MANAGERIAL ACCOUNTING-CUSTOM EBOOK>I<

12th Edition

ISBN: 9781307661217

Author: HILTON

Publisher: INTER MCG2

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 4, Problem 32P

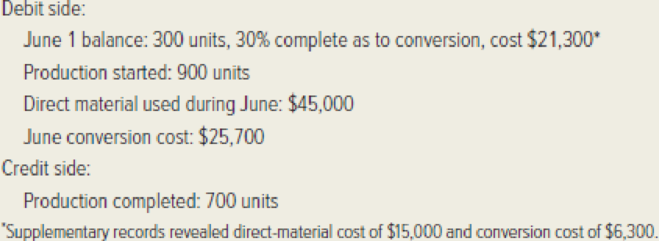

A-1 Products manufactures wooden furniture using an assembly-line process. All direct materials are introduced at the start of the process, and conversion cost is incurred evenly throughout manufacturing. An examination of the company’s Work-in-Process Inventory account for June revealed the following selected information.

Conversations with manufacturing personnel revealed that the ending work in process was 60 percent complete as to conversion.

Required:

- 1. Determine the number of units in the June 30 work-in-process inventory.

- 2. Calculate the cost of goods completed during June and prepare the appropriate

journal entry to record completed production. - 3. Determine the cost of the June 30 work-in-process inventory.

- 4. Briefly explain the meaning of equivalent units. Why are equivalent units needed to properly allocate costs between completed production and production in process?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Please solve. The screen print is kind of split. Please look carefully.

Coronado Fire, Inc. manufactures steel cylinders and nozzles for two models of fire extinguishers: (1) a home fire extinguisher and (2) a

commercial fire extinguisher. The home model is a high-volume (54,000 units), half-gallon cylinder that holds 2 1/2 pounds of multi-

purpose dry chemical at 480 PSI. The commercial model is a low-volume (10,200 units), two-gallon cylinder that holds 10 pounds of

multi-purpose dry chemical at 390 PSI. Both products require 1.5 hours of direct labor for completion. Therefore, total annual direct

labor hours are 96,300 or [1.5 hours x (54,000+10,200)]. Estimated annual manufacturing overhead is $1,566,090. Thus, the

predetermined overhead rate is $16.26 or ($1,566,090 ÷ 96,300) per direct labor hour. The direct materials cost per unit is $18.50 for

the home model and $26.50 for the commercial model. The direct labor cost is $19 per unit for both the home and the commercial

models.

The company's managers identified six activity cost pools and related…

Coronado Fire, Inc. manufactures steel cylinders and nozzles for two models of fire extinguishers: (1) a home fire extinguisher and (2) a

commercial fire extinguisher. The home model is a high-volume (54,000 units), half-gallon cylinder that holds 2 1/2 pounds of multi-

purpose dry chemical at 480 PSI. The commercial model is a low-volume (10,200 units), two-gallon cylinder that holds 10 pounds of

multi-purpose dry chemical at 390 PSI. Both products require 1.5 hours of direct labor for completion. Therefore, total annual direct

labor hours are 96,300 or [1.5 hours x (54,000+ 10,200)]. Estimated annual manufacturing overhead is $1,566,090. Thus, the

predetermined overhead rate is $16.26 or ($1,566,090 ÷ 96,300) per direct labor hour. The direct materials cost per unit is $18.50 for

the home model and $26.50 for the commercial model. The direct labor cost is $19 per unit for both the home and the commercial

models.

The company's managers identified six activity cost pools and related…

Chapter 4 Solutions

MANAGERIAL ACCOUNTING-CUSTOM EBOOK>I<

Ch. 4 - Explain the primary differences between job-order...Ch. 4 - List five types of manufacturing in which process...Ch. 4 - Prob. 3RQCh. 4 - What are the purposes of a product-costing system?Ch. 4 - Define the term equivalent unit and explain how...Ch. 4 - List and briefly describe the purpose of each of...Ch. 4 - Show how to prepare a journal entry to enter...Ch. 4 - Prob. 8RQCh. 4 - Prob. 9RQCh. 4 - Prob. 10RQ

Ch. 4 - How would the process-costing computations differ...Ch. 4 - Explain the concept of operation costing. How does...Ch. 4 - Prob. 13RQCh. 4 - In each case below, fill in the missing amount.Ch. 4 - Rainbow Glass Company manufactures decorative...Ch. 4 - Terra Energy Company refines a variety of...Ch. 4 - The Evanston plant of Fit-for-Life Foods...Ch. 4 - Idaho Lumber Company grows, harvests, and...Ch. 4 - Otsego Glass Company manufactures window glass for...Ch. 4 - Savannah Textiles Company manufactures a variety...Ch. 4 - The following data pertain to Tulsa Paperboard...Ch. 4 - The November production of MVPs Minnesota Division...Ch. 4 - Timing Technology, Inc. manufactures timing...Ch. 4 - Piscataway Plastics Company manufactures a highly...Ch. 4 - The following data pertain to the Vesuvius Tile...Ch. 4 - Triangle Fastener Corporation accumulates costs...Ch. 4 - Moravia Company processes and packages cream...Ch. 4 - Albany Company accumulates costs for its product...Ch. 4 - Goodson Corporation assembles various components...Ch. 4 - A-1 Products manufactures wooden furniture using...Ch. 4 - The following data pertain to the Hercules Tire...Ch. 4 - Scrooge and Zilch, a public accounting firm in...Ch. 4 - GroFast Company manufactures a high-quality...Ch. 4 - Plasto Corporation manufactures a variety of...Ch. 4 - (Contributed by Roland Minch.) Glass Glow Company...Ch. 4 - Orbital Industries of Canada, Inc. manufactures a...Ch. 4 - Laredo Leather Company manufactures high-quality...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The completed Payroll Register for the February and March biweekly pay periods is provided, assuming benefits went into effect as anticipated. Required: Using the payroll registers, complete the General Journal entries as follows: February 10 Journalize the employee pay. February 10 Journalize the employer payroll tax for the February 10 pay period. Use 5.4 percent SUTA and 0.6 percent FUTA. No employees will exceed the FUTA or SUTA wage base. February 14 Issue the employee pay. February 24 Journalize the employee pay. February 24 Journalize the employer payroll tax for the February 24 pay period. Use 5.4 percent SUTA and 0.6 percent FUTA. No employee will exceed the FUTA or SUTA wage base. February 28 Issue the employee pay. February 28 Issue payment for the payroll liabilities. March 10 Journalize the employee pay. March 10 Journalize the employer payroll tax for the March 10 pay period. Use 5.4 percent SUTA and 0.6 percent FUTA. No employees will exceed the FUTA or SUTA wage base.…arrow_forwardPlease given step by step explanation general accounting questionarrow_forwardDon't use ai solution please given answer general accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY