Concept explainers

Preparing a worksheet, financial statements, and dosing entries

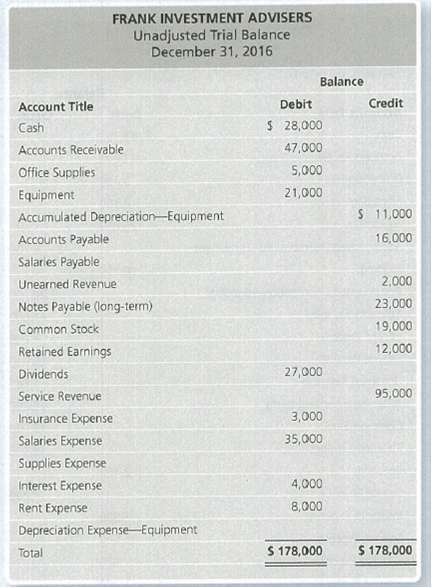

The unadjusted

Adjustment data at December 31, 2016:

a. Unearned Revenue earned during the year, $ 100.

b. Office Supplies on hand, $4,000.

c. Depredation for the year, $7, 000.

d. Acc rued Salaries Expense, $2,000.

e. Accrued Service Revenue, $6,000.

Requirements

1. Prepare a worksheet for Fran k Investment Advisers at December 31, 2016.

2. Prepare the income statement, the statement of

3. Prepare closing entries.

Want to see the full answer?

Check out a sample textbook solution

Chapter 4 Solutions

Horngren's Financial & Managerial Accounting, The Managerial Chapters, Student Value Edition Plus MyLab Accounting with Pearson eText -- Access Card Package (5th Edition)

- BH Company began the year with stockholders' equity of $320,000. During the year, the company recorded revenues of $460,000 and expenses of $310,000, and paid dividends of $30,000. What was Blue Horizon's stockholders' equity at the end of the year? Helparrow_forwardCan you help me with accounting questionsarrow_forwardAccounting question with answer mearrow_forward

- The following is a partially completed departmental expense allocation spreadsheet for Everton Manufacturing. It reports the total amounts of direct and indirect expenses for its four departments. Maintenance department expenses are allocated based on square footage. • Maintenance Department Expense: $35,600 Total Square Footage: ° Machining: 5,200 sq. ft. Assembly: 2,800 sq. ft. Compute the amount of Maintenance department expense allocated to the Machining department.arrow_forwardVariable overhead cost is calculate to bearrow_forwardWhat is the net income?arrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning - Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning