Concept explainers

Preparing

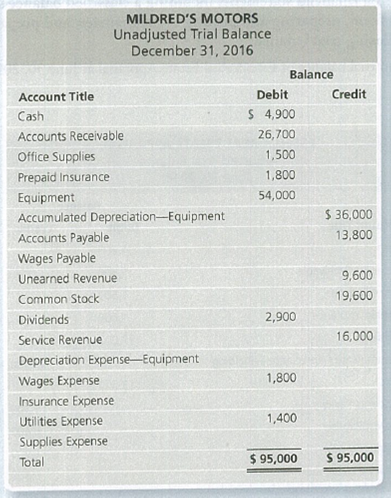

The unadjusted

Adjustment data at December 31, 2016:

a.

b. Accrued Wages Expense, $800.

c. Office Supplies on hand, $600.

d. Prepaid Insurance expired during December, $200.

e. Unearned Revenue earned during December, $4,000.

f. Accrued Service Revenue, $700.

2017 transactions:

a. On January 4, Mildred’s Motors paid wages of $1,200. Of this, $800 related to the accrued wages recorded on December 31.

b. On January 10, Mildred’s Motors received $1,300 for Service Revenue. Of this, $700 is related to the accrued Service Revenue recorded on December 31.

Requirements

1. Journalize adjusting entries.

2. Journalize reversing entries for the appropriate adjusting entries.

3. Refer to the 2017 data. Journalize the cash payment and the cash receipt that occurred in 2017.

Want to see the full answer?

Check out a sample textbook solution

Chapter 4 Solutions

MyLab Accounting with Pearson eText -- Access Card -- for Horngren's Financial & Managerial Accounting, The Financial Chapters (My Accounting Lab)

- Subject: financial accounting problemarrow_forwardDBZ Corp. purchased a machine for $20,000 three years ago. The machine had no residual value and had an estimated useful life of 8 years. If the company uses the straight-line depreciation method, calculate the current book value of the machine.arrow_forwardCan you please answer the financial accounting question?arrow_forward

- What is your company's beginning cash balance on september 1 ? General accounting questionarrow_forwardGeneral accounting questionarrow_forwardMona Equipment Inc. had $18.20 million in sales last year. The cost of goods sold was $9.20 million, depreciation expense was $2.80 million, interest payment on outstanding debt was $1.80 million, and the firm's tax rate was 23%. A. What was the firm's net income? B. What was the firm's cash flow?arrow_forward

- Find the direct labor hour? Helparrow_forwardFind the direct labor hour?arrow_forwardOn January 1, 2021, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and also issued 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows: Moody Osorio Cash $ 180 $ 40 Receivables 810 180 Inventories 1,080 280 Land 600 360 Buildings (net) 1,260 440 Equipment (net) 480 100 Accounts payable (450 ) (80 ) Long-term liabilities (1,290 ) (400 ) Common stock ($1 par) (330 ) Common stock ($20 par) (240 ) Additional paid-in capital (1,080 ) (340 ) Retained…arrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning - Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning