Concept explainers

Requirement 2.

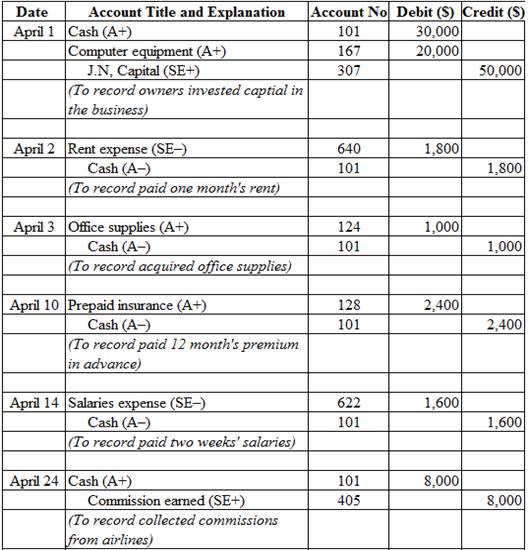

Prepare journal entries to record the transactions for April.

Requirement 2.

Explanation of Solution

Table (1)

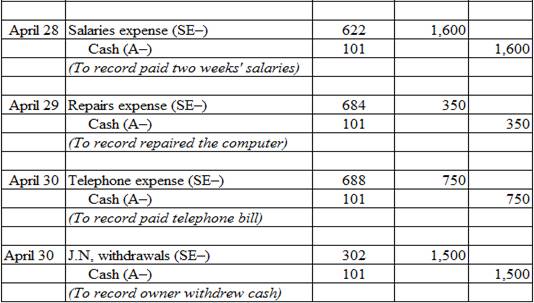

Requirement 3.

Prepare an unadjusted

Requirement 3.

Explanation of Solution

Unadjusted trial balance:

The unadjusted trial balance is the summary of all the ledger accounts that appears on the ledger accounts before making adjusting journal entries.

Prepare an unadjusted trial balance as of April 30, 2015:

Table (2)

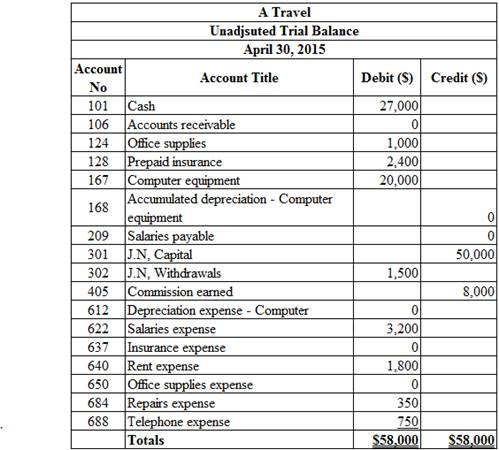

Requirement 4:

Journalize the

Requirement 4:

Explanation of Solution

Adjusting entries: Adjusting entries are those entries which are recorded at the end of the year, to update the income statement accounts (revenue and expenses) and

Journalize the adjusting entries:

Table (3)

Working note:

Calculate the amount of office supplies used:

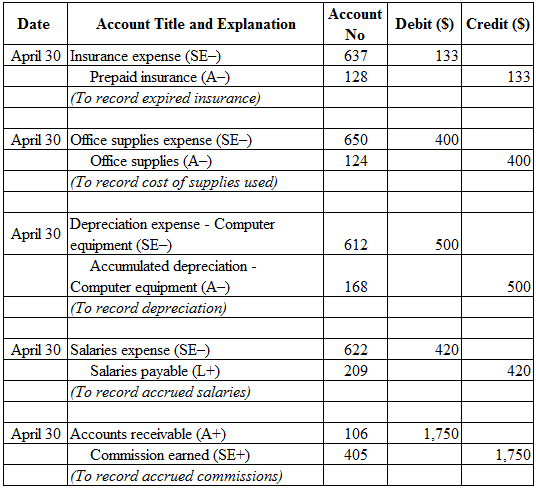

Requirement 5:

Prepare the followings:

- Adjusted trial balance as of April 30, 2015.

- Income statement for the month ended April 30, 2015.

- Statement of owner’s equity for the month ended April 30, 2015.

- Balance sheet at April 30, 2015.

Requirement 5:

Explanation of Solution

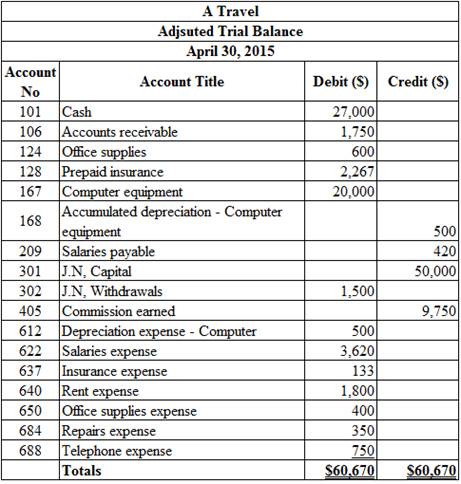

Adjusted Trial Balance: Adjusted trial balance is that statement which contains complete list of accounts with their adjusted balances, after all relevant adjustments have been made. This statement is prepared at the end of every financial period.

Prepare the adjusted trial balance as of April 30, 2015:

Table (4)

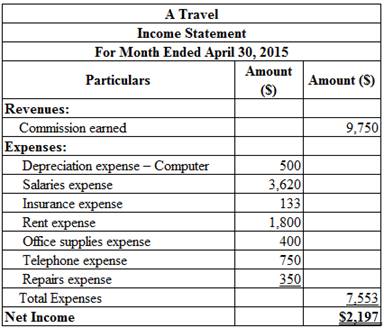

Income statement: The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Prepare an income statement for the month ended April 30, 2015:

Table (5)

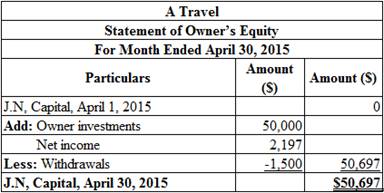

Statement of owners’ equity: This statement reports the beginning owner’s equity and all the changes, which led to ending owners’ equity. Additional capital, net income from income statement is added to and a drawing is deducted from beginning owner’s equity to arrive at the result, ending owner’s equity.

Prepare the statement of owners’ equity for the month ended April 30, 2015:

Table (6)

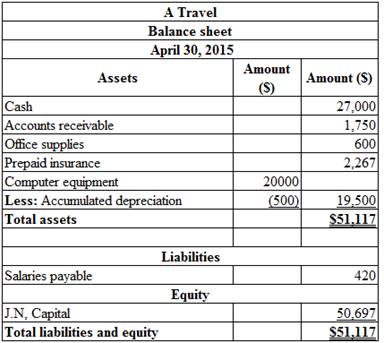

Balance sheet: This financial statement reports a company’s resources (assets) and claims of creditors (liabilities) and stockholders (stockholders’ equity) over those resources. The resources of the company are assets which include money contributed by stockholders and creditors. Hence, the main elements of the balance sheet are assets, liabilities, and stockholders’ equity.

Prepare the balance sheet as of April 30, 2015:

Table (7)

Requirement 5:

Prepare journal entries to close the temporary accounts.

Requirement 5:

Explanation of Solution

Closing entries: The journal entries prepared to close the temporary accounts to permanent account are referred to as closing entries. The revenue, expense, and dividends accounts are referred to as temporary accounts because the information and figures in these accounts is held temporarily and consequently transferred to permanent account at the end of accounting year.

Prepare the closing entries:

| Date | Accounts and Explanation |

Account Number |

Debit ($) | Credit ($) |

| April 30 | Commission earned (SE–) | 405 | 9,750 | |

| Income Summary (SE+) | 901 | 9750 | ||

| (To close the revenue account) | ||||

| April 30 | Income summary (SE–) | 901 | 7,553 | |

| 612 | 500 | |||

| Salaries expense (SE+) | 622 | 3,620 | ||

| Insurance expense (SE+) | 637 | 133 | ||

| Rent expense (SE+) | 640 | 1,800 | ||

| Office supplies expense (SE+) | 650 | 400 | ||

| Repairs expense (SE+) | 684 | 350 | ||

| Telephone expense (SE+) | 688 | 750 | ||

| (To close the expense accounts) | ||||

| April 30 | Income Summary (SE–) | 901 | 2,197 | |

| J.N’s Capital (SE+) | 301 | 2,197 | ||

| (To close the income summary accounts) | ||||

| April 30 | J.N’s Capital (SE–) | 301 | 1,500 | |

| J.N’s Withdrawals (SE+) | 302 | 1,500 | ||

| (To close withdrawals account.) |

Table (8)

Working Note:

Calculate the amount of J.N’s capital (transferred):

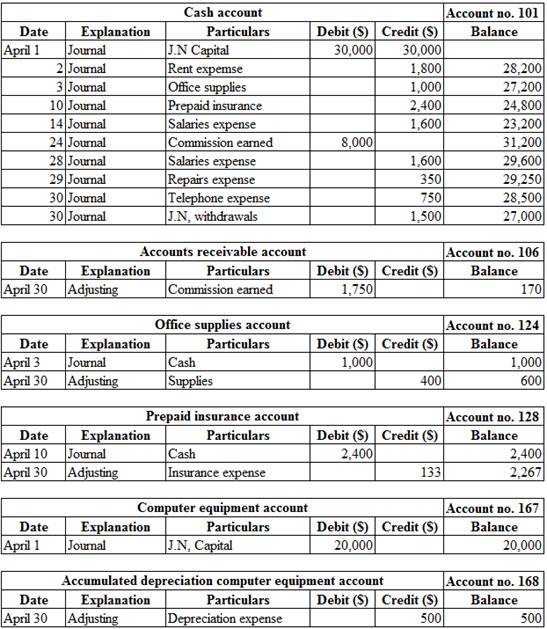

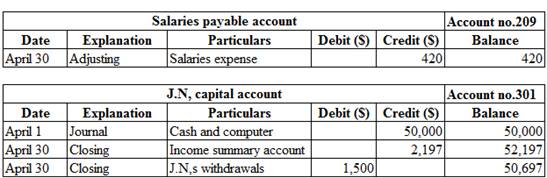

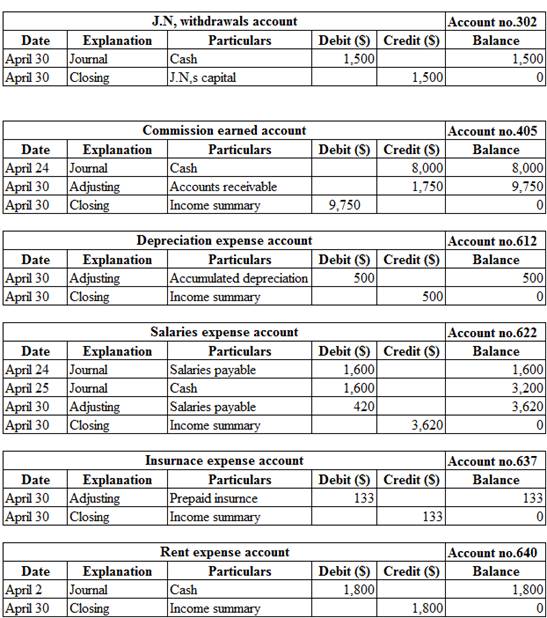

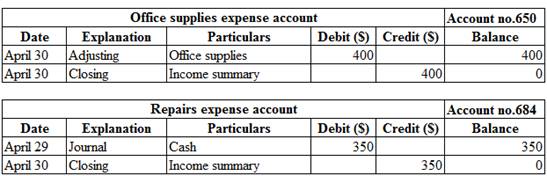

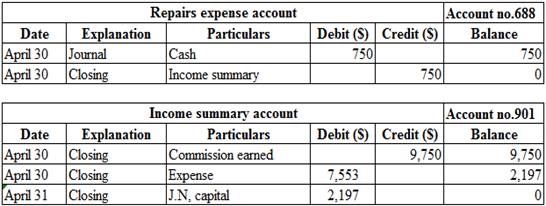

Requirement 1,2,4, and 6:

Post the journal entries, adjusting entries and closing entries to the ledger account:

Requirement 1,2,4, and 6:

Explanation of Solution

Ledger:

Ledger is the book, where the debit and credit entries recorded in the journal book are transferred to their relevant accounts. The entire accounts of the company are collectively called the ledger.

Posting the journal entries, adjusting entries and closing entries to the ledger account:

Table (9)

Requirement 7:

Prepare a post-closing trial balance.

Requirement 7:

Explanation of Solution

Post-closing trial balance:

The post-closing trial balance is a summary of all ledger accounts, and it shows the debit and the credit balances after the closing entries are journalized and posted. The post-closing trial balance contains only permanent (balance sheet) accounts, and the debit and the credit balances of permanent accounts should agree.

Prepare a post-closing trial balance:

| A Company | ||

| Post-Closing Trial Balance | ||

| April 30, 2015 | ||

| Particulars | Debit($) | Credit ($) |

| Cash | 27,000 | |

| Accounts receivable | 1,750 | |

| Office supplies | 600 | |

| Prepaid insurance | 2,267 | |

| Computer equipment | 20,000 | |

| 500 | ||

| Salaries payable | 420 | |

| J.N’s Capital | 50,697 | |

| Totals | $51,617 | $51,617 |

Table (10)

Want to see more full solutions like this?

Chapter 4 Solutions

Principles of Financial Accounting.

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education