Concept explainers

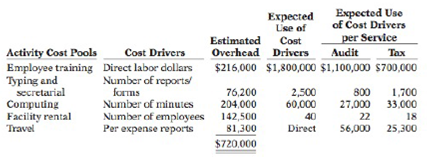

Lewis and Stark is a public accounting firm that offers two primary services, auditing and tax-return preparation. A controversy has developed between the partners of the two service lines as to who is contributing the greater amount to the bottom line. The area of contention is the assignment of

Instructions

(a) Using traditional product costing as proposed by the tax partners, compute the total overhead cost assigned to both services (audit and tax) of Lewis and Stark.

(b) (1) Using activity-based costing, prepare a schedule showing the computations of the

activity-based overhead rates (per cost driver). (2) Prepare a schedule assigning each activity's overhead cost pool to each service based on the use of the cost drivers.

(c) - Comment on the comparative overhead cost for the two services under both traditional costing and ABC.

Want to see the full answer?

Check out a sample textbook solution

Chapter 4 Solutions

Managerial Accounting, Binder Ready Version: Tools for Business Decision Making

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning