Survey of Accounting (Accounting I)

8th Edition

ISBN: 9781337517386

Author: WARREN

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 4, Problem 4.5.2MBA

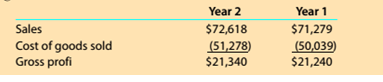

Gross margin percent and markup percent

Target Corp. (TGT) operates retail stores throughout the United States and is a major competitor of Wal-Mart. The following data (in millions) were adapted from recent financial statements of Target.

Compute the average markup percent for Years 1 and 2. Round to one decimal place.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Write down as many descriptions describing rock and roll that you can.

From these descriptions can you come up with s denition of rock and roll?

What performers do you recognize?

What performers don’t you recognize?

What can you say about musical inuence on these current rock musicians?

Try to break these inuences into genres and relate them to the rock musicians. What does

Mick Jagger say about country artists?

What does pioneering mean?

What kind of ensembles w

Recently, Abercrombie & Fitch has been implementing a turnaround strategy since its sales had been falling for the past few years (11% decrease in 2014, 8% in 2015, and just 3% in 2016.) One part of Abercrombie's new strategy has been to abandon its logo-adorned merchandise, replacing it with a subtler look. Abercrombie wrote down $20.6 million of inventory, including logo-adorned merchandise, during the year ending January 30, 2016. Some of this inventory dated back to late 2013. The write-down was net of the amount it would be able to recover selling the inventory at a discount. The write-down is significant; Abercrombie's reported net income after this write-down was $35.6 million. Interestingly, Abercrombie excluded the inventory write-down from its non-GAAP income measures presented to investors; GAAP earnings were also included in the same report. Question: What impact would the write-down of inventory have had on Abercrombie's expenses, Gross margin, and Net income?

Recently, Abercrombie & Fitch has been implementing a turnaround strategy since its sales had been falling for the past few years (11% decrease in 2014, 8% in 2015, and just 3% in 2016.) One part of Abercrombie's new strategy has been to abandon its logo-adorned merchandise, replacing it with a subtler look. Abercrombie wrote down $20.6 million of inventory, including logo-adorned merchandise, during the year ending January 30, 2016. Some of this inventory dated back to late 2013. The write-down was net of the amount it would be able to recover selling the inventory at a discount. The write-down is significant; Abercrombie's reported net income after this write-down was $35.6 million. Interestingly, Abercrombie excluded the inventory write-down from its non-GAAP income measures presented to investors; GAAP earnings were also included in the same report. Question: What impact would the write-down of inventory have had on Abercrombie's assets, Liabilities, and Equity?

Chapter 4 Solutions

Survey of Accounting (Accounting I)

Ch. 4 - If merchandise purchased on account is returned,...Ch. 4 - Prob. 2SEQCh. 4 - Prob. 3SEQCh. 4 - On a multiple-step income statement, the excess of...Ch. 4 - As of December 31, 20Y4, Ames Corporation's...Ch. 4 - What distinguishes a retail business from a...Ch. 4 - Prob. 2CDQCh. 4 - Prob. 3CDQCh. 4 - Prob. 4CDQCh. 4 - Prob. 5CDQ

Ch. 4 - When you purchase a new car, the “sticker price”...Ch. 4 - Prob. 7CDQCh. 4 - Differentiate between the multiple and single-step...Ch. 4 - Prob. 9CDQCh. 4 - Can a business earn a gross profit but incur a net...Ch. 4 - Prob. 11CDQCh. 4 - Prob. 12CDQCh. 4 - Determining gross profit During the current year,...Ch. 4 - Determining cost of goods sold For a recent year,...Ch. 4 - Purchase-related transaction Burr Company...Ch. 4 - Purchase-related transactions A retailer Is...Ch. 4 - Prob. 4.5ECh. 4 - Prob. 4.6ECh. 4 - Determining amounts to be paid on invoices...Ch. 4 - Prob. 4.8ECh. 4 - Sales-related transactions After the amount due on...Ch. 4 - Sales-related transactions Merchandise is sold on...Ch. 4 - Prob. 4.11ECh. 4 - Prob. 4.12ECh. 4 - Prob. 4.13ECh. 4 - Prob. 4.14ECh. 4 - Adjustment for merchandise inventory shrinkage...Ch. 4 - Adjustment for Customer Refunds and Returns Assume...Ch. 4 - Prob. 4.17ECh. 4 - Multiple-step income statement On March 31, 20Y5,...Ch. 4 - Single-step income statement Summary operating...Ch. 4 - Multiple-step income statement Identify the enurs...Ch. 4 - Purchase-related transactions The following...Ch. 4 - Sales-related transactions The- following selected...Ch. 4 - Prob. 4.3PCh. 4 - Multiple-step income statement and report form of...Ch. 4 - Multiple-step income statement and report form of...Ch. 4 - Multiple-step income statement and report form of...Ch. 4 - Multiple-step income statement and report form of...Ch. 4 - Single-step income statement Selected accounts and...Ch. 4 - Prob. 4.5.2PCh. 4 - Prob. 4.6.1PCh. 4 - Prob. 4.6.2PCh. 4 - Prob. 4.1MBACh. 4 - Sales transactions Using transactions listed in...Ch. 4 - Prob. 4.3MBACh. 4 - Prob. 4.4MBACh. 4 - Prob. 4.5.1MBACh. 4 - Gross margin percent and markup percent Target...Ch. 4 - Gross margin percent and markup percent Target...Ch. 4 - Prob. 4.6MBACh. 4 - Gross profit percent and markup percent Deere &...Ch. 4 - Prob. 4.7.2MBACh. 4 - Gross profit percent and markup percent Deere &...Ch. 4 - Gross profit percent and markup percent...Ch. 4 - Gross profit percent and markup percent...Ch. 4 - Gross profit percent and markup percent...Ch. 4 - Prob. 4.9MBACh. 4 - Prob. 4.10.1MBACh. 4 - Gross profit percent and markup percent Companies...Ch. 4 - Prob. 4.10.3MBACh. 4 - Prob. 4.1CCh. 4 - Prob. 4.2CCh. 4 - Prob. 4.3.1CCh. 4 - Determining cost of purchase The following is an...Ch. 4 - Prob. 4.4.1CCh. 4 - Prob. 4.4.2CCh. 4 - Prob. 4.4.3CCh. 4 - Prob. 4.5C

Additional Business Textbook Solutions

Find more solutions based on key concepts

How is activity-based costing useful for pricing decisions?

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Assume the United States is an importer of televisions and there are no trade restrictions. US consumers buy 1 ...

Principles of Microeconomics (MindTap Course List)

1-1. Define marketing and outline the steps in the marketing process. (AASCB: Communication)

Marketing: An Introduction (13th Edition)

Whether callable bonds have a higher or lower yield than otherwise identical bonds without a call feature. Intr...

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

(Interest rate determination) You’re looking at some corporate bonds issued by Ford, and you are trying to det...

Foundations Of Finance

Fundamental and Enhancing Characteristics. Identify whether the following items are fundamental characteristics...

Intermediate Accounting (2nd Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License