Working Papers, Chapters 18-26 for Warren/Reeve/Duchacâs Accounting, 27E

27th Edition

ISBN: 9781337272162

Author: Reeve, James M., Duchac, Jonathan, WARREN, Carl S.

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 4, Problem 4.24EX

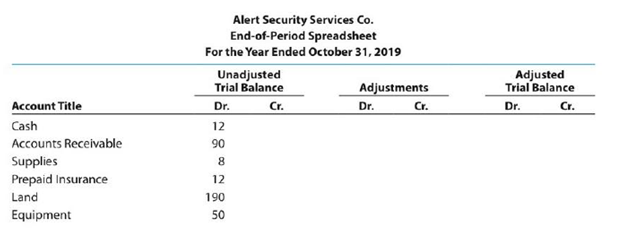

Adjustment data on an end-of-period spreadsheet

Alert Security Services Co. offers security services to business clients. The

| Accum. Depr.—Equipment | 4 | |

| Accounts Payable | 36 | |

| Wages Payable | 0 | |

| Brenda Schultz, Capital | 260 | |

| Brenda Schultz, Drawing | 8 | |

| Fees Earned | 200 | |

| Wages Expense | 110 | |

| Rent Expense | 12 | |

| Insurance Expense | 0 | |

| Utilities Expense | 6 | |

| Supplies Expense | 0 | |

| 0 | ||

| Miscellaneous Expense | 2 | |

| 500 | 500 |

The data for year-end adjustments are as follows:

a. Fees earned but not yet billed, $13

b. Supplies on hand, $4.

c. Insurance premiums expired, $10.

d. Depreciation expense, $3.

e. Wages accrued but not paid, $1.

Enter the adjustment data and place the balances in the Adjusted Trial Balance columns.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

None

Please solve this question

ANSWER

Chapter 4 Solutions

Working Papers, Chapters 18-26 for Warren/Reeve/Duchacâs Accounting, 27E

Ch. 4 - Why do some accountants prepare an end-of-period...Ch. 4 - Describe the nature of the assets that compose the...Ch. 4 - Prob. 3DQCh. 4 - Prob. 4DQCh. 4 - Why are closing entries required at the end of an...Ch. 4 - What is the difference between adjusting entries...Ch. 4 - What is the purpose of the post-closing trial...Ch. 4 - Prob. 8DQCh. 4 - What is the natural business year?Ch. 4 - Prob. 10DQ

Ch. 4 - Flow of accounts into financial statements The...Ch. 4 - Flow of accounts into financial statements The...Ch. 4 - Statement of owner's equity Marcie Davies owns and...Ch. 4 - Statement of owner's equity Blake Knudson owns and...Ch. 4 - Classified balance sheet The following accounts...Ch. 4 - Classified balance sheet The following accounts...Ch. 4 - Closing entries After the accounts have been...Ch. 4 - Closing entries After the accounts have been...Ch. 4 - Accounting cycle From the following list of steps...Ch. 4 - Accounting cycle From the following list of steps...Ch. 4 - Working capital and current ratio Current assets...Ch. 4 - Working capital and current ratio Current assets...Ch. 4 - Flow of accounts into financial statements The...Ch. 4 - Classifying accounts Balances for each of the...Ch. 4 - Financial statements from the end-of-period...Ch. 4 - Financial statements from the end-of-period...Ch. 4 - Income statement The following account balances...Ch. 4 - Income statement; net loss The following revenue...Ch. 4 - Income statement FedEx Corporation had the...Ch. 4 - Statement of owners equity Apex Systems Co. offers...Ch. 4 - Statement of owners equity; net loss Selected...Ch. 4 - Classifying assets Identify each of the following...Ch. 4 - Balance sheet classification At the balance sheet...Ch. 4 - Balance sheet Optimum Weight Loss Co. offers...Ch. 4 - Balance sheet List the errors you find in the...Ch. 4 - Identifying accounts to be closed From the list...Ch. 4 - Closing entries Prior to closing, total revenues...Ch. 4 - Closing entries with net income Assume that the...Ch. 4 - Closing entries with net loss Stylist Services Co....Ch. 4 - Identifying permanent accounts Which of the...Ch. 4 - Post-closing trial balance An accountant prepared...Ch. 4 - Steps in the accounting cycle Rearrange the...Ch. 4 - Working capital and current ratio The following...Ch. 4 - Prob. 4.22EXCh. 4 - Completing an end-of-period spreadsheet List (a)...Ch. 4 - Adjustment data on an end-of-period spreadsheet...Ch. 4 - Completing an end-of-period spreadsheet Alert...Ch. 4 - Prob. 4.26EXCh. 4 - Adjusting entries from an end-of-period...Ch. 4 - Closing entries from an end-of-period spreadsheet...Ch. 4 - Reversing entry The following adjusting entry for...Ch. 4 - Adjusting and reversing entries On the basis of...Ch. 4 - Adjusting and reversing entries On the basis of...Ch. 4 - Entries posted to wages expense account Portions...Ch. 4 - Entries posted to wages expense account Portions...Ch. 4 - Financial statements and closing entries Beacon...Ch. 4 - Financial statements and closing entries Finders...Ch. 4 - T accounts, adjusting entries, financial...Ch. 4 - Ledger accounts, adjusting entries, financial...Ch. 4 - Complete accounting cycle For the past several...Ch. 4 - Financial statements and closing entries Last...Ch. 4 - Financial statements and closing entries The...Ch. 4 - T accounts, adjusting entries, financial...Ch. 4 - Ledger accounts, adjusting entries, financial...Ch. 4 - Complete accounting cycle For the past several...Ch. 4 - The unadjusted trial balance of PS Music as of...Ch. 4 - Kelly Pitney began her consulting business, Kelly...Ch. 4 - Prob. 4.1CPCh. 4 - Communication Your friend, Daniel Nat, recently...Ch. 4 - Financial statements The following is an excerpt...Ch. 4 - Financial statements Assume that you recently...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Craft Made Company expects to produce 20,000 total units during the current period. The costs and cost drivers associated with four activity cost pools are given below: ACTIVITIES UNIT PRODUCT FACILITY Cost LEVEL $27,000 BATCH LEVEL LEVEL LEVEL $39,000 $12,000 $141,000 20,000 units Cost Driver 2,500 labor hrs 192 set ups % of use Production of 1,350 units of an auto towing tool required 600 labor hours, 11 setups, and consumed 35% of the product sustaining activities. How much total overhead cost will be allocated to this product if the company allocates overhead on the basis of a single overhead allocation rate based on direct labor hours?arrow_forwardProblem related financial Accountingarrow_forwardGeneral accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY