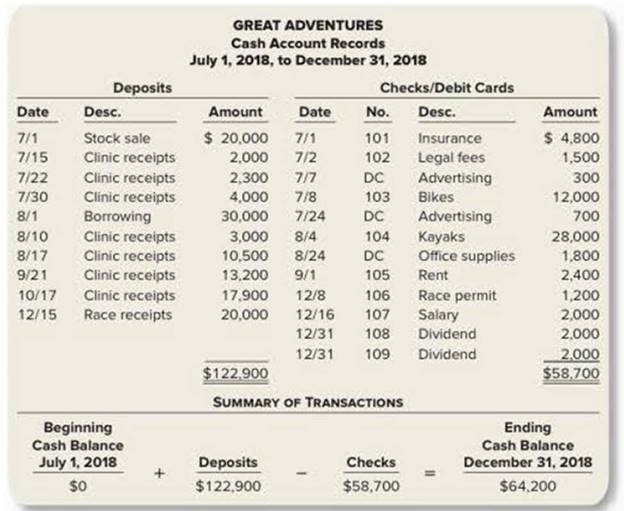

An examination of the cash activities during the year shows the following.

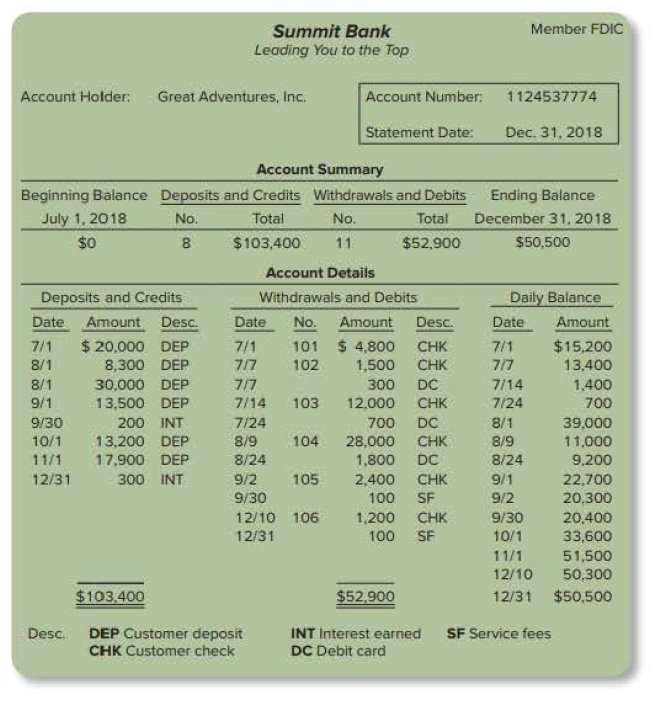

Suzie has not reconciled the company’s cash balance with that of the bank since the company was started. She asks Summit Bank to provide her with a six-month bank statement. To save time, Suzie makes deposits at the bank only on the first day of each month.

After comparing the two balances, Suzie has some concern because the bank’s balance of $50,500 is substantially less than the company’s balance of $64,200.

Required:

1. Discuss any problems you see with Great Adventures’ internal control procedures related to cash.

2. Prepare Great Adventures’ bank reconciliation for the six-month period ended December 31, 2018, and any necessary entries to adjust cash.

3. How did failure to reconcile the bank statement affect the reported amounts for assets, liabilities, stockholders’ equity, revenues, and expenses?

Want to see the full answer?

Check out a sample textbook solution

Chapter 4 Solutions

FINANCIAL ACCOUNTINGLL W/CONNECT >IC<

- General accountingarrow_forwardNo AI What does the term "amortization" refer to?A. Allocation of intangible asset cost over its useful lifeB. Allocation of depreciation on fixed assetsC. Paying off debt over timeD. Writing off bad debtsarrow_forwardWhich of the following would increase the cash balance on the statement of cash flows?A. Payment of dividendsB. Purchase of equipmentC. Issuance of bonds payableD. Payment of salariesneed helparrow_forward

- Which of the following would increase the cash balance on the statement of cash flows?A. Payment of dividendsB. Purchase of equipmentC. Issuance of bonds payableD. Payment of salariesarrow_forwardCan you explain this general accounting question using accurate calculation methods?arrow_forwardAccounting question and answerarrow_forward

- 7. What type of account is Accumulated Depreciation?A. AssetB. Contra AssetC. LiabilityD. Expensearrow_forwardCan you explain this general accounting question using accurate calculation methods?arrow_forwardHello expert. What does the term "amortization" refer to?A. Allocation of intangible asset cost over its useful lifeB. Allocation of depreciation on fixed assetsC. Paying off debt over timeD. Writing off bad debtsarrow_forward

- In a perpetual inventory system, what happens when goods are sold?A. Only sales revenue is recordedB. Inventory and cost of goods sold are updated immediatelyC. Inventory is updated at the end of the accounting periodD. Only cost of goods sold is recorded No Aiarrow_forwardWhat effect does recording depreciation expense have on the accounting equation?A. Increases assets and increases equityB. Decreases assets and decreases equityC. Increases liabilities and decreases equityD. No effect on assets or equityarrow_forwardIn a perpetual inventory system, what happens when goods are sold?A. Only sales revenue is recordedB. Inventory and cost of goods sold are updated immediatelyC. Inventory is updated at the end of the accounting periodD. Only cost of goods sold is recordedarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education