FINANCIAL ACCOUNTING

15th Edition

ISBN: 9781337885928

Author: WARREN

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 4, Problem 33E

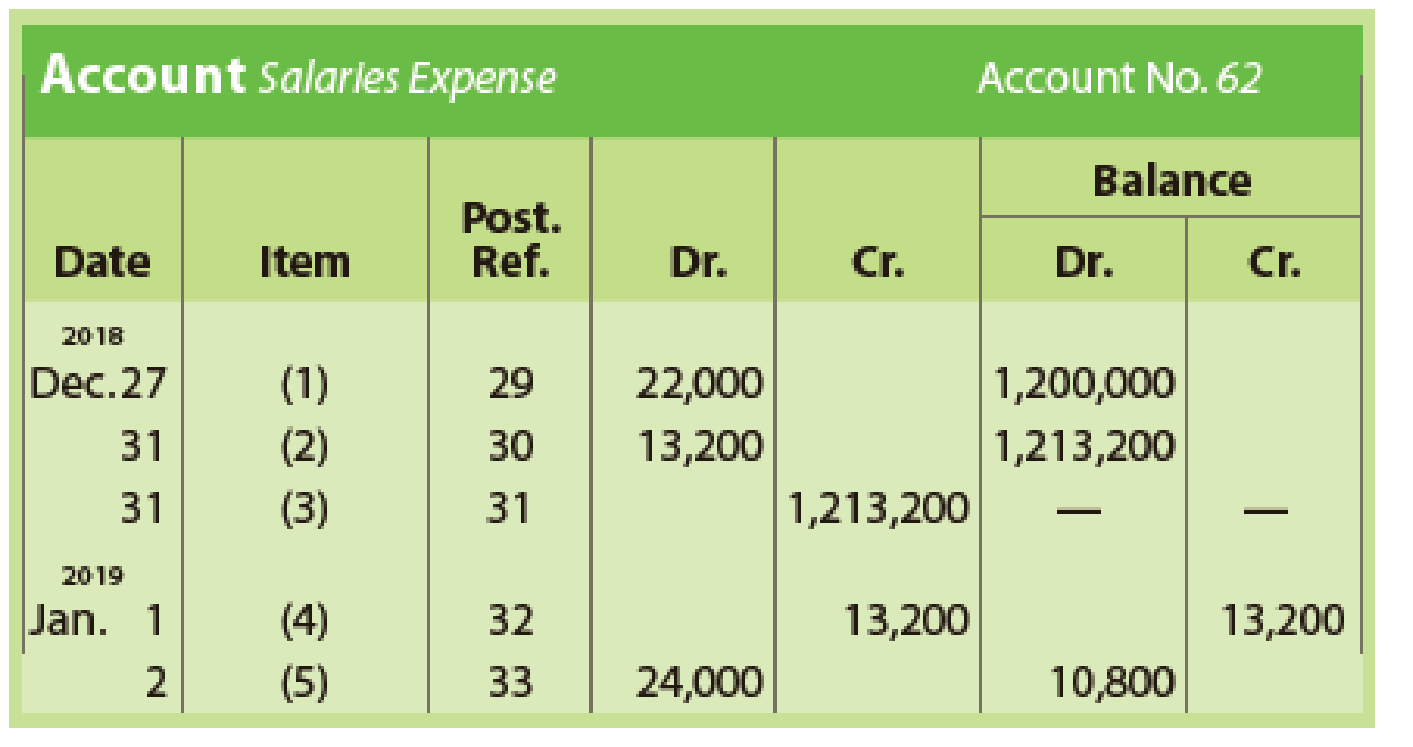

Portions of the salaries expense account of a business follow:

- a. Indicate the nature of the entry (payment, adjusting, closing, reversing) from which each numbered posting was made.

- b. Journalize the complete entry from which each numbered posting was made. Close revenues and expenses to J. McHenry, Capital.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What is the gearing ratio on these financial accounting question?

Cost Pools

Budgeted Costs

Cost Driver

Practical Capacity

Budgeted Activity for S-101

Budgeted Activity for C-110

Setup activity

250000

Setup hours

5000

2500

2350

Packing and shipping

50000

Number of shipments

2000

1200

775

Inspection

30000

Number of batches

1000

250

700

Machining

750000

Units produced

150000

100000

40000

Purchase ordering

40000

Number of orders

300

50

110

1. Which Cost Pool is approximately 22 percent of the total budgeted costs?

2. What percentage of the total budgeted costs does Machining take up?

3. What is the percentage of the total budgeted costs taken up by the smallest Cost Pool?

4. Which Cost Pool has 1.25 percent slack?

5. Which Cost Pool has the highest percent slack?

6. In the Inspection Cost Pool, what is the amount of difference between budgeted costs and the budgeted activity for both products?

7. In how many cost pools is the S-101 manufacturing overhead (MO) greater than the C-110 manufacturing overhead (MO)?

8. In which Cost Pools is…

Financial statements for Askew Industries for 2024 are shown below (in thousands):

2024 Income Statement

Net sales

$ 8,600

Cost of goods sold

(6,050)

Gross profit

2,550

Operating expenses

(1,850)

Interest expense

(100)

Income tax expense

(240)

Net income

$ 360

Comparative Balance Sheets

December 31

2024

2023

Assets

Cash

$ 500

$ 400

Accounts receivable

500

300

Inventory

700

500

Property, plant, and equipment (net)

1,000

1,100

$ 2,700

$ 2,300

Liabilities and Shareholders’ Equity

Current liabilities

$ 500

$ 250

Bonds payable

900

900

Common stock

500

500

Retained earnings

800

650

$ 2,700

$ 2,300

Calculate the following ratios for 2024.

Note: Consider 365 days a year. Round your intermediate calculations and final answers to 2 decimal places.

Chapter 4 Solutions

FINANCIAL ACCOUNTING

Ch. 4 - Prob. 1DQCh. 4 - Describe the nature of the assets that compose the...Ch. 4 - Prob. 3DQCh. 4 - Prob. 4DQCh. 4 - Why are closing entries required at the end of an...Ch. 4 - Prob. 6DQCh. 4 - What is the purpose of the post-closing trial...Ch. 4 - Prob. 8DQCh. 4 - Prob. 9DQCh. 4 - Recent fiscal years for several well-known...

Ch. 4 - The balances for the accounts that follow appear...Ch. 4 - The balances for the accounts that follow appear...Ch. 4 - Marcie Davies owns and operates Gemini Advertising...Ch. 4 - Blake Knudson owns and operates Grab Bag Delivery...Ch. 4 - The following accounts appear in an adjusted trial...Ch. 4 - Prob. 3PEBCh. 4 - After the accounts have been adjusted at December...Ch. 4 - After the accounts have been adjusted at April 30,...Ch. 4 - From the following list of steps in the accounting...Ch. 4 - From the following list of steps in the accounting...Ch. 4 - Current assets and current liabilities for HQ...Ch. 4 - Current assets and current liabilities for...Ch. 4 - The balances for the accounts that follow appear...Ch. 4 - Balances for each of the following accounts appear...Ch. 4 - Bamboo Consulting is a consulting firm owned and...Ch. 4 - Elliptical Consulting is a consulting firm owned...Ch. 4 - The following account balances were taken from the...Ch. 4 - Prob. 6ECh. 4 - FedEx Corporation had the following revenue and...Ch. 4 - Apex Systems Co. offers its services to residents...Ch. 4 - Selected accounts from the ledger of Restoration...Ch. 4 - Ex 410 Classifying assets Identify each of the...Ch. 4 - At the balance sheet date, a business owes a...Ch. 4 - Optimum Weight Loss Co. offers personal weight...Ch. 4 - List the errors you find in the following balance...Ch. 4 - Prob. 14ECh. 4 - Prior to closing, total revenues were 12,840,000...Ch. 4 - Assume that the entry closing total revenues of...Ch. 4 - Stylist Services Co. offers its services to...Ch. 4 - Which of the following accounts will usually...Ch. 4 - An accountant prepared the following post-closing...Ch. 4 - Rearrange the following steps in the accounting...Ch. 4 - The following data (in thousands) were taken from...Ch. 4 - The following data (in thousands) were taken from...Ch. 4 - Prob. 23ECh. 4 - Alert Security Services Co. offers security...Ch. 4 - Alert Security Services Co. offers security...Ch. 4 - Based on the data in Exercise 4-25, prepare an...Ch. 4 - Prob. 27ECh. 4 - Prob. 28ECh. 4 - Prob. 29ECh. 4 - On the basis of the following data, (a) journalize...Ch. 4 - On the basis of the following data, (a) journalize...Ch. 4 - Portions of the wages expense account of a...Ch. 4 - Portions of the salaries expense account of a...Ch. 4 - Beacon Signals Company maintains and repairs...Ch. 4 - Finders Investigative Services is an investigative...Ch. 4 - The unadjusted trial balance of Epicenter Laundry...Ch. 4 - The unadjusted trial balance of Lakota Freight Co....Ch. 4 - For the past several years, Jolene Upton has...Ch. 4 - Last Chance Company offers legal consulting advice...Ch. 4 - The Gorman Group is a financial planning services...Ch. 4 - The unadjusted trial balance of La Mesa Laundry at...Ch. 4 - The unadjusted trial balance of Recessive...Ch. 4 - For the past several years, Jeff Horton has...Ch. 4 - The unadjusted trial balance of PS Music as of...Ch. 4 - Kelly Pitney began her consulting business, Kelly...Ch. 4 - New Wave Images is a graphics design firm that...Ch. 4 - Prob. 3CPCh. 4 - The following is an excerpt from a telephone...Ch. 4 - Prob. 5CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What is the firm's weighted average cost of capital?arrow_forwardThe following condensed income statements of the Jackson Holding Company are presented for the two years ended December 31, 2024 and 2023: 2024 2023 Sales revenue $ 15,900,000 $ 10,500,000 Cost of goods sold 9,650,000 6,450,000 Gross profit 6,250,000 4,050,000 Operating expenses 3,560,000 2,960,000 Operating income 2,690,000 1,090,000 Gain on sale of division 690,000 — 3,380,000 1,090,000 Income tax expense 845,000 272,500 Net income $ 2,535,000 $ 817,500 On October 15, 2024, Jackson entered into a tentative agreement to sell the assets of one of its divisions. The division qualifies as a component of an entity as defined by GAAP. The division was sold on December 31, 2024, for $5,270,000. Book value of the division’s assets was $4,580,000. The division’s contribution to Jackson’s operating income before-tax for each year was as follows: 2024 $ 445,000 2023 $ 345,000 Assume an income tax rate of 25%. Required: Note: In each case, net any gain or…arrow_forwardWant to this question answer general Accountingarrow_forward

- What is this firm s WACC?? Solve this problem general Accounting questionarrow_forwardAccounting questionarrow_forwardGreen Grow Incorporated (GGI) manufactures lawn fertilizer. Because of the product’s very high quality, GGI often receives special orders from agricultural research groups. For each type of fertilizer sold, each bag is carefully filled to have the precise mix of components advertised for that type of fertilizer. GGI’s operating capacity is 34,000 one-hundred-pound bags per month, and it currently is selling 32,000 bags manufactured in 32 batches of 1,000 bags each. The firm just received a request for a special order of 7,400 one-hundred-pound bags of fertilizer for $210,000 from APAC, a research organization. The production costs would be the same, but there would be no variable selling costs. Delivery and other packaging and distribution services would cause a one-time $3,900 cost for GGI. The special order would be processed in two batches of 3,700 bags each. (No incremental batch-level costs are anticipated. Most of the batch-level costs in this case are short-term fixed costs,…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY