Completing the accounting cycle from

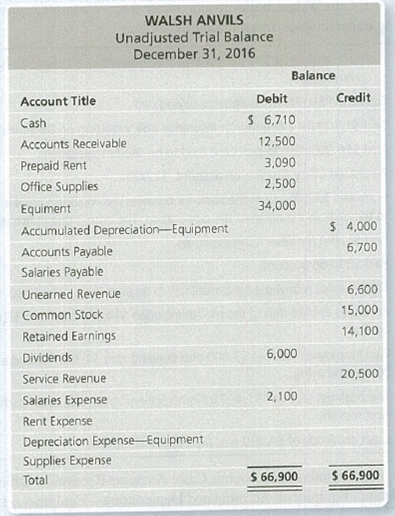

The unadjusted trial balance of Walsh Anvils at December 31, 2016, and the data for the adjustments follow:

Adjustment data:

a. Unearned Revenue still unearned at December 31, $3,000.

b. Prepaid Rent still in force at December 31, $2,900.

c. Office Supplies use d, $1, 600.

d.

e. Accrued Salaries Expense at December 31, $280.

Requirements

1. Open the T-accounts using the balances in the unadjusted trial balance.

2. Complete the worksheet for the year ended December 31, 2016. (optional)

3. Prepare the adjusting entries, and post to the accounts.

4. Prepare an adjusted trial balance.

5. Prepare the income statement, the statement of

6. Prepare the closing entries, and post to the accounts.

7. Prepare a post-closing trial balance.

8. Calculate the

Want to see the full answer?

Check out a sample textbook solution

Chapter 4 Solutions

HORNGREN'S FINANCIAL & MANAGERIAL ACCO

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning - Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning