CORPORATE FINANCIAL ACCOUNTING 15TH ED

15th Edition

ISBN: 9781337894272

Author: Carl S. Warren

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 4, Problem 4.3MAD

Analyze and compare Foot Locker and The Finish Line

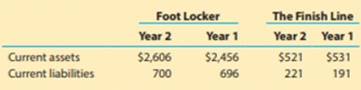

The Foot Locker, Inc. (FL) and The Finish Line, Inc. (FINL) arc two retail athletic footwear chains. The current assets and current liabilities from recent

a. Compute the

b. Compute the

c.  If you were a supplier to these two companies, in which company would you feel most confident about receiving payment?

If you were a supplier to these two companies, in which company would you feel most confident about receiving payment?

d.  For each company, did liquidity improve or decline between the two years?

For each company, did liquidity improve or decline between the two years?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Accounting?

SUBJECT= GENERAL ACCOUNTING

I am looking for help with this general accounting question using proper accounting standards.

Chapter 4 Solutions

CORPORATE FINANCIAL ACCOUNTING 15TH ED

Ch. 4 - Prob. 1DQCh. 4 - Describe the nature of the assets that compose the...Ch. 4 - Prob. 3DQCh. 4 - Prob. 4DQCh. 4 - Why are closing entries required at the end of an...Ch. 4 - Prob. 6DQCh. 4 - What is the purpose of the post-closing trial...Ch. 4 - Prob. 8DQCh. 4 - Which step of the accounting cycle is optional?Ch. 4 - Prob. 10DQ

Ch. 4 - Flow of accounts into financial statements The...Ch. 4 - Statement of stockholders equity Scott Lockhart...Ch. 4 - Classified balance sheet The following accounts...Ch. 4 - Closing entries After the accounts have been...Ch. 4 - Accounting cycle From the following list of steps...Ch. 4 - Working capital and current ratio Current assets...Ch. 4 - Flow of accounts into financial statements The...Ch. 4 - Classifying accounts Balances for each of the...Ch. 4 - Financial statements from the end-of-period...Ch. 4 - Financial statements from the end-of-period...Ch. 4 - Income statement The following account balances...Ch. 4 - Income statement; net loss The following revenue...Ch. 4 - Income statement FedEx Corporation (FDX) had the...Ch. 4 - Statement of stockholders equity Climate Control...Ch. 4 - Statement of stockholders equity; net loss...Ch. 4 - Classifying assets Identify each of the following...Ch. 4 - Balance sheet classification At the balance sheet...Ch. 4 - Balance sheet Dynamic Weight Loss Co. offers...Ch. 4 - Balance sheet The following balance sheet was...Ch. 4 - Identifying accounts to be closed From the list...Ch. 4 - Closing entries with net income Automation...Ch. 4 - Closing entries with net loss Summit Services Co....Ch. 4 - Identifying permanent accounts Which of the...Ch. 4 - Post-closing trial balance An accountant prepared...Ch. 4 - Steps in the accounting cycle Rearrange the...Ch. 4 - Appendix 1 Completing an end-of-period spreadsheet...Ch. 4 - Appendix 1 Adjustment data on an end-of-period...Ch. 4 - Prob. 4.22EXCh. 4 - Appendix 1 Financial statements from an...Ch. 4 - Appendix 1 Adjusting entries from an end-of-period...Ch. 4 - Appendix 1 Closing entries from an end-of-period...Ch. 4 - Appendix 2 Reversing entry The following adjusting...Ch. 4 - Appendix 2 Adjusting and reversing entries On the...Ch. 4 - Appendix 2 Adjusting and reversing entries On the...Ch. 4 - Appendix 2 Entries posted to wages expense account...Ch. 4 - Appendix 2 Entries posted to wages expense account...Ch. 4 - Financial statements and closing entries 8.Net...Ch. 4 - Financial statements and closing entries Foxy...Ch. 4 - accounts, adjusting entries, financial statements,...Ch. 4 - Net Income: 51,150 Ledger accounts, adjusting...Ch. 4 - Net income: 43,475 Complete accounting cycle For...Ch. 4 - Financial statements and closing entries Last...Ch. 4 - Financial statements and closing entries The...Ch. 4 - Income: 27,350 accounts, adjusting entries,...Ch. 4 - Ledger accounts, adjusting entries, financial...Ch. 4 - Net income: 53,77S Complete accounting cycle For...Ch. 4 - Comprehensive Problem 1 8 Net income. 31,425...Ch. 4 - Working Capital and Current Ratio Analyze and...Ch. 4 - Analyze and compare Zynga, Electronic Arts, and...Ch. 4 - Analyze and compare Foot Locker and The Finish...Ch. 4 - Analyze Under Armour The following year-end data...Ch. 4 - Prob. 4.5MADCh. 4 - Analyze and compare Alphabet (Google) and...Ch. 4 - Prob. 4.1TIFCh. 4 - Prob. 4.3TIFCh. 4 - Financial statements The following is an excerpt...Ch. 4 - Prob. 4.5TIF

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Calculate the standard cost per unit for direct materials direct labor and variable manufacturing overheadarrow_forwardI am trying to find the accurate solution to this financial accounting problem with appropriate explanations.arrow_forwardCan you show me the correct approach to solve this financial accounting problem using suitable standards?arrow_forward

- Please explain the correct approach for solving this general accounting question.arrow_forwardZebrix Ltd. has an inventory period of 55 days, an accounts receivable period of 10 days, and an accounts payable period of 6 days. The company's annual sales are $208,400. How many times per year does the company turn over its accounts receivable?arrow_forwardLika company issues 2,000 shares of $10 par value common stock for $25 per share. What amount should be credited to the Common Stock account and to the Additional Paid-in Capital account?arrow_forward

- Can you help me solve this general accounting question using the correct accounting procedures?arrow_forwardCan you solve this general accounting question with accurate accounting calculations?arrow_forwardPlease provide the correct answer to this general accounting problem using accurate calculations.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License