Concept explainers

Preparing

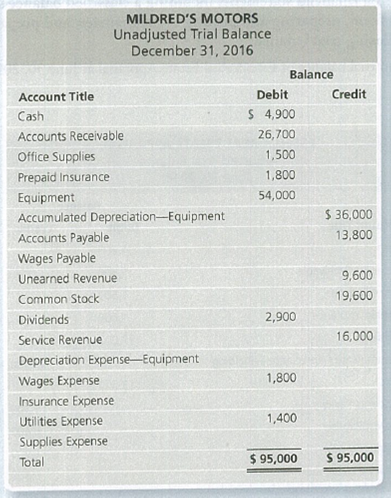

The unadjusted

Adjustment data at December 31, 2016:

a.

b. Accrued Wages Expense, $800.

c. Office Supplies on hand, $600.

d. Prepaid Insurance expired during December, $200.

e. Unearned Revenue earned during December, $4,000.

f. Accrued Service Revenue, $700.

2017 transactions:

a. On January 4, Mildred’s Motors paid wages of $1,200. Of this, $800 related to the accrued wages recorded on December 31.

b. On January 10, Mildred’s Motors received $1,300 for Service Revenue. Of this, $700 is related to the accrued Service Revenue recorded on December 31.

Requirements

1. Journalize adjusting entries.

2. Journalize reversing entries for the appropriate adjusting entries.

3. Refer to the 2017 data. Journalize the cash payment and the cash receipt that occurred in 2017.

Want to see the full answer?

Check out a sample textbook solution

Chapter 4 Solutions

Horngren's Financial & Managerial Accounting, The Managerial Chapters, Student Value Edition Plus MyLab Accounting with Pearson eText -- Access Card Package (5th Edition)

- What is the total number of equivalent units?arrow_forwardDas Corp had originally expected to earn operating income of $150,000 in the coming year. Das's degree of operating leverage is 3.1. Recently, Das revised its plans and now expects to increase sales by 15% next year. What is the percent change in operating income expected by Das in the coming year?arrow_forwardGeneral Accountarrow_forward

- cost 0f goods (COGS) for 2023?arrow_forwardJournalize the following transactions in the accounts of Missouri Gaming Co., which operates a riverboat casino.Assume 360 days in a year. March 29 Received a $57,600, 60-day, 8% note dated March 29 from Karie Platt on account.April 30. Received a $43,200, 60-day, 10% note dated April 30 from Jon Kelly on account.May 28. The note dated March 29 from Karie Platt is dishonored, and the customer's account is charged forthe note, including interest.June 29. The note dated April 30 from Jon Kelly is dishonored, and the customer's account is charged for thenote, including interest.August Cash is received for the amount due on the dishonored note dated March 29 plus interest for 90 days26. at 12% on the total amount debited to Karie Platt on May 28.October Wrote off against the allowance account the amount charged to Jon Kelly on June 29 for the22. dishonored note dated April 30. March 29th ____________ _____ _____ ____________ _____ _____ Apr 30 ____________ _____ _____ ____________…arrow_forwardI want to correct answer general accounting questionarrow_forward

- BrightStar Retailers uses a periodic inventory system. For 2023, its beginning inventory was $85,500, purchases of inventory were $420,000, and inventory at the end of the period was $102,300. What was the amount of BrightStar's cost of goods sold (COGS) for 2023?arrow_forwardThe book value of its liability?arrow_forwardWhat is the total number of units to be assigned?arrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning - Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning