Principles of Managerial Finance, Student Value Edition (15th Edition) (The Pearson Series in Finance)

15th Edition

ISBN: 9780134478166

Author: Chad J. Zutter, Scott B. Smart

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 4, Problem 4.21P

Learning Goal 5

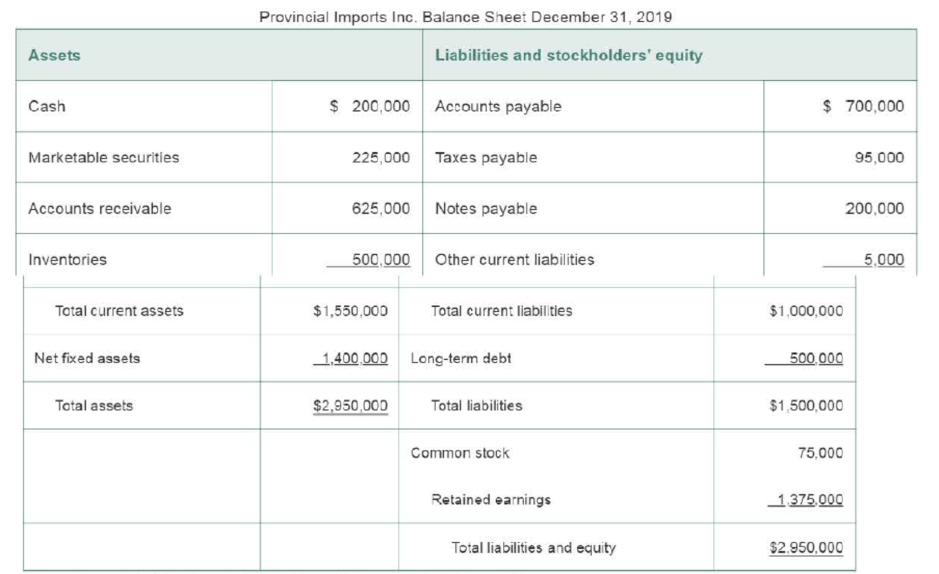

P4-21 Integrative: Pro forma statements Provincial Imports Inc. has assembled past (2019) financial statements (income statement and

Provincial Imports Inc. Income Statement for the Year Ended December 31, 2019

| Sales revenue | $5,000,000 |

| Less: Cost of goods sold | 2,750,000 |

| Gross profits | $2,250,000 |

| Less: Operating expenses | 850,000 |

| Operating profits | $1,400,000 |

| Less: Interest expense | 200,000 |

| Net profits before taxes | $1,200,000 |

| Less: Taxes (rate = 40%) | 480,000 |

| Net profits after taxes | $ 720,000 |

| Less: Cash dividends | 288,000 |

| To |

$ 432,000 |

Information related to financial projections for the year 2020 is as follows:

- 1. Projected sales are $6,000,000.

- 2. Cost of goods sold in 2019 includes $1,000,000 in fixed costs.

- 3. Operating expense in 2019 includes $250,000 in fixed costs.

- 4. Interest expense will remain unchanged

- 5. The firm will pay cash dividends amounting to 40% of net profits after taxes.

- 6. Cash and inventories will double.

- 7. Marketable securities, notes payable, long-term debt, and common stock will remain unchanged.

- 8. Accounts receivable, accounts payable, and other current liabilities will change in direct response to the change in sales

- 9. A new computer system costing $356,000 will be purchased during the year. Total

depreciation expense for the year will be $110,000. - 10. The tax rate will remain at 40%.

- a. Prepare a pro forma income statement for the year ended December 31, 2020, using the fixed cost data given to improve the accuracy of the percent-of-sales method.

- b. Prepare a pro forma balance sheet as of December 31, 2020, using the information given and the judgmental approach. Include a reconciliation of the retained earnings account.

- c. Analyze these statements, and discuss the resulting external financing required.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What are the six sources of data collection and please help to explain the qualitative data collection methods.

What is the thematic analysis?

How to anticipated themes in a research proposal?

Explain in detail the principle of Compounding of interest and why is it so important

in Finance.

What is the bond quote for a $1,000 face value bond with an 8 percent coupon rate (paid semiannually) and a required return of 7.5 percent if the bond is 6.48574, 8.47148, 10.519, and 14.87875 years from maturity?

Chapter 4 Solutions

Principles of Managerial Finance, Student Value Edition (15th Edition) (The Pearson Series in Finance)

Ch. 4.1 - Prob. 4.1RQCh. 4.1 - Prob. 4.2RQCh. 4.2 - Briefly describe the first four modified...Ch. 4.2 - Describe the overall cash flow through the firm in...Ch. 4.2 - Prob. 4.5RQCh. 4.2 - 4-B Why is depreciation (as well as amortization...Ch. 4.2 - Prob. 4.7RQCh. 4.2 - Prob. 4.8RQCh. 4.2 - Prob. 4.9RQCh. 4.3 - Prob. 4.10RQ

Ch. 4.3 - Prob. 4.11RQCh. 4.3 - Prob. 4.12RQCh. 4.3 - What is the cause of uncertainty in the cash...Ch. 4.4 - Prob. 4.14RQCh. 4.5 - Prob. 4.15RQCh. 4.5 - Prob. 4.16RQCh. 4.6 - Prob. 4.17RQCh. 4.6 - What is the significance of the plug figure,...Ch. 4.7 - Prob. 4.19RQCh. 4.7 - Prob. 4.20RQCh. 4 - Opener-in-Review The chapter opener described a...Ch. 4 - Learning Goals 2, 3 ST4-1 Depreciation and cash...Ch. 4 - Prob. 4.2STPCh. 4 - Prob. 4.3STPCh. 4 - Prob. 4.1WUECh. 4 - Prob. 4.2WUECh. 4 - Learning Goal 3 E4-3 Determine the operating cash...Ch. 4 - Prob. 4.4WUECh. 4 - Learning Goal 5 E4-5 Rimier Corp. forecasts sales...Ch. 4 - Prob. 4.1PCh. 4 - Learning Goal 2 P4-2 Depreciation In early 2019,...Ch. 4 - Prob. 4.3PCh. 4 - Learning Goals 2, 3 P4-4 Depreciation and...Ch. 4 - Learning Goal 3 P4-5 Classifying inflows and...Ch. 4 - Prob. 4.6PCh. 4 - Learning Goal 4 P4-8 Cash receipts A firm has...Ch. 4 - Learning Goal 4 P4-9 Cash disbursements schedule...Ch. 4 - Learning Goal 4 P4-10 Cash budget: Basic Grenoble...Ch. 4 - Prob. 4.11PCh. 4 - Learning Goal 4 P4-12 Cash budget: Advanced The...Ch. 4 - Prob. 4.13PCh. 4 - Prob. 4.14PCh. 4 - Learning Goal 4 P4-15 Multiple cash budgets:...Ch. 4 - Learning Goal 5 P4-16 Pro forma income statement...Ch. 4 - Learning Goal 5 P4-17 Pro forma income statement:...Ch. 4 - Learning Goal 5 P4-18 Pro forma balance sheet:...Ch. 4 - Learning Goal 5 P4-19 Pro forma balance sheet...Ch. 4 - Learning Goal 5 P4-20 Integrative: Pro forma...Ch. 4 - Learning Goal 5 P4-21 Integrative: Pro forma...Ch. 4 - Prob. 4.22PCh. 4 - Prob. 1SE

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Gentherm Incorporated has a convertible bond issue outstanding. Each bond, with a face value of $1,000, can be converted into common shares at a rate of 42.25 shares of stock per $1,000 face value bond (the conversion rate), or $19.85 per share. Gentherm’s common stock is trading (on the NYSE) at $19.85 per share and the bonds are trading at $1,025. Calculate the conversion value of each bond. Note: Round your answer to 4 decimal placesarrow_forwardYou are looking to lease a 2019 Subaru Forester. You have found a 36 - month closed end lease on a Forester with an MSRP of $25, 270 and a lease end purchase option of $15,667 (residual value). To get the lease you have to pay a fee of $1,765 due at signing, and the monthly payment was calculated to be $ 265. A) What is the nominal rate of return the dealership is earning on the lease? (Hint: think of the cash flows from the dealerships prospective) B) What would the lease payment be if the dealership wanted a nominal 6% compounded monthly on the lease?arrow_forwardWhat should business people learn about the problem started with Sears and organizational consequences?How the traditional retail businesses face significant challenges in remaining competitive in the digital age? What is the broad exploration of retail industry challenges without assuming specific causes or outcomes, making them suitable for research and why?arrow_forward

- What are Biblical principles researchers can follow to mitigate Unintended errors in research?How a Christian conduct during a research proposal and study can be a witnessof the Gospel to others.arrow_forwardWhat is Sears business problem? What cause Sears to collapse and closeout the company? Would you please help to explain, what is the problem statement, and general problem? Could you help to provide four research questions that align with the problem statement, ensuring they are exploratory, not assumptive, and not specific to an organization.arrow_forwardHilton Hotels Corporation has a convertible bond issue outstanding. Each bond, with a face value of $1,000, can be converted into common shares at a rate of 61.2983 shares of stock per $1,000 face value bond (the conversion rate), or $16.316 per share. Hilton’s common stock is trading (on the NYSE) at $15.90 per share and the bonds are trading at $975. a. Calculate the conversion value of each bond. (Round your answer to 2 decimal places. (e.g., 32.16)). (974.50 was wrong)arrow_forward

- Consider an investor who, on January 1, 2022, purchases a TIPS bond with an original principal of $100,000, an 8 percent annual (or 4 percent semiannual) coupon rate, and 10 years to maturity. If the semiannual inflation rate during the first six months is 0.3 percent, calculate the principal amount used to determine the first coupon payment and the first coupon payment (paid on June 30, 2022). From your answer to part a, calculate the inflation-adjusted principal at the beginning of the second six months. Suppose that the semiannual inflation rate for the second six-month period is 1 percent. Calculate the inflation-adjusted principal at the end of the second six months (on December 31, 2022) and the coupon payment to the investor for the second six-month period.arrow_forwardA municipal bond you are considering as an investment currently pays a yield of 6.75 percent. Calculate the tax-equivalent yield if your marginal tax rate is 28 percent. Calculate the tax-equivalent yield if your marginal tax rate is 21 percent.arrow_forwardWhat would your assessment of the plight of the working poor? Explain.arrow_forward

- What is considered to be "living on the edge"? Explain.arrow_forwardHow close to the edge are the working poor living? Explain.arrow_forwardSuppose three countries’ per capita Gross Domestic Products (GDPs) are £1000, £2000, and £3000. What is the average of each pair of countries’ GDPs per capita? (b) What is the difference between each of the individual observations and the overall average? What is the sum of these differences? (c) Suppose instead of three countries, we had a sample of 100 countries with the same sample average GDP per capita as the overall average for the three observations above, with the standard deviation of these 100 observations being £1000. Form the 95% confidence interval for the population mean. (d) What might explain differences in GDP across countries? Consider the following regression equation, where Earnings is measured in £/hour, and Experience is measured in years in a particular job, with standard errors in parentheses: Earnings \ = −0.25 (−0.5) + 0.2 (0.1) Experience, One of these numbers has been reported incorrectly - it shouldn’t be negative. Which one and why? (b)…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License