Concept explainers

The

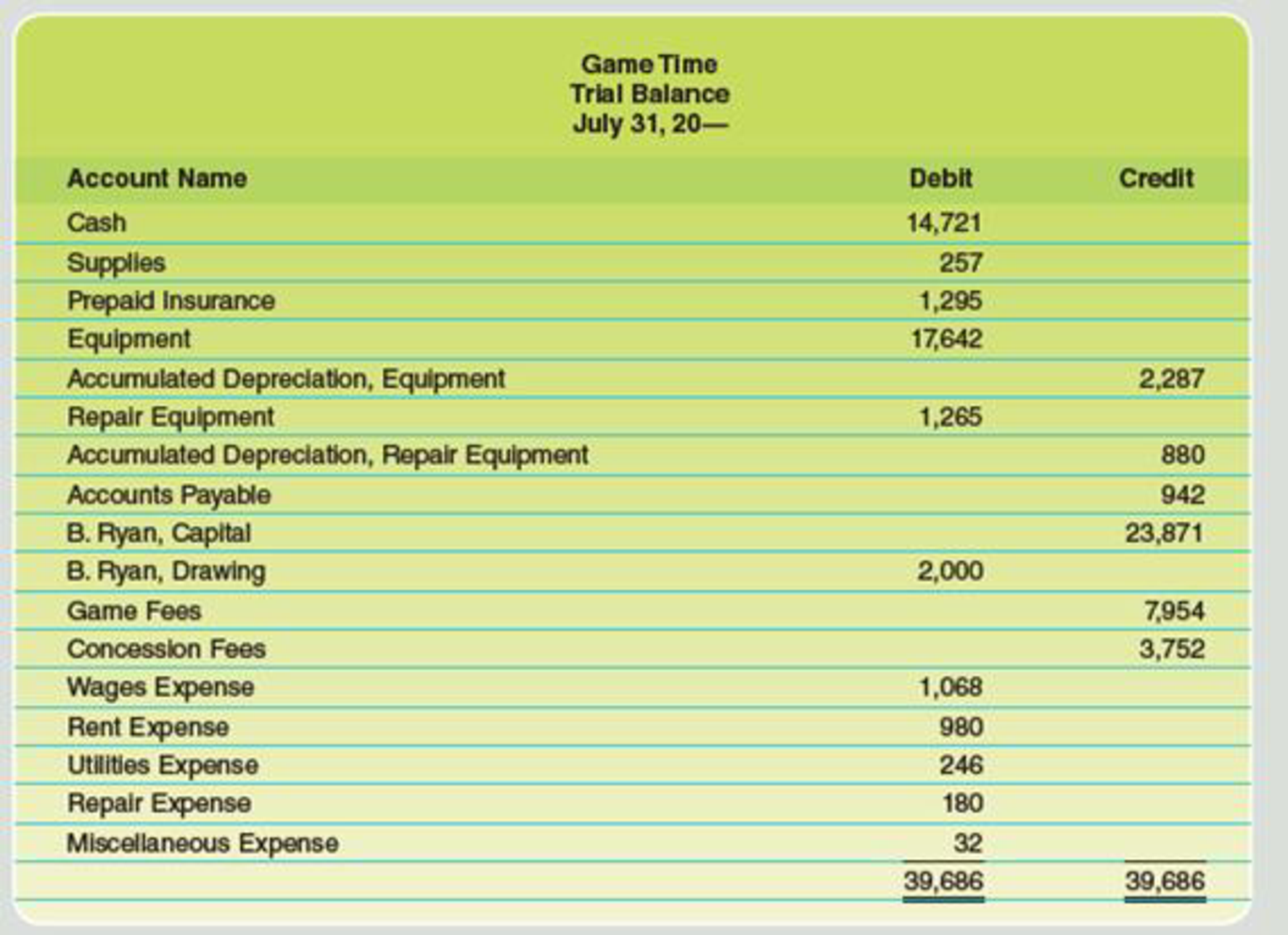

Data for month-end adjustments are as follows:

- Expired or used-up insurance, $480.

Depreciation expense on equipment, $850.- Depreciation expense on repair equipment, $120.

- Wages accrued or earned since the last payday, $525 (owed and to be paid on the next payday).

- Supplies used, $70.

Required

- Complete a work sheet for the month. (Skip this step if using CLGL.)

- Journalize the

adjusting entries . - If using CLGL prepare an adjusted trial balance.

- Prepare an income statement, a statement of owner’s equity, and a

balance sheet . Assume that no additional investments were made during July.

*If you are using CLGL, use the year 2020 when recording transactions and preparing reports.

1.

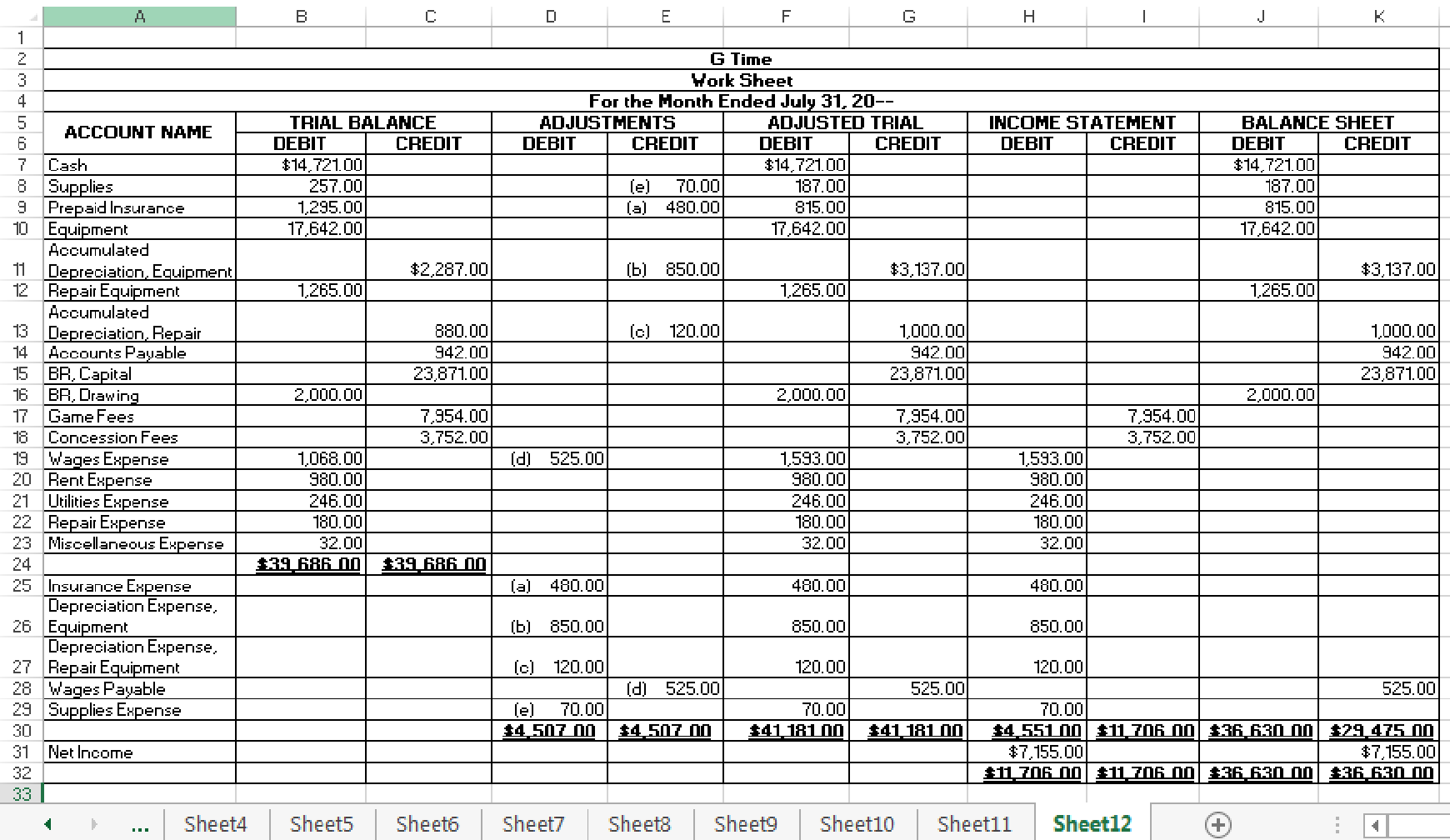

Indicate the given adjustments and complete the worksheet for G Time for the month ended July 31, 20--.

Explanation of Solution

Worksheet: Worksheet is an accounting tool that help accountants to record adjustments and up-date balances required to prepare financial statements. Worksheet is a central place where trial balance, adjustments, adjusted trial balance, income statement, and balance sheet are presented.

Indicate the given adjustments and complete the worksheet for G Time for the month ended July 31, 20--.

Table (1)

2.

Prepare adjusting journal entries for G Time.

Explanation of Solution

Adjusting entries: Adjusting entries are those entries which are recorded at the end of the year, to update the income statement accounts (revenue and expenses) and balance sheet accounts (assets, liabilities, and owners’ or stockholders’ equity) to maintain the records according to accrual basis principle and matching concept.

Journal entry: Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

Debit and credit rules:

- Debit an increase in asset account, increase in expense account, decrease in liability account, and decrease in stockholders’ equity accounts.

- Credit decrease in asset account, increase in revenue account, increase in liability account, and increase in stockholders’ equity accounts.

Prepare adjusting journal entries for G Time.

Adjusting entry for the prepaid insurance:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| July | 31 | Insurance Expense | 480 | |||

| Prepaid Insurance | 480 | |||||

| (Record part of prepaid insurance expired) | ||||||

Table (2)

Description:

- Insurance Expense is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Prepaid Insurance is an asset account. Since amount of insurance is expired, asset account decreased, and a decrease in asset is credited.

Adjusting entry for the depreciation expense, equipment:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| July | 31 | Depreciation Expense, Equipment | 850 | |||

| Accumulated Depreciation, Equipment | 850 | |||||

| (Record depreciation expense) | ||||||

Table (3)

Description:

- Depreciation Expense, Equipment is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Accumulated Depreciation, Equipment is a contra-asset account, and contra-asset accounts would have a normal credit balance, hence, the account is credited.

Adjusting entry for the depreciation expense, repair equipment:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| July | 31 | Depreciation Expense, Repair Equipment | 120 | |||

| Accumulated Depreciation, Repair Equipment | 120 | |||||

| (Record depreciation expense) | ||||||

Table (4)

Description:

- Depreciation Expense, Repair Equipment is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Accumulated Depreciation, Repair Equipment is a contra-asset account, and contra-asset accounts would have a normal credit balance, hence, the account is credited.

Adjusting entry for the wages expense:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| July | 31 | Wages Expense | 525 | |||

| Wages Payable | 525 | |||||

| (Record accrued wages expenses) | ||||||

Table (5)

Description:

- Wages Expense is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Wages Payable is a liability account. Since amount of payables has increased, liability decreased, and an increase in liability is credited.

Adjusting entry for the supplies expense:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| July | 31 | Supplies Expense | 70 | |||

| Supplies | 70 | |||||

| (Record part of supplies consumed) | ||||||

Table (6)

Description:

- Supplies Expense is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Supplies is an asset account. Since amount of supplies is used, asset account decreased, and a decrease in asset is credited.

3.

Prepare an adjusted trial balance for G Time at July 31, 20--.

Explanation of Solution

Adjusted trial balance: Adjusted trial balance is a summary of all the ledger accounts, and it contains the balances of all the accounts after the adjustment entries are journalized, and posted.

Prepare an adjusted trial balance for G Time at July 31, 20--.

| G Time | |||

| Adjusted Trial Balance | |||

| July 31, 20-- | |||

| Particulars | AccountNo. | Debit $ | Credit $ |

| Cash | $14,721.00 | ||

| Supplies | 187.00 | ||

| Prepaid Insurance | 815.00 | ||

| Equipment | 17,642.00 | ||

| Accumulated Depreciation, Equipment | $3,137.00 | ||

| Repair Equipment | 1,265.00 | ||

| Accumulated Depreciation, Repair Equipment | 1,000.00 | ||

| Accounts payable | 942.00 | ||

| Wages payable | 525.00 | ||

| BR, Capital | 23,871.00 | ||

| BR, Drawing | 2,000.00 | ||

| Game Fees | 7,954.00 | ||

| Concession Fees | 3,752.00 | ||

| Depreciation Expense, Equipment | 850.00 | ||

| Depreciation Expense, Repair Equipment | 120.00 | ||

| Wages Expense | 1,593.00 | ||

| Rent Expense | 980.00 | ||

| Supplies Expense | 70.00 | ||

| Insurance Expense | 480.00 | ||

| Utilities Expense | 246.00 | ||

| Repair Expense | 180.00 | ||

| Miscellaneous Expense | 32.00 | ||

| $41,181.00 | $41,181.00 | ||

Table (7)

The debit column and credit column of the adjusted trial balance are agreed, both having the balance of $41,181.

4.

Prepare income statement, statement of owners’ equity, and balance sheet for G Time.

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operations, and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Prepare an income statement of G Time for the month ended July 31, 20--.

| G Time | ||

| Income Statement | ||

| For the Month Ended July 31, 20-- | ||

| Revenues: | ||

| Game Fees | $7,954 | |

| Concession Fees | 3,752 | |

| Total Revenue | $11,706 | |

| Expenses: | ||

| Wages Expense | $1,593 | |

| Rent Expense | 980 | |

| Depreciation Expense, Equipment | 850 | |

| Depreciation Expense, Repair Equipment | 120 | |

| Supplies Expense | 70 | |

| Insurance Expense | 480 | |

| Utilities Expense | 246 | |

| Repair Expense | 180 | |

| Miscellaneous Expense | 32 | |

| Total expenses | 4,551 | |

| Net income | $7,155 | |

Table (8)

Statement of owners’ equity: This statement reports the beginning owner’s equity and all the changes which led to ending owners’ equity. Additional capital, net income from income statement is added to, and drawings is deducted from beginning owner’s equity to arrive at the end result, ending owner’s equity.

Prepare a statement of owners’ equity for G Time for the month ended July 31, 20--.

| G Time | ||

| Statement of Owners’ Equity | ||

| For the Month Ended July 31, 20-- | ||

| BR, Capital, July 1, 20-- | $23,871 | |

| Investments during July | $0 | |

| Net income for July | 7,155 | |

| 7,155 | ||

| Less: Withdrawals for July | 2,000 | |

| Increase in capital | 5,155 | |

| BR, Capital, July 31, 20-- | $29,026 | |

Table (9)

Balance sheet: This financial statement reports a company’s resources (assets) and claims of creditors (liabilities) and owners (owners’ equity) over those resources. The resources of the company are assets which include money contributed by owners and creditors. Hence, the main elements of the balance sheet are assets, liabilities, and owners’ equity.

Prepare the balance sheet for G Time as at July 31, 20--.

| G Time | ||

| Balance Sheet | ||

| July 31, 20-- | ||

| Assets | ||

| Cash | $14,721 | |

| Supplies | 187 | |

| Prepaid Insurance | 815 | |

| Equipment | $17,642 | |

| Less: Accumulated Depreciation | 3,317 | 14,505 |

| Repair Equipment | $1,265 | |

| Less: Accumulated Depreciation | 1,000 | 265 |

| Total Assets | $30,493 | |

| Liabilities | ||

| Accounts Payable | $942 | |

| Wages Payable | 525 | |

| Total Liabilities | $1,467 | |

| Owners’ Equity | ||

| BR, Capital | 29,026 | |

| Total Liabilities and Owners’ Equity | $30,493 | |

Table (10)

Want to see more full solutions like this?

Chapter 4 Solutions

Bundle: College Accounting: A Career Approach (with QuickBooks Online), Loose-leaf Version,13th + CengageNOWV2, 1 term (6 months) Printed Access

Additional Business Textbook Solutions

Engineering Economy (17th Edition)

Marketing: An Introduction (13th Edition)

Intermediate Accounting (2nd Edition)

Horngren's Accounting (12th Edition)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

- Please provide answer this financial accounting questionarrow_forwardWhat is the denominator in computing the annual rate of return on these financial accounting question?arrow_forwardCustom Cabinetry has one job in process (Job 120) as of June 30; at that time, its job cost sheet reports direct materials of $7,000, direct labor of $3,400, and applied overhead of $2,890. Custom Cabinetry applies overhead at the rate of 85% of direct labor cost. During July, Job 120 is sold (on credit) for $26,000, Job 121 is started and completed, and Job 122 is started and still in process at the end of July. Custom Cabinetry incurs the following costs during July. Job 120 Direct materials used Direct labor used $ 2,300 3,400 Job 121 $ 7,100 4,700 Job 122 $ 2,600 3,700 1. Prepare journal entries for the following July transactions and events a through e. a. Direct materials used. b. Direct labor used. c. Overhead applied. d. Sale of Job 120. e. Cost of goods sold for Job 120. Hint. Job 120 has costs from June and July. 2. Compute the July 31 balances of the Work in Process Inventory and the Finished Goods Inventory accounts. (There were no jobs in Finished Goods Inventory at June…arrow_forward

- In 2014, LL Bean sold 450,000 pairs of boots. At one point in 2014, it had a back order of 100,000. In 2015, LL Bean expects to sell 500,000 pairs of boots. As of late November 2015, it has a back order of 50,000.Question: When would LL Bean see sales revenue from the sale of its back order on the boots?arrow_forwardHelp me to solve this questionsarrow_forwardcorrect answer pleasearrow_forward

- Give this question financial accountingarrow_forward1.3 1.2.5 za When using a computerised accounting system, the paper work will be reduced in the organisation. Calculate the omitting figures: Enter only the answer next to the question number (1.3.1-1.3.5) in the NOTE. Round off to TWO decimals. VAT report of Comfy shoes as at 30 April 2021 OUTPUT TAX INPUT TAX NETT TAX Tax Gross Tax(15%) Gross (15%) Standard 75 614,04 1.3.1 Capital 1.3.2 9 893,36 94 924,94 Tax (15%) 1.3.3 Gross 484 782,70 75 849,08 -9 893,36 -75 849,08 Bad Debts TOTAL 1.3.4 4 400,00 1 922,27 14 737,42 -1 348,36 1.3.5 (5 x 2) (10arrow_forwardNonearrow_forward

- What was her capital gains yield? General accountingarrow_forwardL.L. Bean operates two factories that produce its popular Bean boots (also known as "duck boots") in its home state of Maine. Since L.L. Bean prides itself on manufacturing its boots in Maine and not outsourcing, backorders for its boots can be high. In 2014, L.L. Bean sold about 450,000 pairs of the boots. At one point during 2014, it had a backorder level of about 100,000 pairs of boots. L.L. Bean can manufacture about 2,200 pairs of its duck boots each day with its factories running 24/7. In 2015, L.L. Bean expects to sell more than 500,000 pairs of its duck boots. As of late November 2015, the backorder quantity for Bean Boots was estimated to be about 50,000 pairs. Question:arrow_forwardWhat was her capital gains yield?arrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College