Concept explainers

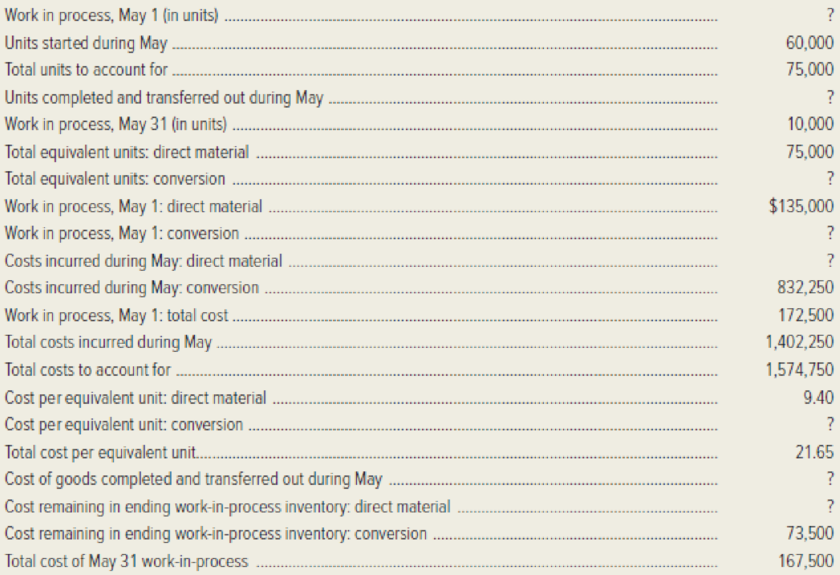

The following data pertain to the Hercules Tire and Rubber Company for the month of May.

Additional Information:

- a. Direct material is added at the beginning of the production process, and conversion activity occurs uniformly throughout the process.

- b. Hercules uses weighted-average

process costing . - c. The May 1 work in process was 20 percent complete as to conversion.

- d. The May 31 work in process was 60 percent complete as to conversion.

Required: Compute the missing amounts, and prepare the firm’s May production report.

Calculate the missing amounts, and prepare the production report during the month of May.

Explanation of Solution

Process Costing: Process costing is method of cost accounting in which all the costs that are incurred production process are recorded. Output of one process becomes input for next process. This method is used to apply cot to similar products that are mass-produced in uninterrupted manner.

Calculate opening work in process during the month of May.

Therefore, opening work in process inventory during the month of May is 15,000 units.

Calculate units completed and transferred out during May.

Therefore, units completed and transferred out during May is 65,000 units.

Calculate equivalent units for conversion.

| Particulars | Physical Units | Conversion | Workings |

| Units completed and transferred out | 65,000 | 65,000 | (65,000 × 100%) |

| Add: Ending work in process | 10,000 | 6,000 | (10,000 × 60%) |

| Equivalent units of production | 75,000 | 71,000 |

Table (1)

Calculate opening work in process for conversion costs.

Therefore, opening work in process for conversion is $37,500.

Calculate cost incurred during the period of May for direct materials.

Calculate cost per equivalent unit for direct materials.

Therefore, cost per equivalent per unit for conversion cost is $12.25 per unit.

Calculate cost of goods completed and transferred out during the period of May.

Therefore, total cost of goods completed and transferred out during the period of May is $1,407,250.

Calculate the cost of ending work in process inventory for direct materials.

Therefore, cost of ending work in process inventory for direct materials cost is $94,000.

Prepare production cost report during the period of May month.

| PRODUCTION COST REPORT - COMPANY HT &R | |||

| Units | Physical Units | Direct Materials | Conversion |

| Opening work in process, May | 15,000 | ||

| Units started during May | 60,000 | ||

| Total units accounted for | 75,000 | ||

| Units completed and transferred out | 65,000 | 65,000 | 65,000 |

| Ending work in process, May | 10,000 | 10,000 | 6,000 |

| Total units accounted for | 75,000 | ||

| Total equivalent units | 75,000 | 71,000 | |

| Cost per unit | Direct Materials | Conversion | Total |

| Opening work in process, May | $135,000 | $37,500 | $172,500 |

| Cost incurred during May | $570,000 | $832,250 | $1,402,250 |

| Total costs accounted for | $705,000 | $869,750 | $1,574,750 |

| Equivalent units | 75,000 | 71,000 | |

| Cost per equivalent unit | $9.40 | $12.25 | $21.65 |

| Costs | |||

| Opening work in process inventory, May | $135,000 | $37,500 | $172,500 |

| Units started during April | $570,000 | $832,250 | $1,402,250 |

| Total costs accounted for | $705,000 | $869,750 | $1,574,750 |

| Cost of goods completed and transferred out | $611,000 | $796,250 | $1,407,250 |

| Ending work in process inventory | $94,000 | $73,500 | $167,500 |

| Total costs accounted for | $705,000 | $869,750 | $1,574,750 |

Table (2)

Want to see more full solutions like this?

Chapter 4 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- QS 15-18 (Algo) Computing and recording over- or underapplied overhead LO P4 A company applies overhead at a rate of 170% of direct labor cost. Actual overhead cost for the current period is $1,081,900, and direct labor cost is $627,000. 1. Compute the under- or overapplied overhead. 2. Prepare the journal entry to close over- or underapplied overhead to Cost of Goods Sold. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the under- or overapplied overhead.arrow_forwardQuestion 6 During 2019, Bitsincoins Corporation had EBIT of $100,000, a change in net fixed assets of $400,000, an increase in net current assets of $100,000, an increase in spontaneous current liabilities of $400,000, a depreciation expense of $50,000, and a tax rate of 30%. Based on this information, what is Bitsincoin's free cash flow? (3 marks)arrow_forwardQuestion 4 Waterfront Inc. wishes to borrow on a short-term basis without reducing its current ratio below 1.25. At present its current assets and current liabilities are $1,600 and $1,000 respectively. How much can Waterfront Inc. borrow? (5 marks)arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,