Concept explainers

(Appendix 4B) Sequential Method of Support Department Cost Allocation

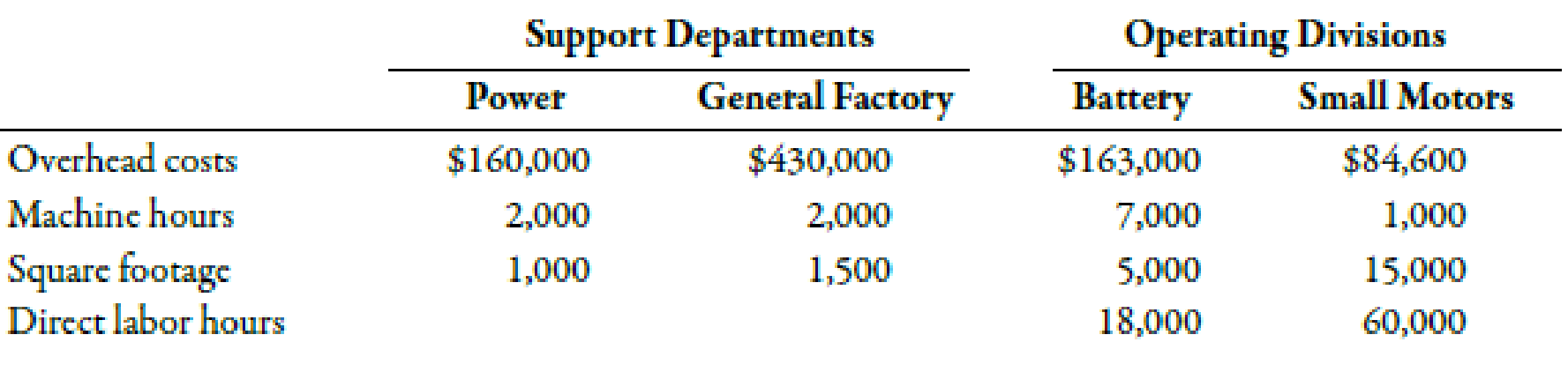

Refer to Exercise 4-51 for data. Now assume that Stevenson uses the sequential method to allocate support department costs to the operating divisions. General Factory is allocated first in the sequential method for the company.

Required:

- 1. Calculate the allocation ratios for Power and General Factory. (Note: Carry these calculations out to four decimal places.)

- 2. Allocate the support service costs to the operating divisions. (Note: Round all amounts to the nearest dollar.)

- 3. Assume divisional

overhead rates are based on direct labor hours. Calculate the overhead rate for the Battery Division and for the Small Motors Division. (Note: Round overhead rates to the nearest cent.)

1.

Computeallocation ratios for power and general factory under the sequential method.

Explanation of Solution

Sequential Method:

Sequential method recognizes that there is possible interaction between the support departments. However, it does notaccount for such interaction in full which makes it more accurate as compared to the direct method.

Use the following formula to calculate allocation ratios for general factory on the basis of number of square footage:

Power:

Substitute 1,000 for number of square footage in power and 21,000 for total square footage in the above formula.

Therefore, the cost assignment ratio for S2 is 0.0476.

Battery:

Substitute 5,000 for number ofsquare footage in battery and 21,000 for total square footage in the above formula.

Therefore, the cost assignment ratio for battery is 0.2381.

Small motors:

Substitute 15,000 for number ofsquare footage in small motors and 21,000 for total square footage in the above formula.

Therefore, the cost assignment ratio for painting department is 0.7143.

Use the following formula to calculate cost assignment ratios for power on the basis of number of machine hours:

Battery:

Substitute 7,000 for number of machine hoursofbattery and 8,000 for total machine hours ofoperating department in the above formula.

Therefore, the assignment ratio for assembly department is 0.8750.

Small motors:

Substitute 1,000 for number of machine hours of painting and 8,000 for total machine hours of operating department in the above formula.

Therefore, the assignment ratio for painting department is 0.1250.

2.

Apportion the support service costs to the operating divisions by using the sequential method:

Explanation of Solution

Allocation:

Allocation can be defined as the process of assigning the indirect costs to the cost object with the help of a convenient and reasonable method. It is essential to allocate indirect costs to the cost objects.

| Support departments | Operating departments | |||

| Power($) | General factory($) | Battery($) | Small motors($) | |

| Direct costs | 160,000 | 430,000 | 163,000 | 84,600 |

| Allocate: | ||||

| Power | 20,468 | (430,000) | 102,383 | 307,149 |

| General factory | (180,468) | 157,910 | 22,559 | |

| Total | 0 | 0 | 423,293 | 414,308 |

Table (1)

Working Note:

#. Allocation of support service costs to power:

1. Allocation of support servicecost to battery:

For power cost:

For general factory cost:

2. Allocation of support service cost to small motors:

For power cost:

For general factory cost:

3.

Compute overhead rate of battery and small motors divisions.

Answer to Problem 52E

The overhead rate of battery and small motors divisions is $23.52 and $6.91 respectively.

Explanation of Solution

Overhead Rate:

The amount which is calculate at the beginning of the accounting year for a related activity by dividing the total estimated annual overhead by estimated annual activity level is known as the overhead rate.

Use the following formula to calculate overhead rate for battery division:

Substitute $423,293 for estimated annual overhead and 18,000 DLH for estimated annual activity level in the above formula.

Therefore, overhead rate is $23.52.

Use the following formula to calculate overhead rate for small motors division:

Substitute $414,308 for estimated annual overhead and 60,000 DLH for estimated annual activity level in the above formula.

Therefore, overhead rate is $6.91.

Want to see more full solutions like this?

Chapter 4 Solutions

Cengagenowv2, 1 Term Printed Access Card For Mowen/hansen/heitger?s Managerial Accounting: The Cornerstone Of Business Decision-making, 7th

- Financial Accountingarrow_forwardMason (single) is a 50 percent shareholder in Angels Corporation (an S Corporation). Mason receives a $184,500 salary working full time for Angels Corporation. Angels Corporation reported $418,000 of taxable business income for the year. Before considering his business income allocation from Angels and the self-employment tax deduction (if any), Mason's adjusted gross income is $184,500 (all salary from Angels Corporation). Mason claims $59,000 in itemized deductions. Answer the following questions for Mason. c. b. Assuming the business income allocated to Mason is income from a specified service trade or business, except that Angels Corporation reported $168,000 of taxable business income for the year. What is Mason's deduction for qualified business income? Ignore the wage-based limitation when computing the deduction.arrow_forwardPlease give me true answer this financial accounting questionarrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub