1.

Record and post the necessary closing entries as of December 31, 2015.

1.

Explanation of Solution

Closing

Record the closing entries as of December 31, 2015:

| Date | Accounts and Explanation |

Account Number |

Debit ($) | Credit ($) |

| 2015 | Computer service revenue (SE–) | 401 | 31,284 | |

| December 31 | Income Summary (SE+) | 901 | 31,284 | |

| (To close the revenue account) | ||||

| 2015 | ||||

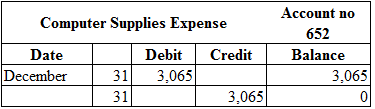

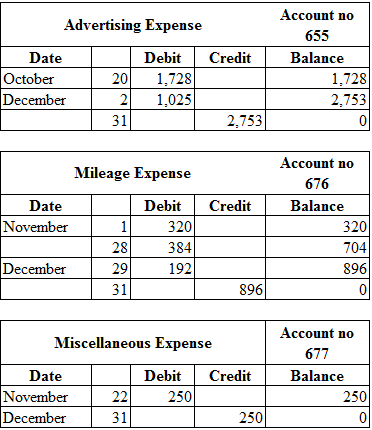

| December 31 | Income summary (SE–) | 901 | 16,824 | |

| 612 | 400 | |||

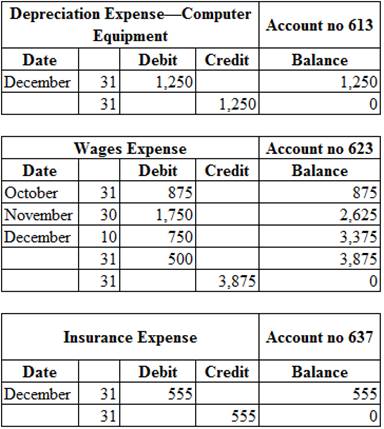

| Depreciation expense – Computer equipment(SE+) | 613 | 1,250 | ||

| Wages expense (SE+) | 623 | 3,875 | ||

| Insurance expense (SE+) | 637 | 555 | ||

| Rent expense (SE+) | 640 | 2,475 | ||

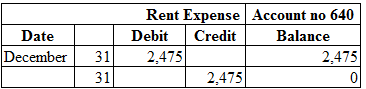

| Computer supplies expense (SE+) | 652 | 3,065 | ||

| Advertising expense (SE+) | 655 | 2,753 | ||

| Mileage expense (SE+) | 676 | 896 | ||

| Miscellaneous expense (SE+) | 677 | 250 | ||

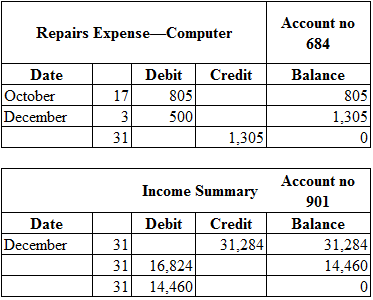

| Repairs expense (SE+) | 684 | 1,305 | ||

| (To close the expense accounts) | ||||

| 2015 | Income Summary (SE–) | 901 | 14,460 | |

| December 31 | S.R’s Capital (SE+) | 301 | 14,460 | |

| (To close the income summary accounts) | ||||

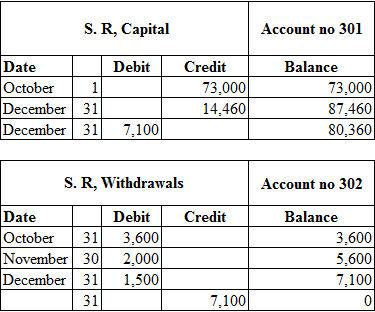

| 2015 | S.R’s Capital (SE–) | 301 | 7,100 | |

| December 31 | S.R’s Withdrawals (SE+) | 302 | 7,100 | |

| (To close withdrawals account.) |

Table (1)

Working Note:

Calculate the amount of S.R’s capital (transferred):

Revenue account:

In this closing entry, the service revenue earned account is closed by transferring the amount of service revenue account to Income summary account in order to bring the revenue account balance to zero. Hence, debit service revenue account and credit Income summary account.

Expense account:

In this closing entry, all expense accounts are closed by transferring the amount of total expense to the Income summary account in order to bring the expense account balance to zero. Hence, debit the Income summary account and credit all expenses account.

Income summary account:

Income summary account is a temporary account. This account is debited to close the net income value to S.R’s capital account.

S.R’s capital is a component of

Withdrawals account:

S.R’s capital is a component of owner’s equity. Thus, owners ‘equity is debited since the capital is decreased on owners’ drawings.

S.R’s withdrawals are a component of owner’s equity. It is credited because the balance of owners’ withdrawals account is transferred to owners ‘capital account.

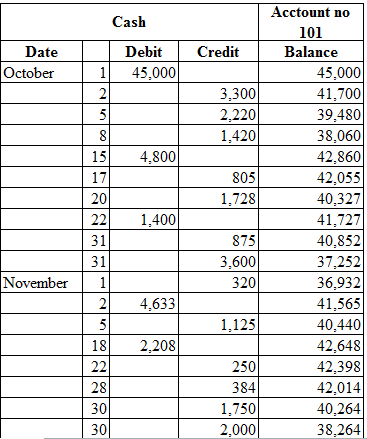

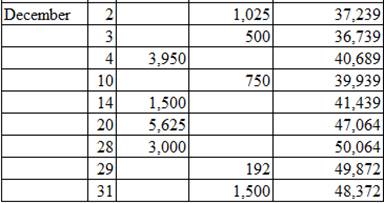

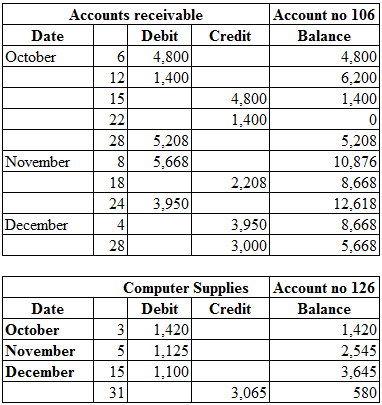

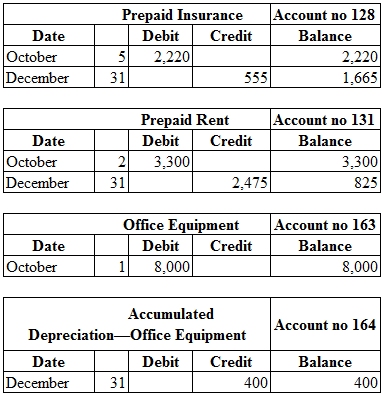

Ledger:

Ledger is the book, where the debit and credit entries are recorded in the journal book are transferred to their relevant accounts. The entire accounts of the company are collectively called the ledger.

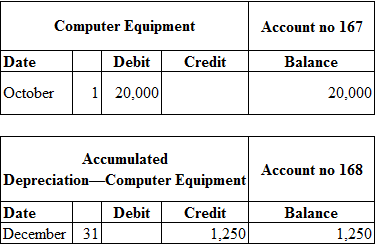

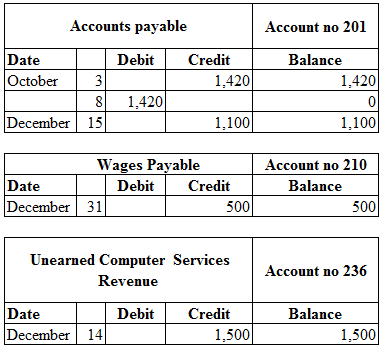

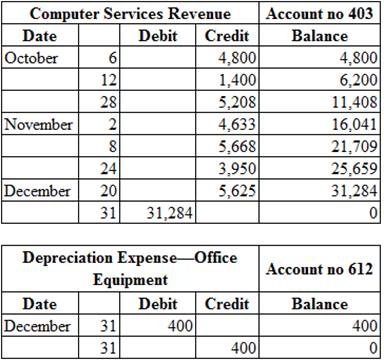

Posting the closing entries to the ledger account:

Table (2)

2.

Prepare a post-closing

2.

Explanation of Solution

Post-closing trial balance:

The post-closing trial balance is a summary of all ledger accounts, and it shows the debit and the credit balances after the closing entries are journalized and posted. The post-closing trial balance contains only permanent (

Prepare a post-closing trial balance as of December 31, 2015:

| B Solutions | ||

| Post-Closing Trial Balance | ||

| December 31, 2015 | ||

| Particulars | Debit($) | Credit ($) |

| Cash | 48,372 | |

| 5,668 | ||

| Computer supplies | 580 | |

| Prepaid insurance | 1,665 | |

| Prepaid rent | 825 | |

| Office equipment | 8,000 | |

| 400 | ||

| Computer equipment | 20,000 | |

| Accumulated depreciation – Computer equipment | 1,250 | |

| Accounts payable | 1,100 | |

| Wages payable | 500 | |

| Unearned computer service revenue | 1,500 | |

| S.R’s Capital | 80,360 | |

| Totals | $85,110 | $85,110 |

Table (3)

Want to see more full solutions like this?

Chapter 4 Solutions

Principles of Financial Accounting.

- What is the difference between a contra asset account and a liability? No aiarrow_forwardWhat is the difference between a contra asset account and a liability?arrow_forwardJoe transferred land worth $200,000, with a tax basis of $40,000, to JH Corporation, an existing entity, for 100 shares of its stock. JH Corporation has two other shareholders, Ethan and Young, each of whom holds 100 shares. With respect to the transfer:a. Joe has no recognized gain. b. JH Corporation has a basis of $160,000 in the land.c. Joe has a basis of $200,000 in his 100 shares in JH Corporation. d. Joe has a basis of $40,000 in his 100 shares in JH Corporation. e. None of the above.arrow_forward

- I need help with this general accounting problem using proper accounting guidelines.arrow_forwardI am looking for the correct answer to this general accounting problem using valid accounting standards.arrow_forwardHow does a company record depreciation using the straight-line method?dont use aiarrow_forward

- How does a company record depreciation using the straight-line method?arrow_forwardPlease provide the solution to this general accounting question with accurate financial calculations.arrow_forwardCan you solve this general accounting question with the appropriate accounting analysis techniques?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education