Concept explainers

Financial statements and closing entries

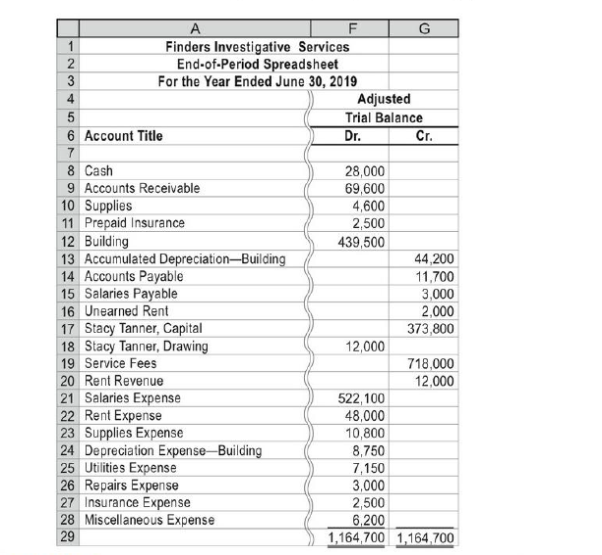

Finders Investigative Services is an investigative services firm that is owned and operated by Stacy Tanner. On June 30, 2019, the end of the fiscal year, the accountant for Finders Investigative Services prepared an end-of-period spreadsheet, a part of which follows:

Instructions

1. Prepare an income statement, a statement of owner's equity (no additional investments were made during the year), and a

2. Journalize the entries that were required to close the accounts at June 30.

3 If Stacy Tanner, Capital has instead decreased $30,000 after the closing entries were posted, and the withdrawals remained the same, what would have been the amount of net income or net loss?

Trending nowThis is a popular solution!

Chapter 4 Solutions

Bundle: Accounting, 27th Edition, Loose-leaf Version + Cengagenowv2, 1 Term Printed Access

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub