CORPORATE FINANCIAL ACCOUNTING 15TH ED

15th Edition

ISBN: 9781337894272

Author: Carl S. Warren

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 4, Problem 4.2MAD

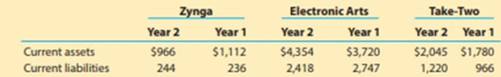

Analyze and compare Zynga, Electronic Arts, and Take-Two

Data (in millions) from recent financial statements of Zynga Inc. (ZNGA), Electronic Arts Inc. (EA), and Take-Two Interactive Software, Inc. (TTWO) are as follows:

a. Compute the

b. Which company has the largest working capital?

c. Compute the

d. For Year 2, rank the companies from most liquid to least liquid based upon the current ratio.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Kawasaki Corporation had accounts receivable of $12,800 at the beginning of the month and $7,500 at the end of the month. Credit sales totaled $68,000 during the month. Calculate the cash collected from customers during the month, assuming that all sales were made on account.

Can you explain this financial accounting question using accurate calculation methods?

Please provide the accurate answer to this general accounting problem using valid techniques.

Chapter 4 Solutions

CORPORATE FINANCIAL ACCOUNTING 15TH ED

Ch. 4 - Prob. 1DQCh. 4 - Describe the nature of the assets that compose the...Ch. 4 - Prob. 3DQCh. 4 - Prob. 4DQCh. 4 - Why are closing entries required at the end of an...Ch. 4 - Prob. 6DQCh. 4 - What is the purpose of the post-closing trial...Ch. 4 - Prob. 8DQCh. 4 - Which step of the accounting cycle is optional?Ch. 4 - Prob. 10DQ

Ch. 4 - Flow of accounts into financial statements The...Ch. 4 - Statement of stockholders equity Scott Lockhart...Ch. 4 - Classified balance sheet The following accounts...Ch. 4 - Closing entries After the accounts have been...Ch. 4 - Accounting cycle From the following list of steps...Ch. 4 - Working capital and current ratio Current assets...Ch. 4 - Flow of accounts into financial statements The...Ch. 4 - Classifying accounts Balances for each of the...Ch. 4 - Financial statements from the end-of-period...Ch. 4 - Financial statements from the end-of-period...Ch. 4 - Income statement The following account balances...Ch. 4 - Income statement; net loss The following revenue...Ch. 4 - Income statement FedEx Corporation (FDX) had the...Ch. 4 - Statement of stockholders equity Climate Control...Ch. 4 - Statement of stockholders equity; net loss...Ch. 4 - Classifying assets Identify each of the following...Ch. 4 - Balance sheet classification At the balance sheet...Ch. 4 - Balance sheet Dynamic Weight Loss Co. offers...Ch. 4 - Balance sheet The following balance sheet was...Ch. 4 - Identifying accounts to be closed From the list...Ch. 4 - Closing entries with net income Automation...Ch. 4 - Closing entries with net loss Summit Services Co....Ch. 4 - Identifying permanent accounts Which of the...Ch. 4 - Post-closing trial balance An accountant prepared...Ch. 4 - Steps in the accounting cycle Rearrange the...Ch. 4 - Appendix 1 Completing an end-of-period spreadsheet...Ch. 4 - Appendix 1 Adjustment data on an end-of-period...Ch. 4 - Prob. 4.22EXCh. 4 - Appendix 1 Financial statements from an...Ch. 4 - Appendix 1 Adjusting entries from an end-of-period...Ch. 4 - Appendix 1 Closing entries from an end-of-period...Ch. 4 - Appendix 2 Reversing entry The following adjusting...Ch. 4 - Appendix 2 Adjusting and reversing entries On the...Ch. 4 - Appendix 2 Adjusting and reversing entries On the...Ch. 4 - Appendix 2 Entries posted to wages expense account...Ch. 4 - Appendix 2 Entries posted to wages expense account...Ch. 4 - Financial statements and closing entries 8.Net...Ch. 4 - Financial statements and closing entries Foxy...Ch. 4 - accounts, adjusting entries, financial statements,...Ch. 4 - Net Income: 51,150 Ledger accounts, adjusting...Ch. 4 - Net income: 43,475 Complete accounting cycle For...Ch. 4 - Financial statements and closing entries Last...Ch. 4 - Financial statements and closing entries The...Ch. 4 - Income: 27,350 accounts, adjusting entries,...Ch. 4 - Ledger accounts, adjusting entries, financial...Ch. 4 - Net income: 53,77S Complete accounting cycle For...Ch. 4 - Comprehensive Problem 1 8 Net income. 31,425...Ch. 4 - Working Capital and Current Ratio Analyze and...Ch. 4 - Analyze and compare Zynga, Electronic Arts, and...Ch. 4 - Analyze and compare Foot Locker and The Finish...Ch. 4 - Analyze Under Armour The following year-end data...Ch. 4 - Prob. 4.5MADCh. 4 - Analyze and compare Alphabet (Google) and...Ch. 4 - Prob. 4.1TIFCh. 4 - Prob. 4.3TIFCh. 4 - Financial statements The following is an excerpt...Ch. 4 - Prob. 4.5TIF

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please provide the correct answer to this general accounting problem using valid calculations.arrow_forwardWhat are the total product costs for the company under variable costing?arrow_forwardNovus Corp's contribution margin ratio is 58% and its fixed monthly expenses are $37,200. Assuming that the fixed monthly expenses do not change, what is the best estimate of the company's net operating income in a month when sales are $145,000?arrow_forward

- MCQarrow_forwardPlease provide the answer to this general accounting question with proper steps.arrow_forwardTidal Industries had a beginning finished goods inventory of$27,800 and an ending finished goods inventory of $25,200 during FY 2024. Beginning work-in-process was $22,300 and ending work-in-process was $20,500.Factory overhead was $32,400. The total manufacturing costs amounted to $315,600. Use this information to determine the FY 2024 Cost of Goods Sold. Need Answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License