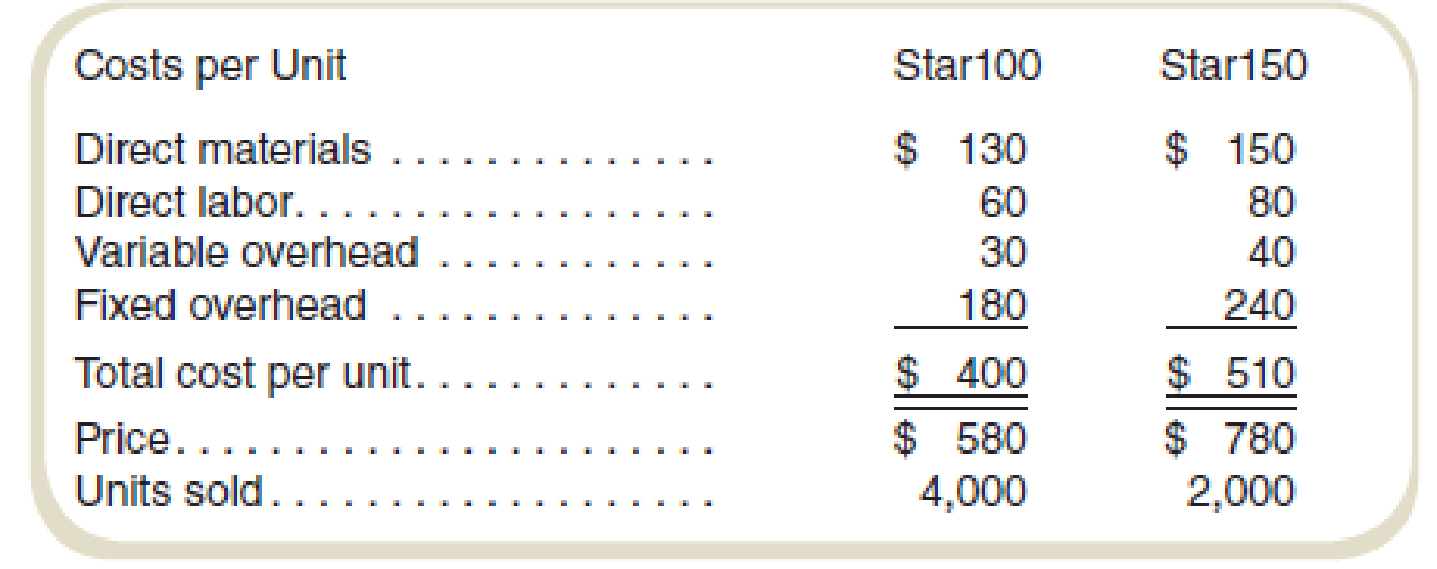

The average wage rate is $40 per hour. Variable

Required

- a. A nationwide car-sharing service has offered to buy 2,500 Star100 systems and 2,500 Star150 systems if the price is lowered to $400 and $500, respectively, per unit. If Unter accepts the offer, how many direct labor-hours will be required to produce the additional systems? How much will the profit increase (or decrease) if Unter accepts this proposal? Prices on regular sales will remain the same.

- b. Suppose that the car-sharing has offered instead to buy 3,500 each of the two models at $400 and $500, respectively. This customer will purchase the 3,500 units of each model only in an all-or-nothing deal. That is, Unter must provide all 3,500 units of each model or none. Unter’s management has decided to fill the entire special order for both models. In view of its capacity constraints, Unter will reduce sales to regular customers as needed to fill the special order. How much will the profits change if the order is accepted? Assume that the company cannot increase its production capacity to meet the extra demand.

- c. Answer the question in requirement (b), assuming instead that the plant can work overtime. Direct labor costs for the overtime production increase to $60 per hour. Variable overhead costs for overtime production are $10 per hour more than for normal production.

a.

Identify, if Company U accepts the offer, how many direct labors will be required to produce the additional systems, and calculate the change in profit in case of company accepts the offer.

Explanation of Solution

Calculate direct labor hours per unit:

| Particulars | Star 100 | Star 150 |

| Labor cost per unit (A) | $60 | $80 |

| Wage rate per labor hour (B) | $40 | $40 |

| Labor hours per unit (A) ÷ (B) | 1.5 hours | 2 hours |

Table (1)

Calculate total direct labor hours required for the additional business.

The current production uses 10,000 direct labor hours and capcity is 20,000 direct labor hours. Thus capacity will not have to expanded to accept the order.

Calculate the change in profit:

| Particulars | Star 100 | Star 150 | Total |

| Units (A) | $2,500 | $2,500 | |

| Sales price (B) | $400 | $500 | |

| Variable costs (C) | $220 | $270 | |

| Differential revenue (A × B) | $1,000,000 | $1,250,000 | $2,250,000 |

| Less: Differential variable cost (A × C) | $550,000 | $675,000 | $1,225,000 |

| Differential Profit | $450,000 | $575,000 | $1,025,000 |

Table (2)

Thus, the differential operating profit is $1,025,000, so Company U should accept the offer.

Working note 1:

Calculate the variable costs:

| Particulars | Star 100 | Star 150 |

| Direct materials | $130 | $150 |

| Add: Direct labor | $60 | $80 |

| Variable overheads | $30 | $40 |

| Total variable costs | $220 | $270 |

Table (3)

b.

Calculate the change in profit in case of acceptance of the offer.

Answer to Problem 53P

The increase in profit is $895,000 if it accepts the offer. So the company should accept the offer.

Explanation of Solution

Calculate total direct labor hours required for the additional business.

The total production time required is 10,000 hours for normal business and 12,250 direct labor hours for the special order, but the direct labor hours capacity is limited to 20,000 hours. In this case, company need to reduce the production of the units sold to the regular customers.

Due to direct labor time is the constraing resource, the companyhaving two alternatives, one is company need to reduce the number of star 100 machines sold to the regular customers, and the second is company need to reduce the number of start 150 machines sold to the regular customers.

Calculate the contribution margin per direct labor hour for each product on the basis of regular customers:

| Particulars | Star 100 | Star 150 |

| Revenue per unit | $580 | $780 |

| Less: Variable cost per unit | $220 | $270 |

| Contribution margin per unit (A) | $360 | $510 |

| Direct labor hours per unit (B) | 1.5 | 2 |

| Contribution margin per hour (A ÷ B) | $240 | $255 |

Table (4)

Star 100 model has the lower contribution margin per hour compared with the star 150 model. The company should reduce the production of this product to sell the special order.

After producing the special order, the company will have 7,750 direct labor hours (20,000 direct labor hours – 12,250 direct labor hours). Company will produce first 2,000 units of srtar 150 model (4,000 direct labor hours = 2,000 units × 2 direct labor hours). The balance direct labor hours ( 3,750 direct labor hours = 7,750 direct labor hours – 4,000 direct labor hours) to produce 2,500 units of the star 100 model.

Calculate the change in operating profit:

Thus, the changes in profit are $895,000, if it accepts the offer. So the company should accept the offer.

Working note 2:

Calculate the contribution margin in case of special order and normal production:

| Particulars | Star 100 | Star 150 | Total |

| Special order: | |||

| Sales price | $400 | $500 | |

| Less: Variable cost | $220 | $270 | |

| Contribution margin per unit (A) | $180 | $230 | |

| Number of units (B) | 3,500 | 3,500 | |

| Total contribution margin ( 1 =A × B) | $630,000 | $805,000 | $1,435,000 |

| Regular production: | |||

| Sales price | $580 | $780 | |

| Less: Variable cost | $220 | $270 | |

| Contribution margin per unit (A) | $360 | $510 | |

| Number of units (B) | 2,500 | 2,000 | |

| Total contribution margin ( 2 =A × B) | $900,000 | $1,020,000 | $1,920,000 |

| Total contribution margin (1 + 2) | $1,530,000 | $1,825,000 | $3,355,000 |

| Less: Fixed Costs | $720,000 | $480,000 | $1,200,000 |

| Net Operating Income (3) | $810,000 | $1,345,000 | $2,155,000 |

Table (5)

Working note 3:

Total contribution margin in case of normal course of business:

| Particulars | Star 100 | Star 150 | Total |

| Regular production: | |||

| Sales price | $580 | $780 | |

| Less: Variable cost | $220 | $270 | |

| Contribution margin per unit (A) | $360 | $510 | |

| Number of units (B) | 4,000 | 2,000 | |

| Total contribution margin ( C =A × B) | $1,440,000 | $1,020,000 | $2,460,000 |

| Less: Fixed costs | $720,000 | $480,000 | $1,200,000 |

| Net operating Income (4) | $720,000 | $540,000 | $1,260,000 |

Table (6)

c.

Calculate the change in profit in case of acceptance of the offer with the given change.

Answer to Problem 53P

The change in profit is $1,367,500 if it accepts the offer. So the company should accept the offer.

Explanation of Solution

Contribution margin:

The excess of sales price over the variable expenses is referred to as the contribution margin. It is computed by deducting the variable expenses from the sales revenue. A contribution margin income statement is prepared in order to record the contribution margin.

Calculate the change in operating profit:

Thus, the change in profit is $1,367,500 if, it accepts the offer. So the company should accept the offer.

Working note 4:

Calculate the contribution margin in case of special order:

| Particulars | Star 100 | Star 150 | Total |

| Special order: | |||

| Sales price | $400 | $500 | |

| Less: Variable cost | $220 | $270 | |

| Contribution margin per unit (A) | $180 | $230 | |

| Number of units (B) | 3,500 | 3,500 | |

| Total contribution margin ( 1 =A × B) | $630,000 | $805,000 | $1,435,000 |

| Regular production: | |||

| Sales price | $580 | $780 | |

| Less: Variable cost | $220 | $270 | |

| Contribution margin per unit (A) | $360 | $510 | |

| Number of units (B) | 4,000 | 2,000 | |

| Total contribution margin ( 2 =A × B) | $1,440,000 | $1,020,000 | $2,460,000 |

| Gross contribution margin (1 + 2) | $2,070,000 | $1,825,000 | $3,895,000 |

| Less: Additional direct labor costs | $45,000 | ||

| Additional variable overhead | $22,500 | ||

| Total contribution margin | $3,827,500 | ||

| Less: Fixed costs | $720,000 | $480,000 | $1,200,000 |

| Net operating Income | $2,627,500 |

Table (7)

Working note 5:

Calculate the additional labor costs:

Calculate the additional variable costs:

Want to see more full solutions like this?

Chapter 4 Solutions

Gen Combo Fundamentals Of Cost Accounting; Connect Access Card

- Maplewood Textiles reported $1,100,000 in net sales and $720,000 in cost of goods sold. If operating expenses totaled $250,000, what is the company's gross profit and operating income?arrow_forwardNonearrow_forwardHarbor Freight Equipment issued $800,000 in bonds with a 7% annual interest rate for a term of 6 years. The company makes semiannual interest payments. What will be the total interest expense over the bond's life?arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning