Concept explainers

Recording

North Star prepared the following unadjusted trial balance at the end of its second year of operations ending December 31.

| Account Titles | Debit | Credit |

| Cash | $12,000 | |

| 6,000 | ||

| Prepaid Rent | 2,400 | |

| Equipment | 21.000 | |

| Depreciation—Equipment |

$ 1,000 | |

| Accounts Payable | 1.000 | |

| Income Tax Pavable | 0 | |

| Common Stock | 24,800 | |

| 2,100 | ||

| Sales Revenue | 50.000 | |

| Salaries and Wages Expense Utilities Expense | 25,000 12.500 |

|

| Rent Expense | 0 | |

| Depreciation Expense Income Tax Expense | 0 0 |

|

| Totals | 578,900 | 578,900 |

Other data not yet recorded at December 31:

- a. Rent expired during the year, $1,200.

- b. Depreciation expense for the year, $ 1,000.

- c. Utilities owing, $9,000.

- d. Income tax expense, $390.

Required:

- 1. Using the format shown in the demonstration case, indicate the

accounting equation effects o each required adjustment. - 2. Prepare the adjusting

journal entries required at December 31. - 3. Summarize the adjusting journal entries in T-accounts. After entering the beginning balances and computing the adjusted ending balances, prepare an adjusted trial balance as o December 31.

- 4. Compute the amount of net income using (a) the preliminary (unadjusted) numbers, and (b) the final (adjusted) numbers. Had the adjusting entries not been recorded, would net income have been overstated or understated, and by what amount?

1.

Answer to Problem 4.15E

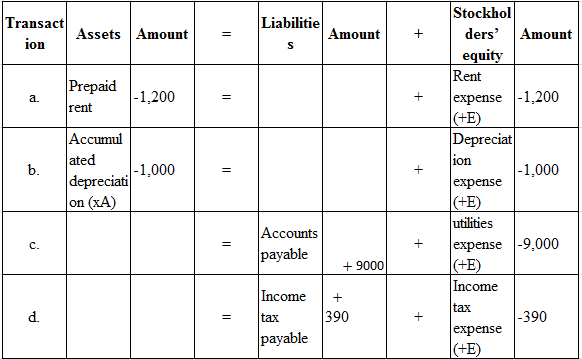

Following are the effects of accounting equation on the adjusting journal entries.

Figure (1)

Note:

E represents expenses

xA represents contra asset

Explanation of Solution

Accounting equation:

Accounting equation is an accounting tool expressed in the form of equation, by creating a relationship between the resources or assets of a company, and claims on the resources by the creditors and the owners. Accounting equation is expressed as shown below:

a.

- Prepaid rent is an asset. There is a decrease in the asset. Hence, the asset will be decreased by $1,200.

- Prepaid rent is an asset. Hence, there is no effect on liability account.

- Rent expense is an expense account which is a component of stockholders’ equity. There is an increase in the expense account which decreases the stockholders’ equity. Hence, the stockholders’ equity will be decreased by $1,200.

b.

- Accumulated depreciation is a contra asset. There is a decrease in the asset. Hence, the asset account will be decreased by $1,000.

- Accumulated depreciation is a contra asset. Hence, there is no effect on liability account.

- Depreciation expense is an expense account which is a component of stockholders’ equity. There is an increase in the expense account which decreases the stockholders’ equity. Hence, the stockholders’ equity is decreased by $1,000.

c.

- Accounts payable is a liability. Hence, there is no effect on the asset account.

- Accounts payable is a liability. There is an increase in the liability. Hence, the liability account will be increased by $9,000.

- Utilities expense is an expense account which is a component of stockholders’ equity. There is an increase in the expense account which decreases the stockholders’ equity. Hence, the stockholders’ equity will be decreased by $9,000.

d.

- Income tax payable is a liability. Hence, there is no effect on the asset account.

- Income tax payable is a liability. There is an increase in liability. Hence, the liability account will be increased by $390.

- Income tax expense is an expense account which is a component of stockholders’ equity. There is an increase in the expense account which decreases the stockholders’ equity. Hence, the stockholders’ equity is decreased by $390.

2.

To prepare: Adjusting journal entry required for each item at December 31.

Answer to Problem 4.15E

Prepare adjusted journal entries for each item at June 30:

| Date | Account Title and Explanation | Debit ($) | Credit ($) | |

| Rent expense (+E, -SE) (1) | 1,200 | |||

| Prepaid rent (-A) | 1,200 | |||

| (To record the adjusting entry for Rent expense) | ||||

| Depreciation expense (+E, -SE) | 1,000 | |||

| Accumulated Depreciation-Equipment(+xA, -A) | 1,000 | |||

| (To record adjusting entry for depreciation expense) | ||||

| Utilities expense (+E, -SE) | 9,000 | |||

| Accounts payable(+L) | 9,000 | |||

| (To record the adjusting entry for utilities expenses) | ||||

| Income tax expense(+E, -SE) | 390 | |||

| Income tax payable(+L) | 390 | |||

| (To record the adjusting entry for income tax expense) | ||||

a.

b.

c.

d.

Table (1)

Explanation of Solution

Adjusting entries:

Adjusting entries are the journal entries which are recorded at the end of the accounting period to correct or adjust the revenue and expense accounts, to concede with the accrual principle of accounting.

a.

- Prepaid rent is an asset and it increases. Hence, debit prepaid expenses account with $1,200.

- Cash is an asset and it decreases. Hence, credit cash account with $1,200.

b.

- Depreciation expense is an expense which is the component of stockholders’ equity. There is an increase in expense account which decreases the stockholders’ equity. Hence, debit Depreciation expense with $1,000.

- Accumulated depreciation is a contra asset. There is a decrease in the asset. Hence, credit the asset account by $1,000.

c.

- Utilities expense is an expense which is a component of stockholders’ equity. There is an increase in the expense account which decreases the stockholders’ equity. Hence, debit the utilities expense by $9,000.

- Accounts payable is a liability. There is an increase in the liability. Hence, credit the accounts payable account by $9,000.

d.

- Income tax expense is an expense which is a component of stockholders’ equity. There is an increase in the expense account which decreases the stockholders’ equity. Hence, debit the income tax expense by $390.

- Income tax payable is a liability. There is an increase in liability. Hence, credit the income tax payable account by $390.

3.

To Summarize: The adjusting journal entries in T-accounts after the beginning balances and computing the adjusted ending balances, and to prepare the adjusted trial balance as of December 31.

Explanation of Solution

T-account:

T-account refers to an individual account, where the increases or decreases in the value of specific asset, liability, stockholder’s equity, revenue, and expenditure items are recorded.

This account is referred to as the T-account, because the alignment of the components of the account resembles the capital letter ‘T’. An account consists of the three main components which are as follows:

(a)The title of the account

(b)The left or debit side

(c)The right or credit side

Post the adjusted entries in T-account:

| Prepaid rent (A) account | |||

| Balance | 2,400 | ||

| a | 1,200 | ||

| Ending balance | 1,200 | ||

|

Rent expense (E) account |

|||

| Balance | 0 | ||

| a | 1,200 | ||

| Ending balance | 1,200 | ||

| Accumulated DepreciationEquipment -(xA) account | |||

| Balance | 1,000 | ||

| b | 1,000 | ||

| Ending balance | 2,000 | ||

|

Depreciation expense (E) account |

|||

| Balance | 0 | ||

| b | 1,000 | ||

| Ending balance | 1,000 | ||

|

Accounts payable (L) account |

|||

| Balance | 1,000 | ||

| c | 9,000 | ||

| Ending balance | 10,000 | ||

|

Utilities expense(E) account |

|||

| Balance | 12,500 | ||

| c | 9,000 | ||

| Ending balance | 21,500 | ||

|

Income tax payable (L) account |

|||

| Balance | 0 | ||

| d | 390 | ||

| Ending balance | 390 | ||

| Income tax expense(E) account | |||

| Balance | 0 | ||

| d | 390 | ||

| Ending balance | 390 | ||

Prepare adjusted trial balance as of December 31:

| Company NS | ||

| Adjusted Trial balance | ||

| As of December 31 | ||

| Account Titles | Debit ($) | Credit ($) |

| Cash | 12,000 | |

| Accounts Receivable | 6,000 | |

| Prepaid Rent | 1,200 | |

| Equipment | 21,000 | |

| Accumulated Depreciation–Equipment | 2,000 | |

| Accounts Payable | 10,000 | |

| Income Taxes Payable | 390 | |

| Common Stock | 24,800 | |

| Retained Earnings | 2,100 | |

| Sales Revenue | 50,000 | |

| Salaries and Wages Expense | 25,000 | |

| Utilities Expense | 21,500 | |

| Rent Expense | 1,200 | |

| Depreciation Expense | 1,000 | |

| Income Tax Expense | 390 | |

| Totals | $ 89,290 | $ 89,290 |

Table (2)

4.

To Compute: The amount of net income using (a) the preliminary (unadjusted) numbers, and (b) the final (adjusted) numbers and to state without adjustments would net income have been overstated or understated and by what amount.

Explanation of Solution

- (a) Calculation of preliminary net income:

- (b) Calculation of adjusted net income:

Calculation of overstated preliminary net income:

Without adjustments, preliminary net income would have been overstated by $11,590.

Want to see more full solutions like this?

Chapter 4 Solutions

Fundamentals of Financial Accounting

- I am trying to find the accurate solution to this general accounting problem with the correct explanation.arrow_forwardI am looking for a step-by-step explanation of this financial accounting problem with correct standards.arrow_forwardPlease provide the answer to this financial accounting question with proper steps.arrow_forward

- What are the three sections of the statement of cash flows, and what does each section report?no aiarrow_forwardWhat are the three sections of the statement of cash flows, and what does each section report? I need helparrow_forwardI am searching for the correct answer to this general accounting problem with proper accounting rules.arrow_forward

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning  EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT