EBK HORNGREN'S COST ACCOUNTING

16th Edition

ISBN: 9780134475950

Author: Datar

Publisher: PEARSON CO

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 4, Problem 4.42P

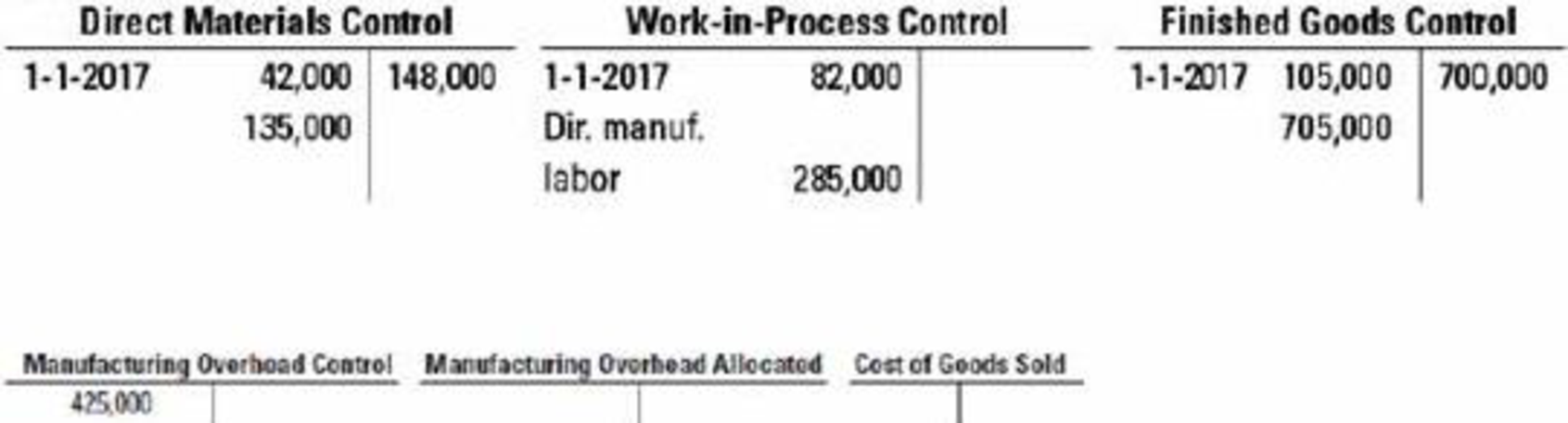

General ledger relationships, under- and overallocation. (S. Sridhar adapted) Keezel Company uses normal costing in its

Additional information follows:

- a. Direct manufacturing labor wage rate was $15 per hour.

- b. Manufacturing

overhead was allocated at $20 per direct manufacturing labor-hour. - c. During the year sales revenues were $1,550,000, and marketing and distribution costs were $810,000.

- 1. What was the amount of direct materials issued to production during 2017?

Required

- 2. What was the amount of manufacturing overhead allocated to jobs during 2017?

- 3. What was the total cost of jobs completed during 2017?

- 4. What was the balance of work-in-process inventory on December 31, 2017?

- 5. What was the cost of goods sold before proration of under- or overallocated overhead?

- 6. What was the under- or overallocated manufacturing overhead in 2017?

- 7. Dispose of the under- or overallocated manufacturing overhead using the following:

- a. Write-off to Cost of Goods Sold

- b. Proration based on ending balances (before proration) in Work-in-Process Control, Finished Goods Control, and Cost of Goods Sold

- 8. Using each of the approaches in requirement 7, calculate Keezel’s operating income for 2017.

- 9. Which approach in requirement 7 do you recommend Keezel use? Explain your answer briefly.

Expert Solution & Answer

Learn your wayIncludes step-by-step video

schedule07:21

Students have asked these similar questions

Keezel Company uses normal costing in its job-costing system. Partially completed T-accounts and additional information for Keezel for 2017 are as follows:

a.

Direct manufacturing labor wage rate was

$15

per hour.

b.

Manufacturing overhead was allocated at

$20

per direct manufacturing labor-hour.

c.

During the year, sales revenues were

$1,550,000,

and marketing and distribution costs were

$810,000.

Question

1.

What was the amount of direct materials issued to production during

2017?

2.

What was the amount of manufacturing overhead allocated to jobs during

2017?

3.

What was the total cost of jobs completed during

2017?

4.

What was the balance of work-in-process inventory on December 31,

2017?

5.

What was the cost of goods sold before proration of under- or overallocated overhead?

6.

What was the under- or overallocated manufacturing overhead in

2017?

7.

Dispose of the under- or overallocated…

The company uses normal costing and applies overhead on the basis of direct labor costs. The total factory cost for the period is:

Help me please asap

Chapter 4 Solutions

EBK HORNGREN'S COST ACCOUNTING

Ch. 4 - Define cost pool, cost tracing, cost allocation,...Ch. 4 - How does a job-costing system differ from a...Ch. 4 - Why might an advertising agency use job costing...Ch. 4 - Describe the seven steps in job costing.Ch. 4 - Give examples of two cost objects in companies...Ch. 4 - Describe three major source documents used in...Ch. 4 - What is the advantage of using computerized source...Ch. 4 - Give two reasons why most organizations use an...Ch. 4 - Distinguish between actual costing and normal...Ch. 4 - Describe two ways in which a house-construction...

Ch. 4 - Comment on the following statement: In a...Ch. 4 - Describe three different debit entries to the...Ch. 4 - Describe three alternative ways to dispose of...Ch. 4 - When might a company use budgeted costs rather...Ch. 4 - Prob. 4.15QCh. 4 - Which of the following does not accurately...Ch. 4 - Sturdy Manufacturing Co. assembled the following...Ch. 4 - For which of the following industries would...Ch. 4 - ABC Company uses job-order costing and has...Ch. 4 - Under Stanford Corporations job costing system,...Ch. 4 - (10 min) Job costing, process costing. In each of...Ch. 4 - Actual costing, normal costing, accounting for...Ch. 4 - Job costing, normal and actual costing. Atkinson...Ch. 4 - Budgeted manufacturing overhead rate, allocated...Ch. 4 - Job costing, accounting for manufacturing...Ch. 4 - Job costing, consulting firm. Frontier Partners, a...Ch. 4 - Time period used to compute indirect cost rates....Ch. 4 - Accounting for manufacturing overhead. Creative...Ch. 4 - Job costing, journal entries. The University of...Ch. 4 - Journal entries, T-accounts, and source documents....Ch. 4 - Job costing, journal entries. Donald Transport...Ch. 4 - Job costing, unit cost, ending work in process....Ch. 4 - Job costing; actual, normal, and variation from...Ch. 4 - Job costing; variation on actual, normal, and...Ch. 4 - Proration of overhead. The Ride-On-Wave Company...Ch. 4 - Job costing, accounting for manufacturing...Ch. 4 - Service industry, job costing, law firm. Kidman ...Ch. 4 - Service industry, job costing, two direct- and two...Ch. 4 - Proration of overhead. (Z. Iqbal, adapted) The Zaf...Ch. 4 - Normal costing, overhead allocation, working...Ch. 4 - Proration of overhead with two indirect cost...Ch. 4 - General ledger relationships, under- and...Ch. 4 - Overview of general ledger relationships. Estevez...Ch. 4 - Allocation and proration of overhead. Resource...Ch. 4 - (2530 min.) Job costing, ethics. Joseph Underwood...Ch. 4 - Job costingservice industry. Market Pulse performs...

Additional Business Textbook Solutions

Find more solutions based on key concepts

Would treasury stock be considered authorized, issued, or outstanding? Explain your answer.

Financial Accounting

Discussion Questions 1. What characteristics of the product or manufacturing process would lead a company to us...

Managerial Accounting (4th Edition)

Small Business Analysis Purpose: To help you understand the importance of cash flows in the operation of a smal...

Financial Accounting, Student Value Edition (4th Edition)

How is activity-based costing useful for pricing decisions?

Cost Accounting (15th Edition)

Sykes Corporations comparative balance sheets at December 31, Year 2 and Year 1, reported accumulated depreciat...

Intermediate Accounting

Compute Cost of Goods Manufactured and Cost of Goods Sold (Learning Objective 5) Compute the Cost of Goods Manu...

Managerial Accounting (5th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Ripley, Inc., costs products using a normal costing system. The following data are available for last year: Overhead is applied on the basis of direct labor hours. Required: 1. What was the predetermined overhead rate? 2. What was the applied overhead for last year? 3. Was overhead over- or underapplied, and by how much? 4. What was the total cost per unit produced (carry your answer to four significant digits)?arrow_forwardCushing, Inc., costs products using a normal costing system. The following data are available for last year: Overhead is applied on the basis of direct labor hours. What was last years per unit product cost? a. 1.39 b. 4.40 c. 4.43 d. 3.01arrow_forwardThe cost accountant for River Rock Beverage Co. estimated that total factory overhead cost for the Blending Department for the coming fiscal year beginning February 1 would be 3,150,000, and total direct labor costs would be 1,800,000. During February, the actual direct labor cost totalled 160,000, and factory overhead cost incurred totaled 283,900. a. What is the predetermined factory overhead rate based on direct labor cost? b. Journalize the entry to apply factory overhead to production for February. c. What is the February 28 balance of the account Factory OverheadBlending Department? d. Does the balance in part (c) represent over- or underapplied factory overhead?arrow_forward

- The following product costs are available for Kellee Company on the production of eyeglass frames: direct materials, $32,125; direct labor, $23.50; manufacturing overhead, applied at 225% of direct labor cost; selling expenses, $22,225; and administrative expenses, $31,125. The direct labor hours worked for the month are 3,200 hours. A. What are the prime costs? B. What are the conversion costs? C. What is the total product cost? D. What is the total period cost? E. If 6.425 equivalent units are produced, what is the equivalent material cost per unit? F. What is the equivalent conversion cost per unit?arrow_forwardCompute the total job cost for each of the following scenarios: a. If the direct labor cost method is used in applying factory overhead and the predetermined rate is 100%, what amount should be charged to Job 2010 for factory overhead? Assume that direct materials used totaled 5,000 and that the direct labor cost totaled 3,200. b. If the direct labor hour method is used in applying factory overhead and the predetermined rate is 10 an hour, what amount should be charged to Job 2010 for factory overhead? Assume that the direct materials used totaled 5,000, the direct labor cost totaled 3,200, and the number of direct labor hours totaled 250. c. If the machine hour method is used in applying factory overhead and the predetermined rate is 12.50 an hour, what amount should be charged to Job 2010 for factory overhead? Assume that the direct materials used totaled 5,000, the direct labor cost totaled 3,200, the direct labor hours were 250 hours, and the machine hours were 295 hours.arrow_forwardDavis Co. uses backflush costing to account for its manufacturing costs. The trigger points are the purchase of materials, the completion of goods, and the sale of goods. Prepare journal entries to account for the following: a. Purchased raw materials, on account, 70,000. b. Requisitioned raw materials to production, 70,000. c. Distributed direct labor costs, 15,000. d. Factory overhead costs incurred, 45,000. (Use Various Credits for the account in the credit part of the entry.) e. Completed all of the production started. f. Sold the completed production for 195,000, on account. (Hint: Use a single account for raw materials and work in process.)arrow_forward

- Leen Production Co. uses the job order cost system of accounting. The following information was taken from the companys books after all posting had been completed at the end of May: a. Compute the total production cost of each job. b. Prepare the journal entry to transfer the cost of jobs completed to Finished Goods. c. Compute the selling price per unit for each job, assuming a mark-on percentage of 40%. d. Prepare the journal entries to record the sale of Job 1065.arrow_forwardPlease assistarrow_forwardHamada company uses normal costing to cost each job. Its job-costing system has two direct-cost categories (direct materials and direct manufacturing labor) and one indirect- cost pool (manufacturing overhead, allocated on the basis of direct manufacturing labor costs). During 2020, Indirect manufacturing labor cost incurred $1,300,000. The journal entry is: а. Manufacturing Overhead Control debit $1,300,000 and Materials Control credit $1,300,000. b. Work-in-Process Control debit $1,300,000 and Wages payable control credit $1,300,000. С. Wages payable control debit $1,300,000 and Manufacturing Overhead Control credit $1,300,000. d. Wages payable control debit $1,300,000 and Work-in-Process Control credit $1,300,000.arrow_forward

- Hamada company uses normal costing to cost each job. Its job-costing system has two direct-cost categories (direct materials and direct manufacturing labor) and one indirect-cost pool (manufacturing overhead, allocated on the basis of direct manufacturing labor costs). During 2020, Indirect manufacturing labor cost incurred $1,300,000. The journal entry is: a. Work-in-Process Control debit $1,300,000 and Wages payable control credit $1,300,000. b. Manufacturing Overhead Control debit $1,300,000 and Materials Control credit $1,300,000. c. Wages payable control debit $1,300,000 and Work-in-Process Control credit $1,300,000. d. Wages payable control debit $1,300,000 and Manufacturing Overhead Control credit $1,300,000.arrow_forwardDesert Products uses a job-costing system with two direct-cost categories (direct materials and direct manufacturing labor) and one manufacturing overhead cost pool. Desert allocates manufacturing overhead costs using direct manufacturing labor costs. Desert provides the following information: E (Click the icon to view the information.) Read the requirements ... Requirement 1. Compute the actual and budgeted manufacturing overhead rates for 2017. (Enter your answer as a number [not as a percentage] rounded to two decimal places, X.XX.) Actual manufacturing overhead rate Budgeted manufacturing overhead rate Data Table Requirements Budget for 2017 Actual Results for 2017 Direct material costs 2,100,000 $ 2.050,000 1. Compute the actual and budgeted manufacturing overhead rates for 2017. 2. During March, the job-cost record for Job 626 contained the following information: Direct manufacturing labor costs 1,500,000 1,460,000 Direct materials used $50,000 Manufacturing overhead costs…arrow_forwardDakota Products uses a job-costing system with two direct-cost categories (direct materials and direct manufacturing labor) and one manufacturing overhead cost pool. Dakota allocates manufacturing overhead costs using direct manufacturing labor costs. Dakota provides the following information: E (Click the icon to view the information.) Read the requirements. Requirement 1. Compute the actual and budgeted manufacturing overhead rates for 2017. (Enter your answer as a number (not as a percentage) rounded to two decimal places, X.XX.) Actual manufacturing overhead rate Budgeted manufacturing overhead rate = Data table Budget for 2017 Actual Results for 2017 Direct material costs 2,250,000 $ 2,150,000 Direct manufacturing labor costs 1,700,000 1,650,000 Manufacturing overhead costs 3,060,000 3,217,500 Print Donearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

What is variance analysis?; Author: Corporate finance institute;https://www.youtube.com/watch?v=SMTa1lZu7Qw;License: Standard YouTube License, CC-BY