Subpart (a)

Calculate and illustrate the

Subpart (a)

Explanation of Solution

Given information:

The equilibrium for market of DVD s is attained when

The consumer surplus when the

Thus, the consumer surplus is $18.

The producer surplus when the equilibrium price is P and Quantity is Q is calculated using equation (2),

Thus, the producer surplus is $18.

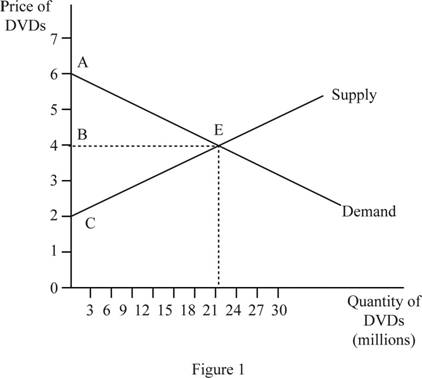

Figure 1 illustrates the consumer surplus and producer surplus.

The figure 1 shows the equilibrium where the quantity of DVDs is plotted along the horizontal axis and the price of DVDs is plotted along the vertical axis. The consumer surplus is obtained by the area of the triangle ABE and the producer surplus is obtained by the area of triangle CBE.

Consumer Surplus: The consumer surplus is defined as the difference between the maximum amount a person is willing to pay for consuming a commodity and the actual price he pay for it.

Producer Surplus: The producer surplus is defined as the difference between the actual market price for which a commodity is sold and the minimum cost at which the producer is willing to sell the commodity. This minimum accepted price is usually the cost of production of the commodity.

Subpart (b)

To calculate the total consumer surplus, producer surplus and dead weight loss when there is underproduction and show them on the graph.

Subpart (b)

Explanation of Solution

Given information:

The equilibrium for market of DVD s is attained when price is $4 and quantity is 18 million. The underproduction leads to production of 9 million DVDs.

When the production reduces to 9 million, the consumer surplus is calculated as follows.

Thus, the consumer surplus at underproduction of 9 million DVD s is $13.5 million.

When the production reduces to 9 million, the producer surplus is calculated as,

Thus, the producer surplus at underproduction of 9 million DVDs is $13.5 million.

The

Thus, the deadweight loss of underproduction is $9 million.

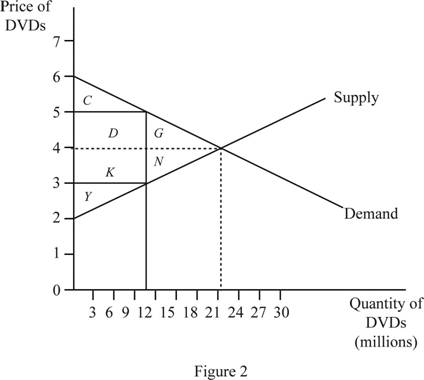

Figure 2 illustrates the deadweight loss.

The figure 2 shows the market for DVD s with underproduction. The horizontal axis measures the quantity of DVDs and the vertical axis measures the price of DVDs. The underproduction results in a deadweight loss which is shown by the area of G and N.

Consumer Surplus: The consumer surplus is defined as the difference between the maximum amount a person is willing to pay for consuming a commodity and the actual price he pay for it.

Producer Surplus: The producer surplus is defined as the difference between the actual market price for which a commodity is sold and the minimum cost at which the producer is willing to sell the commodity. This minimum accepted price is usually the cost of production of the commodity.

Deadweight loss: Deadweight loss is defined as the loss of the total consumer surplus and producer surplus due to overproduction or underproduction.

Subpart (c)

To calculate the total consumer surplus, producer surplus and dead weight loss when there is overproduction and show them on the graph.

Subpart (c)

Explanation of Solution

Given information:

The equilibrium for market of DVD s is attained when price is $4 and quantity is 18 million. The overproduction leads to production of 27 million DVDs.

When there is overproduction, the consumer surplus is calculated as the same as consumer surplus at equilibrium.

Thus, the consumer surplus is $18.

The producer surplus of overproduction is same as the equilibrium producer surplus and is calculated using equation (2),

Thus, the producer surplus is $18.

The deadweight loss of over production is equal to the area of triangle EFG. It can be calculated as follows,

Thus, the deadweight loss of overproduction is $9 million.

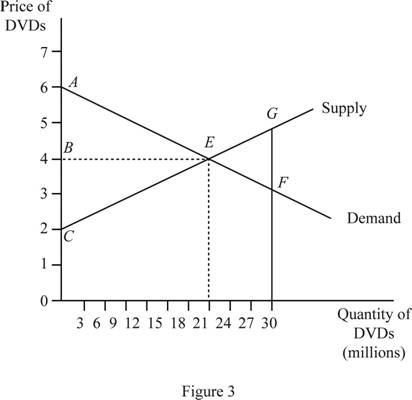

Figure 3 illustrates the deadweight loss.

The figure 3 shows the equilibrium where the quantity of DVDs is plotted along the horizontal axis and the price of DVDs is plotted along the vertical axis. The consumer surplus is obtained by the area of the triangle ABE and the producer surplus is obtained by the area of triangle CBE. Due to overproduction there is a deadweight loss which is equal to the area of the triangle EFG.

Consumer Surplus: The consumer surplus is defined as the difference between the maximum amount a person is willing to pay for consuming a commodity and the actual price he pay for it.

Producer Surplus: The producer surplus is defined as the difference between the actual market price for which a commodity is sold and the minimum cost at which the producer is willing to sell the commodity. This minimum accepted price is usually the cost of production of the commodity.

Deadweight loss: Deadweight loss is defined as the loss of the total consumer surplus and producer surplus due to overproduction or underproduction.

Want to see more full solutions like this?

Chapter 4 Solutions

Principles of Macroeconomics

- How did Jennifer Lopez use free enterprise to become successful ?arrow_forwardAn actuary analyzes a company’s annual personal auto claims, M and annual commercialauto claims, N . The analysis reveals that V ar(M ) = 1600, V ar(N ) = 900, and thecorrelation between M and N is ρ = 0.64. Compute V ar(M + N ).arrow_forwardDon't used hand raitingarrow_forward

- Answer in step by step with explanation. Don't use Ai.arrow_forwardUse the figure below to answer the following question. Let I represent Income when healthy, let I represent income when ill. Let E [I] represent expected income for a given probability (p) of falling ill. Utility у в ULI income Is есте IM The actuarially fair & partial contract is represented by Point X × OB A Yarrow_forwardSuppose that there is a 25% chance Riju is injured and earns $180,000, and a 75% chance she stays healthy and will earn $900,000. Suppose further that her utility function is the following: U = (Income) ³. Riju's utility if she earns $180,000 is _ and her utility if she earns $900,000 is. X 56.46; 169.38 56.46; 96.55 96.55; 56.46 40.00; 200.00 169.38; 56.46arrow_forward

- Use the figure below to answer the following question. Let là represent Income when healthy, let Is represent income when ill. Let E[I], represent expected income for a given probability (p) of falling ill. Utility & B естве IH S Point D represents ☑ actuarially fair & full contract actuarially fair & partial contract O actuarially unfair & full contract uninsurance incomearrow_forwardSuppose that there is a 25% chance Riju is injured and earns $180,000, and a 75% chance she stays healthy and will earn $900,000. Suppose further that her utility function is the following: U = (Income). Riju is risk. She will prefer (given the same expected income). averse; no insurance to actuarially fair and full insurance lover; actuarially fair and full insurance to no insurance averse; actuarially fair and full insurance to no insurance neutral; he will be indifferent between actuarially fair and full insurance to no insurance lover; no insurance to actuarially fair and full insurancearrow_forward19. (20 points in total) Suppose that the market demand curve is p = 80 - 8Qd, where p is the price per unit and Qd is the number of units demanded per week, and the market supply curve is p = 5+7Qs, where Q5 is the quantity supplied per week. a. b. C. d. e. Calculate the equilibrium price and quantity for a competitive market in which there is no market failure. Draw a diagram that includes the demand and supply curves, the values of the vertical- axis intercepts, and the competitive equilibrium quantity and price. Label the curves, axes and areas. Calculate both the marginal willingness to pay and the total willingness to pay for the equilibrium quantity. Calculate both the marginal cost of the equilibrium quantity and variable cost of producing the equilibrium quantity. Calculate the total surplus. How is the value of total surplus related to your calculations in parts c and d?arrow_forward

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education