Concept explainers

Income: $27,350

accounts,

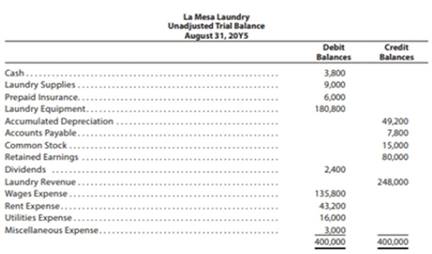

The unadjusted

The data needed to determine >ear-end adjustments are as follows:

(a) Wages accrued but not paid at August 31 are $2,200.

(b)

(c) Laundry supplies on hand at August 31 are $2,000.

(d) Insurance premiums expired during the year are $5,300.

Instructions

1. For each account listed in the unadjusted trial balance, enter the balance in a T account. Identify the balance as “Aug. 51 Bal.” In addition, add T accounts for Wages Payable. Depreciation Expense, Laundry Supplies Expense, and Insurance Expense.

2. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. Add the accounts listed in part (1) as needed.

3. Journalize and post the adjusting entries. Identify the adjustments by “Adj.” and the new balances as “Adj. Bal.”

4. Prepare an adjusted trial balance.

5. Prepare an income statement, a statement of stockholders’ equity, and a

6. Journalize and

7. Prepare a post-closing trial balance.

Trending nowThis is a popular solution!

Chapter 4 Solutions

Cengagenowv2, 1 Term Printed Access Card For Warren/jones’ Corporate Financial Accounting, 15th

- General Accountarrow_forwardTo measure controllable production inefficiencies, which of the following is the best basis for a company to use in establishing the standard hours allowed for the output of one unit of product? a) Average historical performance for the last several years. b) Engineering estimates based on ideal performance. c) Engineering estimates based on attainable performance. d) The hours per unit that would be required for the present workforce to satisfy expected demand over the long run.arrow_forwardNeed general account solutionarrow_forward

- Financial Account information is presented below: Operating expenses $ 54,000 Sales returns and allowances 6,000 Sales discounts 8,000 Sales revenue 1,78,000 Cost of goods sold 92,000 Gross Profit would be: a. $92,000. b. $80,000. c. $86,000. d. $72,000.arrow_forwardPlease provide solution this general accounting questionarrow_forwardFinancial Accountarrow_forward

- What is the return on equity of this financial accounting question?arrow_forwardWhich of the following statements is true? A. In a standard costing system, standard costs can only be used for cost control. B. In a standard costing system, standard costs can only be used for product costing. C. In a standard costing system, standard costs are used for both cost control and product costing. D. In a normal costing system, standard costs are used for cost control, and normal costs are used for product costing.arrow_forwardWhich of the following is not a correct expression of the accounting equation? a. Assets Liabilities + Owners Equity. b. Assets Liabilities Owners Equity. c. Assets Liabilities + Paid-In Capital + Retained Earnings. d. Assets = Liabilities + Paid-In Capital + Revenues Expenses. e. Assets Liabilities = Owners Equity.arrow_forward

- On January 1, 2017, Christel Madan Corporation had inventory of $54,500. At December 31, 2017, Christel Madan had the following account balances. Freight-in Purchases Purchase discounts Purchase returns and allowances Sales revenue $ 4,500 $5,10,000 $7,350 $ 3,700 $ 8,08,000 $ 5,900 $ 11,100 Sales discounts Sales returns and allowances At December 31, 2017, Christel Madan determines that its ending inventory is $64,500. Compute Christel Madan's 2017 gross profit.arrow_forwardGeneral Accountingarrow_forwardFinancial Accountingarrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub  College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning