Concept explainers

The

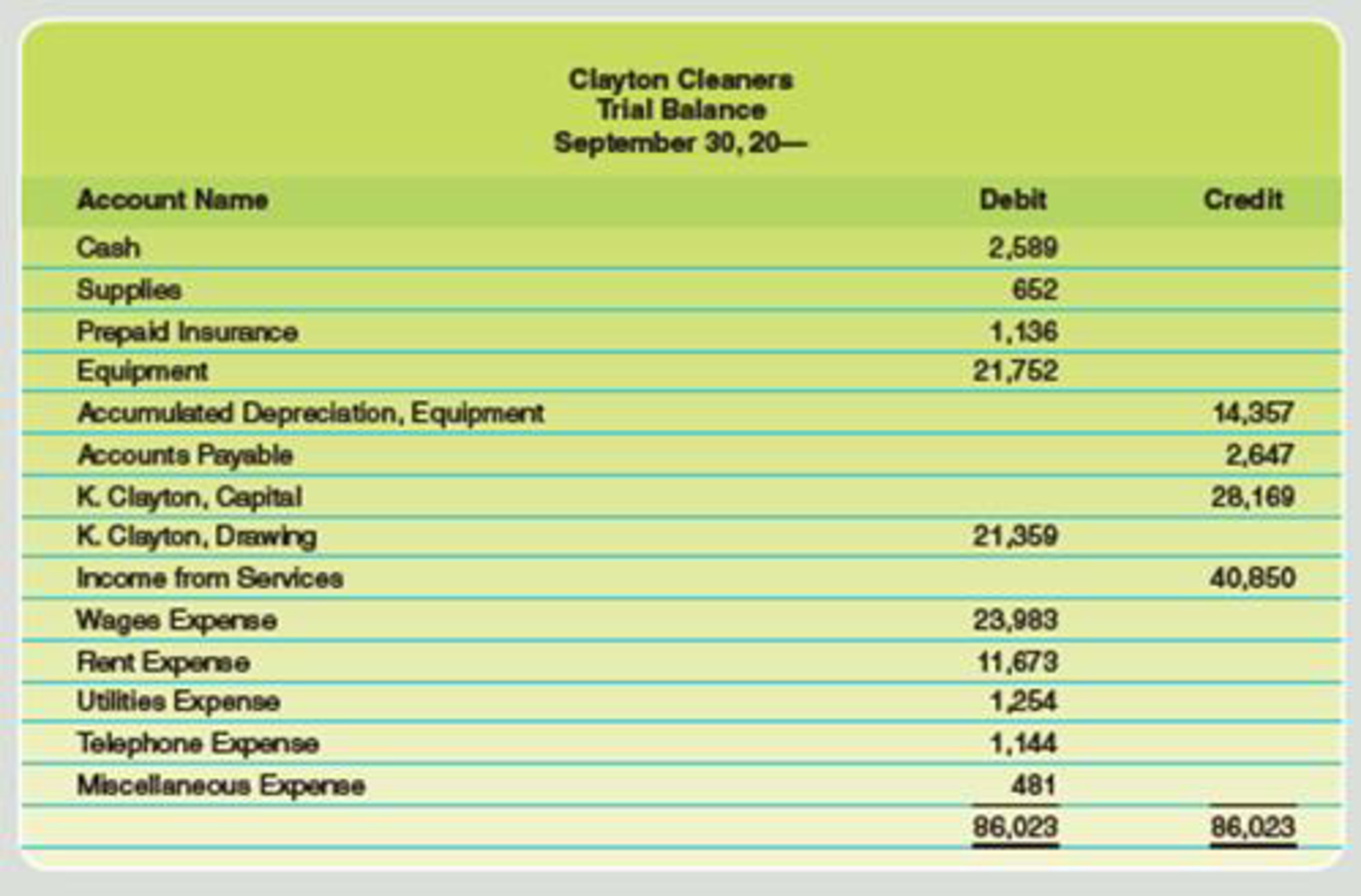

Data for the adjustments are as follows:

- a. Expired or used-up insurance, $800.

- b.

Depreciation expense on equipment, $2,700. - c. Wages accrued or earned since the last payday, $585 (owed and to be paid on the next payday).

- d. Supplies remaining at the end of month, $230.

Required

- 1. Complete a work sheet. (Skip this step if using CLGL.)

- 2. Journalize the

adjusting entries .

*If you are using CLGL, use the year 2020 when recording transactions.

Trending nowThis is a popular solution!

Chapter 4 Solutions

Working Papers with Study Guide for Scott's College Accounting: A Career Approach, 13th

Additional Business Textbook Solutions

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

Financial Accounting, Student Value Edition (5th Edition)

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Horngren's Accounting (12th Edition)

- For each of the transactions above, indicate the amount of the adjusting entry on the elements of the balance sheet and income statement.Note: Enter negative amounts with a minus sign.arrow_forwardNeed help with this question solution general accountingarrow_forwardDon't use ai given answer accounting questionsarrow_forward

- I want to correct answer general accounting questionarrow_forwardKindly help me with accounting questionsarrow_forwardDuo Corporation is evaluating a project with the following cash flows: Year 0 1 2 3 Cash Flow -$ 30,000 12,200 14,900 16,800 4 5 13,900 -10,400 The company uses an interest rate of 8 percent on all of its projects. a. Calculate the MIRR of the project using the discounting approach. Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. b. Calculate the MIRR of the project using the reinvestment approach. Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. c. Calculate the MIRR of the project using the combination approach. Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. a. Discounting approach MIRR b. Reinvestment approach MIRR c. Combination approach MIRR % % %arrow_forward

- Provide correct answer general accounting questionarrow_forwardNeed help with this question solution general accountingarrow_forwardConsider a four-year project with the following information: Initial fixed asset investment = $555,000; straight-line depreciation to zero over the four-year life; zero salvage value; price = $37; variable costs = $25; fixed costs = $230,000; quantity sold = 79,000 units; tax rate = 24 percent. How sensitive is OCF to changes in quantity sold?arrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax CollegePrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College