Concept explainers

Cost Flows

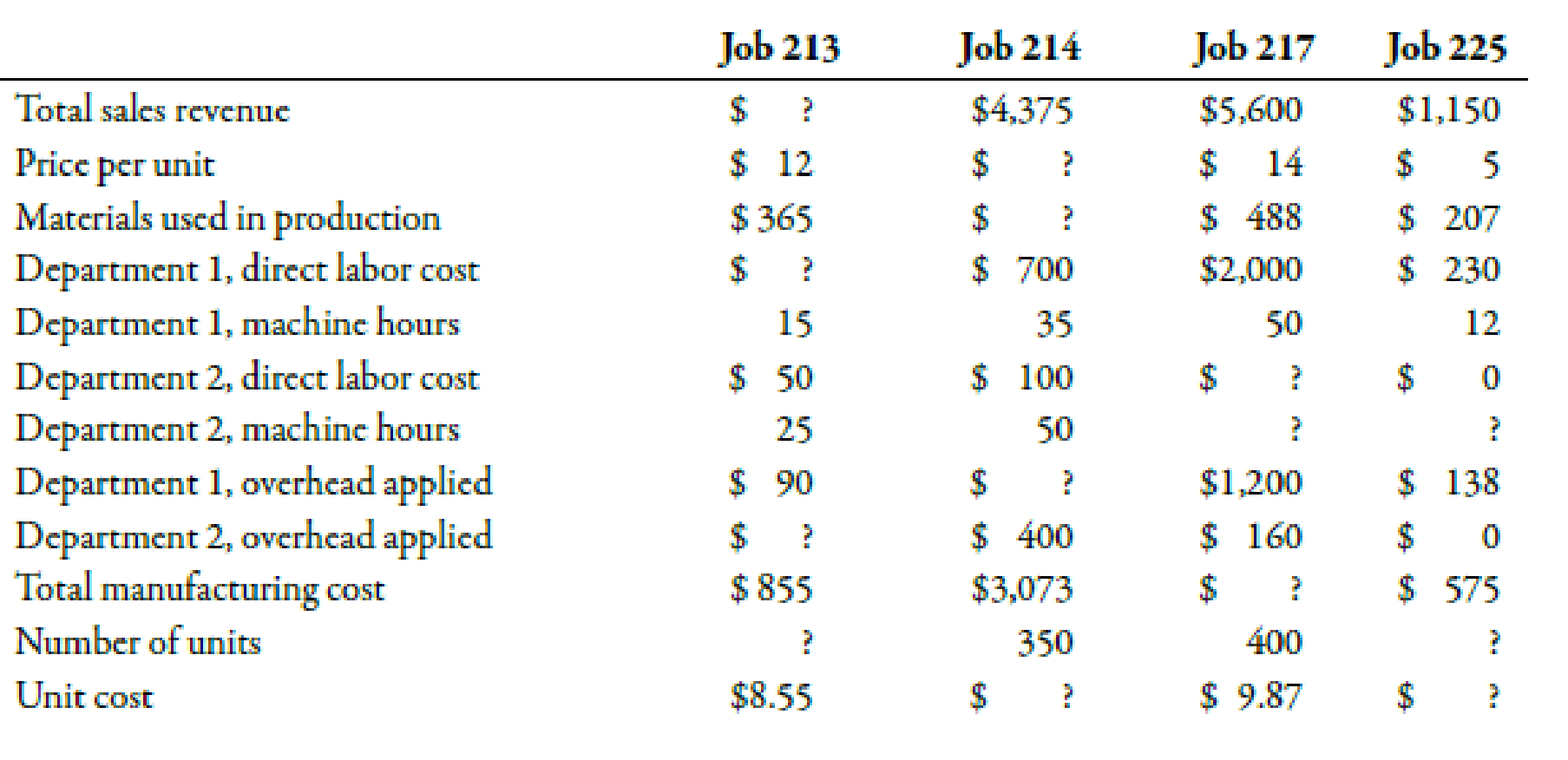

Consider the following independent jobs.

Direct labor wages average $10 per hour in each department.

Required:

Fill in the missing data for each job.

Complete the table by finding the missing amounts.

Explanation of Solution

Cost Flow:

A method which describes the way of accounting costs from the time of their occurrence to the time of their recognition as an expense on the income statement is known as cost flow.

| Job 213 | Job 214 | Job 217 | Job 225 | |

| Total sales revenue | $1,200 | $4,375 | $5,600 | $1,150 |

| Price per unit | $12 | $8.78 | $14 | $5 |

| Materials used in production | $365 | $1,453 | $488 | $207 |

| Department 1, direct labor cost | $150 | $700 | $2,000 | $230 |

| Department 1, machine hours | 15 | 35 | 50 | 12 |

| Department 2, direct labor cost | $50 | $100 | $100 | $0 |

| Department 2, machine hours | 25 | 50 | 20 | 0 |

| Department 1, overhead applied | $90 | $420 | $1,200 | $138 |

| Department 2, overhead applied | $200 | $400 | $160 | $0 |

| Total manufacturing cost | $855 | $3,073 | $3,948 | $575 |

| Number of units | 100 | 350 | 400 | 230 |

| Unit cost | $8.55 | $12.50 | $9.87 | $2.50 |

Table (1)

Working Note:

1. Job 213:

Calculation of number of units

Calculation of total sales revenue:

Calculation of department 1, direct labor hours:

Calculation of department 1, direct labor cost:

Calculation of department 2, overhead applied:

2. Job 214:

Calculation of price per unit:

Calculation of department 1, direct labor hours:

Calculation of department 1, overhead applied:

Calculation of material used:

Calculation of unit cost:

3. Job 217:

Calculation of department 2, machine hours:

Calculation of manufacturing cost:

Calculation of department 2, labor cost:

4. Job 225:

Calculation of number of units:

Calculation of unit cost:

Calculation of department 2, machine hours:

Want to see more full solutions like this?

Chapter 4 Solutions

Bundle: Managerial Accounting: The Cornerstone of Business Decision-Making, 7th + CengageNOWv2, 1 term (6 months) Printed Access Card

- Subject: Financial Accountingarrow_forwardANSWER PLZarrow_forwardThe Cavy Company estimates that the factory overhead for the following year will be $1,620,000. The company has decided that the basis for applying factory overhead should be machine hours, which is estimated to be 45,000 hours. Calculate the predetermined overhead rate to apply factory overhead. Helparrow_forward

- Please solve this problem general accounting questionarrow_forwardThe Cavy Company estimates that the factory overhead for the following year will be $1,620,000. The company has decided that the basis for applying factory overhead should be machine hours, which is estimated to be 45,000 hours. Calculate the predetermined overhead rate to apply factory overhead.arrow_forwardAnswer? Financial accounting questionarrow_forward

- In December 2019, Solar Systems Inc. management establishes the 2020 predetermined overhead rate based on direct labor cost. The information used in setting this rate includes estimates that the company will incur $920,000 of overhead costs and $600,000 of direct labor cost in year 2020. During March 2020, Solar Systems began and completed Job No. 20-78. What is the predetermined overhead rate for year 2020?arrow_forwardGive me Solutionarrow_forwardPlease see an attachment for details financial accounting questionarrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub