Make-or-Buy Decisions

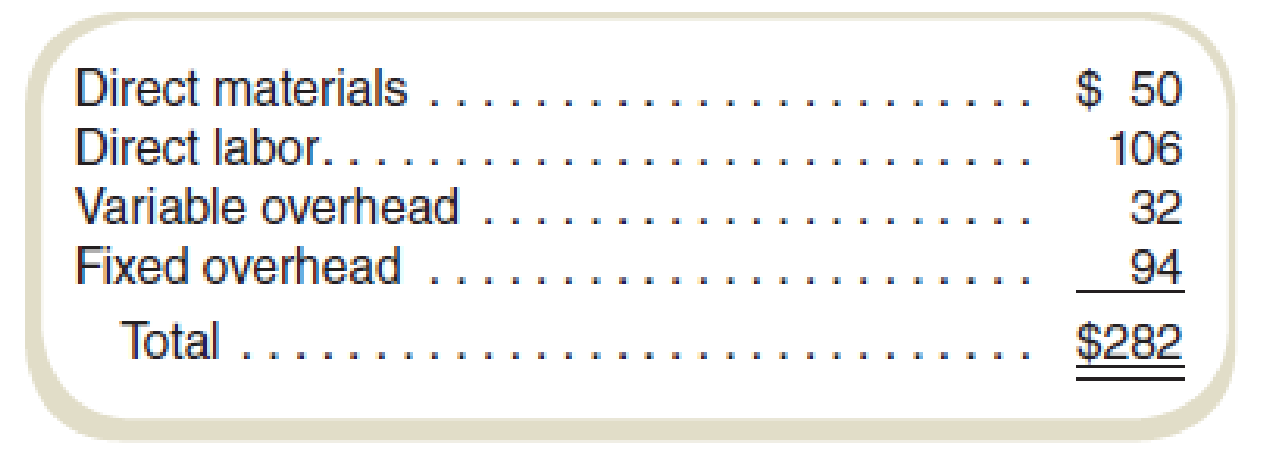

Mobility Partners makes wheelchairs and other assistive devices. For years it has made the rear wheel assembly for its wheelchairs. A local bicycle manufacturing firm, Trailblazers, Inc., offered to sell these rear wheel assemblies to Mobility. If Mobility makes the assembly, its cost per rear wheel assembly is as follows (based on annual production of 2,000 units):

Trailblazers has offered to sell the assembly to Mobility for $220 each. The total order would amount to 2,000 rear wheel assemblies per year, which Mobility’s management will buy instead of make if Mobility can save at least $20,000 per year. Accepting Trailblazers’s offer would eliminate annual fixed

Required

Should Mobility make rear wheel assemblies or buy them from Trailblazers? Prepare a schedule that shows the differential costs per rear wheel assembly.

Want to see the full answer?

Check out a sample textbook solution

Chapter 4 Solutions

Fundamentals Of Cost Accounting (6th Edition)

- Cost account tutor solve thisarrow_forwardOwnership and profit distribution in a sole proprietorship are generally seen on its balance sheet, respectively, as: a. A personal capital account and dividends b. Common stock and dividends c. Common stock and withdrawals d. A personal capital account and withdrawalsarrow_forwardIf the contribution margin ratio for Vera Company is 28%, sales were $1,135,000, and fixed costs were $297,420, what was the income from operations? Right Answerarrow_forward

- Calculate the plantwide factory overhead ratearrow_forwardDuring FY 2020, Dorchester Company plans to sell Widgets for $14 a unit. Current variable costs are $6 a unit and fixed costs are expected to total $146,000. Use this information to determine the dollar value of sales for Dorchester to break even. (Round to the nearest whole dollar.)arrow_forwardWhat is the pension expense for 2023?arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College