Concept explainers

(25–30 min.)

Underwood is eager to impress his new employer, and he knows that in 2017. Anderson’s upper management is under pressure to show a profit in a challenging competitive environment because they are hoping to be acquired by a large private equity firm sometime in 2018. At the end of 2016, Underwood decides to adjust the manufacturing overhead rate to 160% of direct labor cost. He explains to the company president that, because overhead was underallocated in 2016, this adjustment is necessary. Cost information for 2017 follows:

| Direct materials control, 1/1/2017 | 25,000 |

| Direct materials purchased, 2017 | 650,000 |

| Direct materials added to production, 2017 | 630,000 |

| Work in process control, 1/1/2017 | 280,000 |

| Direct manufacturing labor, 2017 | 880,000 |

| Cost of goods manufactured, 2017 | 2,900,000 |

| Finished goods control, 1/1/2017 | 320,000 |

| Finished goods control, 12/31/2017 | 290,000 |

| Manufacturing overhead costs, 2017 | 1,300,000 |

Anderson’s revenue for 2017 was $5,550,000, and the company’s selling and administrative expenses were $2,720,000.

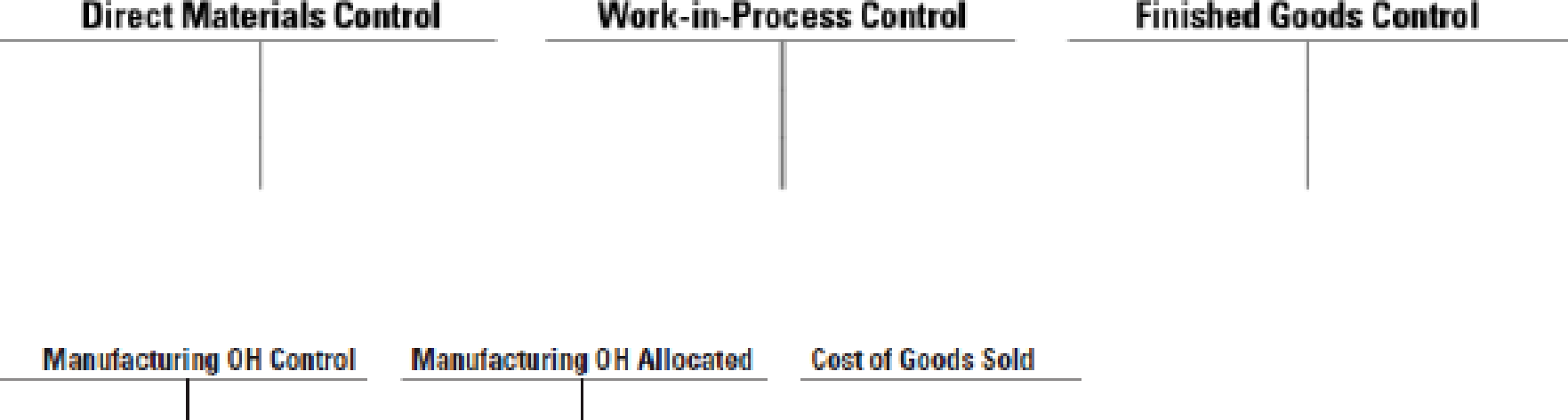

- 1. Insert the given information in the T-accounts below. Calculate the following amounts to complete the T-accounts:

Required

- a. Direct materials control, 12/31/2017

- b. Manufacturing overhead allocated, 2017

- c. Cost of goods sold, 2017

- 2. Calculate the amount of under- or overallocated manufacturing overhead.

- 3. Calculate Anderson’s net operating income under the following:

- a. Under- or overallocated manufacturing overhead is written off to cost of goods sold.

- b. Under- or overallocated manufacturing overhead is prorated based on the ending balances in work in process, finished goods, and cost of goods sold.

- 4. Underwood chooses option 3a above, stating that the amount is immaterial. Comment on the ethical implications of his choice. Do you think that there were any ethical issues when he established the manufacturing overhead rate for 2017 back in late 2016? Refer to the IMA Statement of Ethical Professional Practice.

Trending nowThis is a popular solution!

Learn your wayIncludes step-by-step video

Chapter 4 Solutions

Horngren's Cost Accounting, Student Value Edition Plus MyLab Accounting with Pearson eText - Access Card Package (16th Edition)

Additional Business Textbook Solutions

Financial Accounting (12th Edition) (What's New in Accounting)

Operations Management

Fundamentals of Management (10th Edition)

Essentials of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

Financial Accounting, Student Value Edition (5th Edition)

Intermediate Accounting (2nd Edition)

- Please give me true answer this financial accounting questionarrow_forwardCan you please give me correct solution this general accounting question?arrow_forwardMichael McDowell Co. establishes a $108 million liability at the end of 2025 for the estimated site-cleanup costs at two of its manufacturing facilities. All related closing costs will be paid and deducted on the tax return in 2026. Also, at the end of 2025, the company has $54 million of temporary differences due to excess depreciation for tax purposes, $7.56 million of which will reverse in 2026. The enacted tax rate for all years is 20%, and the company pays taxes of $34.56 million on $172.80 million of taxable income in 2025. McDowell expects to have taxable income in 2026. Assuming that the only deferred tax account at the beginning of 2025 was a deferred tax liability of $5,400,000, draft the income tax expense portion of the income statement for 2025, beginning with the line "Income before income taxes." (Hint: You must first compute (1) the amount of temporary difference underlying the beginning $5,400,000 deferred tax liability, then (2) the amount of temporary differences…arrow_forward

- Please answer the following requirements a and b on these general accounting questionarrow_forwardGeneral Accountingarrow_forwardHarper, Incorporated, acquires 40 percent of the outstanding voting stock of Kinman Company on January 1, 2023, for $210,000 in cash. The book value of Kinman's net assets on that date was $400,000, although one of the company's buildings, with a $60,000 carrying amount, was actually worth $100,000. This building had a 10-year remaining life. Kinman owned a royalty agreement with a 20-year remaining life that was undervalued by $85,000. Kinman sold Inventory with an original cost of $60,000 to Harper during 2023 at a price of $90,000. Harper still held $15,000 (transfer price) of this amount in Inventory as of December 31, 2023. These goods are to be sold to outside parties during 2024. Kinman reported a $40,000 net loss and a $20,000 other comprehensive loss for 2023. The company still manages to declare and pay a $10,000 cash dividend during the year. During 2024, Kinman reported a $40,000 net income and declared and paid a cash dividend of $12,000. It made additional inventory sales…arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College