College Accounting

13th Edition

ISBN: 9781337280563

Author: Scott, Cathy J.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

thumb_up100%

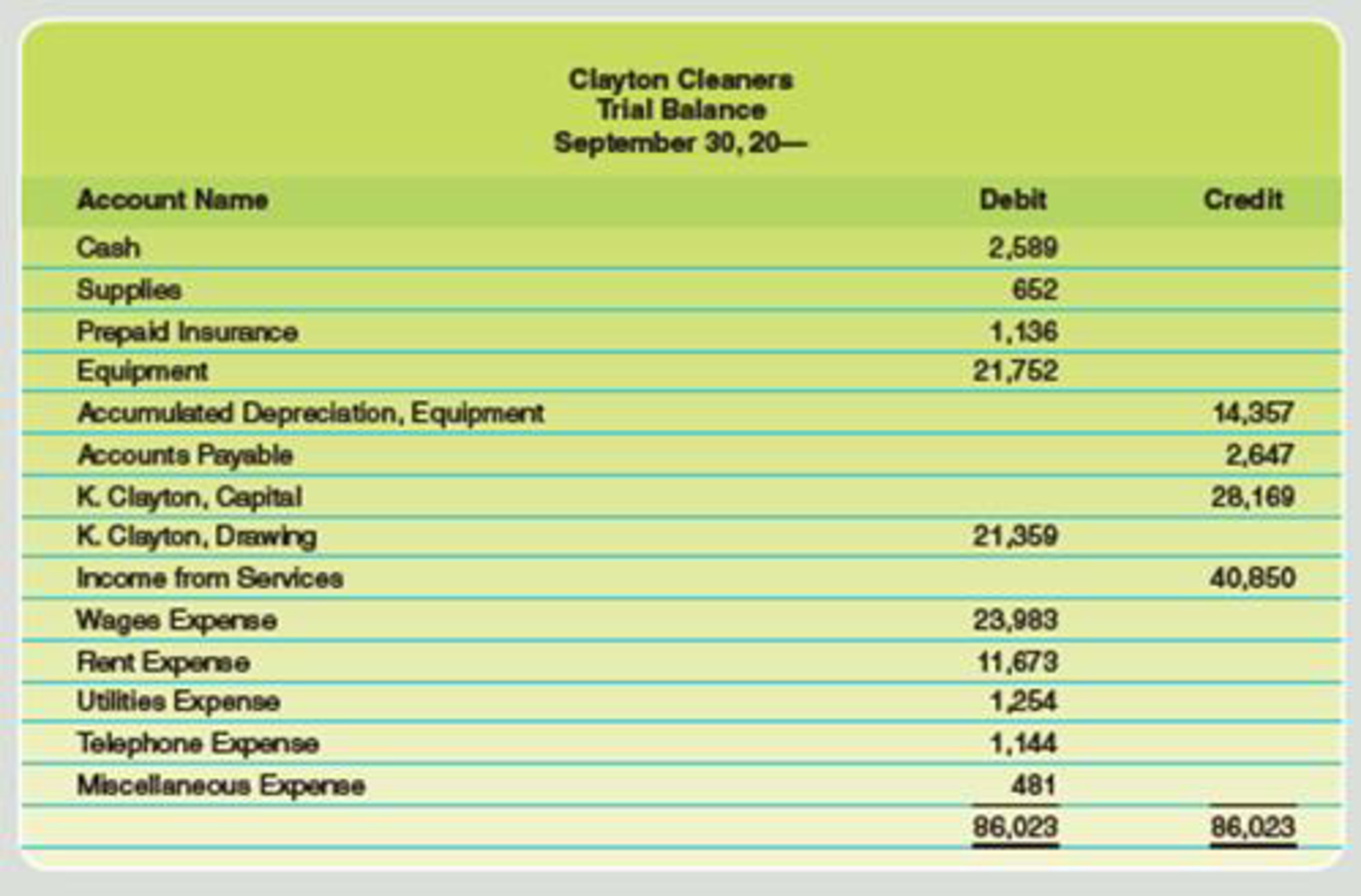

Chapter 4, Problem 2PA

The

Data for the adjustments are as follows:

- a. Expired or used-up insurance, $800.

- b.

Depreciation expense on equipment, $2,700. - c. Wages accrued or earned since the last payday, $585 (owed and to be paid on the next payday).

- d. Supplies remaining at the end of month, $230.

Required

- 1. Complete a work sheet. (Skip this step if using CLGL.)

- 2. Journalize the

adjusting entries .

*If you are using CLGL, use the year 2020 when recording transactions.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Please solve this questions general accounting

Current Attempt in Progress

During 2025, Crane Corporation had the following amounts, all before calculating tax effects: income before income taxes $550,000,

loss on operation of discontinued music division $66,000, gain on disposal of discontinued music division $44,000, and unrealized loss

on available-for-sale securities $165,000. The income tax rate is 20%.

Prepare a partial income statement, beginning with income before income taxes for the year ended December 31, 2025.

CRANE CORPORATION

Income Statement (Partial)

$

GA

$

$

Prepare a statement of comprehensive income for the year ended December 31, 2025.

CRANE CORPORATION

Statement of Comprehensive Income

$

$

Make an Excel spreadsheet to compute gross wages due each employee under federal wage-hour law. See notes below.

Ryan is normally paid $1,000 for a 40-hour workweek. One week, he works 46 hours.

Latisha is normally paid $1,200 for a 40-hour workweek. One Monday she is out sick but receives 8 hours sick pay. She then works 40 hours Tuesday–Friday.

Al is normally paid $500 for a 40-hour workweek. One week, he works 45 hours.

Lee is normally paid $1,500 for a 40-hour workweek. To make up for leaving early one Friday, he works 44 hours this week.

Chapter 4 Solutions

College Accounting

Ch. 4 - The __________ represents the sequence of steps in...Ch. 4 - The __________ is a working paper used by...Ch. 4 - On the work sheet, assets are recorded in which of...Ch. 4 - Rainy Day Services had 430 of supplies reported on...Ch. 4 - On the work sheet, Accumulated Depreciation,...Ch. 4 - The __________ requires that expenses be matched...Ch. 4 - Accumulated Depreciation, Equipment is reported a....Ch. 4 - What is the purpose of a work sheet?Ch. 4 - What is the purpose of adjusting entries?Ch. 4 - Prob. 3DQ

Ch. 4 - Prob. 4DQCh. 4 - Prob. 5DQCh. 4 - Define depreciation as it relates to a van you...Ch. 4 - Prob. 7DQCh. 4 - Why is it necessary to journalize and post...Ch. 4 - 1. List the following classifications of accounts...Ch. 4 - Classify each of the accounts listed below as...Ch. 4 - Place a check mark next to any account(s)...Ch. 4 - A partial work sheet for Marges Place is shown...Ch. 4 - Complete the work sheet for Ramey Company, dated...Ch. 4 - Journalize the adjusting entries from the partial...Ch. 4 - Journalize the adjusting entries from the partial...Ch. 4 - Journalize the following adjusting entries that...Ch. 4 - Determine on which financial statement each...Ch. 4 - Prob. 1PACh. 4 - The trial balance of Clayton Cleaners for the...Ch. 4 - The trial balance for Game Time on July 31 is as...Ch. 4 - The trial balance for Benner Hair Salon on March...Ch. 4 - The trial balance for Masons Insurance Agency as...Ch. 4 - The trial balance of The New Decors for the month...Ch. 4 - The trial balance for Harris Pitch and Putt on...Ch. 4 - The trial balance for Wilson Financial Services on...Ch. 4 - Prob. 1ACh. 4 - You are the bookkeeper for a small but thriving...Ch. 4 - Prob. 3ACh. 4 - Your client is preparing financial statements to...Ch. 4 - Prob. 1CP

Additional Business Textbook Solutions

Find more solutions based on key concepts

The flowchart for the process at the local car wash. Introduction: Flowchart: A flowchart is a visualrepresenta...

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

Assume you are a CFO of a company that is attempting to race additional capital to finance an expansion of its ...

Financial Accounting, Student Value Edition (5th Edition)

Real options and its types. Introduction: The net present value is the variation between present cash inflows v...

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Mary Williams, owner of Williams Products, is evaluating whether to introduce a new product line. After thinkin...

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

How is activity-based costing useful for pricing decisions?

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

E6-14 Using accounting vocabulary

Learning Objective 1, 2

Match the accounting terms with the corresponding d...

Horngren's Accounting (12th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please solve this questionsarrow_forwardwhat will be the new ROE'?arrow_forwardObjective: The purpose of this exercise is to ensure that students can locate the audit requirements for a Single Audit. Scenario: A nonprofit organization, ABC Youth Services, receives $1.2 million in federal grant funding to provide after-school programs. The organization must comply with the Single Audit Act but is unfamiliar with the audit requirements. To guide the organization, please provide the information below. Use the federal regulations for Single Audits (2 CFR Part 200, Subpart F) as a reference for your responses. Why Is the non-profit subject to the Single Audit Requirements? Cite the federal regulation that applies.arrow_forward

- Question 1Toodles Inc. had sales of $1,840,000. Cost of goods sold,administrative and selling expenses, and depreciation expenses were$1,180,000, $185,000 and $365,000 respectively. In addition, thecompany had an interest expense of $280,000 and a tax rate of 35percent. (Ignore any tax loss carry-back or carry-forward provisions.)Arrange the financial information for Toodles Inc. in an incomestatement and compute its OCF?arrow_forwardIts days' sales uncollected equalsarrow_forwardI want to correct answer general accounting questionarrow_forward

- the estimated total fixed cost is:arrow_forwardStone Company is facing several decisions regarding investing and financing activities. Address each decision independently. On June 30, 2024, the Stone Company purchased equipment from Paper Corporation. Stone agreed to pay $28,000 on the purchase date and the balance in five annual installments of $5,000 on each June 30 beginning June 30, 2025. Assuming that an interest rate of 10% properly reflects the time value of money in this situation, at what amount should Stone value the equipment? Stone needs to accumulate sufficient funds to pay a $580,000 debt that comes due on December 31, 2029. The company will accumulate the funds by making five equal annual deposits to an account paying 5% interest compounded annually. Determine the required annual deposit if the first deposit is made on December 31, 2024. On January 1, 2024, Stone leased an office building. Terms of the lease require Stone to make 10 annual lease payments of $138,000 beginning on January 1, 2024. A 10% interest rate…arrow_forwardCorrect answer pleasearrow_forward

- Get correct answer general accounting questionsarrow_forwardWhat is tikki's ROE for 2008 ?arrow_forward1. I want to know how to solve these 2 questions and what the answers are 1. Solar industries has a debt-to-equity ratio of 1.25. Its WACC is 7.8%, and its cost of debt is 4.7%. The corporate tax rate is 21%. a. What is the company’s cost of equity capital?b. What is the company’s unlevered cost of equity capital?c. What would be the cost of equity if the D/E ratio were 2? What if it were 1? 2. Therap software company is trying to determine its optimal capital structure. The company’s current capital structure consists of 35% debt and 65% common equity; however, the treasurer believes that the firm should use more debt. Currently, the company’s cost of equity capital is 9%, which is determined by CAPM. What would be Therap’s estimated cost of equity capital if they change their capital structure to 50% debt? Risk-free rate is 3%, market index returns 11%, and the Therap’s tax rate is 25%.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax CollegePrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY