Concept explainers

Preparing

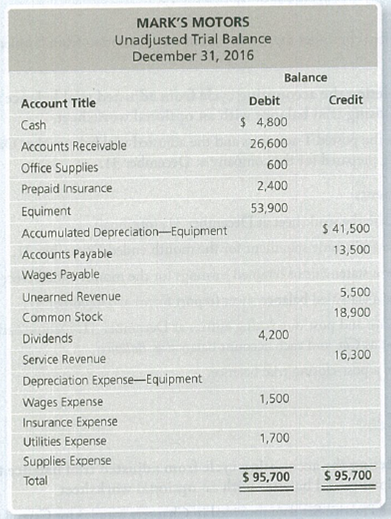

The unadjusted

Adjustment data at December 31, 2016:

a.

b. Accrued Wages Expense, $ 1,000.

c. Office Supplies on hand, $ 100.

d. Prepaid Insurance expired during December, $200.

e. Unearned Revenue earned during December, $4,400.

f. Accrued Service Revenue, $800.

2017 transactions:

a. On January 4, Mark’s Motors paid wages of $1,200. Of this, $1,000 related to the accrued wages recorded on December 31.

b. On January 10, Mark’s Motors received $ 1,500 for Service Revenue. Of this, $800 related to the accrued Service Revenue recorded on December 31.

Requirements

1. Journalize adjusting entries.

2. Journalize reversing entries for the appropriate adjusting entries.

3. Refer to the 2017 data. Journalize the cash payment and the cash receipt chat occurred in 2017.

Want to see the full answer?

Check out a sample textbook solution

Chapter 4 Solutions

Horngren's Financial & Managerial Accounting, The Financial Chapters (Book & Access Card)

- What is the denominator in computing the annual rate of return on these financial accounting question?arrow_forwardCustom Cabinetry has one job in process (Job 120) as of June 30; at that time, its job cost sheet reports direct materials of $7,000, direct labor of $3,400, and applied overhead of $2,890. Custom Cabinetry applies overhead at the rate of 85% of direct labor cost. During July, Job 120 is sold (on credit) for $26,000, Job 121 is started and completed, and Job 122 is started and still in process at the end of July. Custom Cabinetry incurs the following costs during July. Job 120 Direct materials used Direct labor used $ 2,300 3,400 Job 121 $ 7,100 4,700 Job 122 $ 2,600 3,700 1. Prepare journal entries for the following July transactions and events a through e. a. Direct materials used. b. Direct labor used. c. Overhead applied. d. Sale of Job 120. e. Cost of goods sold for Job 120. Hint. Job 120 has costs from June and July. 2. Compute the July 31 balances of the Work in Process Inventory and the Finished Goods Inventory accounts. (There were no jobs in Finished Goods Inventory at June…arrow_forwardIn 2014, LL Bean sold 450,000 pairs of boots. At one point in 2014, it had a back order of 100,000. In 2015, LL Bean expects to sell 500,000 pairs of boots. As of late November 2015, it has a back order of 50,000.Question: When would LL Bean see sales revenue from the sale of its back order on the boots?arrow_forward

- 1.3 1.2.5 za When using a computerised accounting system, the paper work will be reduced in the organisation. Calculate the omitting figures: Enter only the answer next to the question number (1.3.1-1.3.5) in the NOTE. Round off to TWO decimals. VAT report of Comfy shoes as at 30 April 2021 OUTPUT TAX INPUT TAX NETT TAX Tax Gross Tax(15%) Gross (15%) Standard 75 614,04 1.3.1 Capital 1.3.2 9 893,36 94 924,94 Tax (15%) 1.3.3 Gross 484 782,70 75 849,08 -9 893,36 -75 849,08 Bad Debts TOTAL 1.3.4 4 400,00 1 922,27 14 737,42 -1 348,36 1.3.5 (5 x 2) (10arrow_forwardNonearrow_forwardWhat was her capital gains yield? General accountingarrow_forward

- L.L. Bean operates two factories that produce its popular Bean boots (also known as "duck boots") in its home state of Maine. Since L.L. Bean prides itself on manufacturing its boots in Maine and not outsourcing, backorders for its boots can be high. In 2014, L.L. Bean sold about 450,000 pairs of the boots. At one point during 2014, it had a backorder level of about 100,000 pairs of boots. L.L. Bean can manufacture about 2,200 pairs of its duck boots each day with its factories running 24/7. In 2015, L.L. Bean expects to sell more than 500,000 pairs of its duck boots. As of late November 2015, the backorder quantity for Bean Boots was estimated to be about 50,000 pairs. Question:arrow_forwardWhat was her capital gains yield?arrow_forwardneed help this questionsarrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning  College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning