Concept explainers

a.

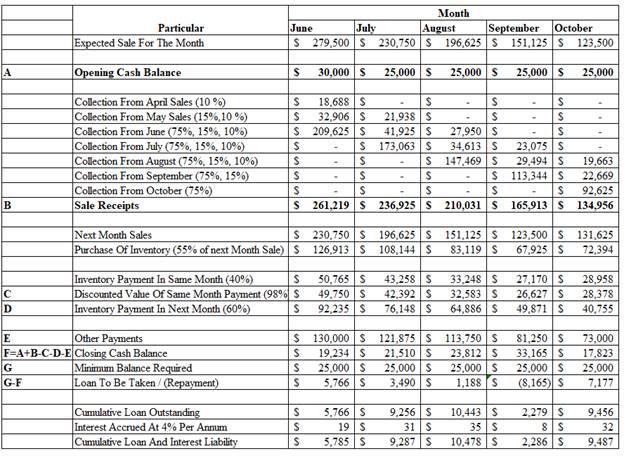

To calculate: Cash budget for June 2017 to October 2017.

Introduction: Cash budgets are prepared to plan cash availability for smooth maintenance of company’s operations, they shall account for all cash in-flows and cash out-flows.

a.

Explanation of Solution

Loan outstanding shall be repaid by cash available over and above the minimum requirement of $25,000 which are required to be maintained.

b.

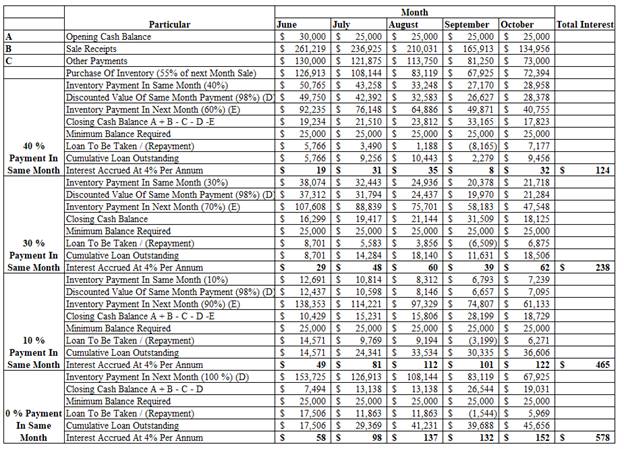

To create:A scenario summary with total interest cost for differing the payment to suppliers at different rateswith comment on B’s view.

Introduction: When payment to suppliers is differed to next month, it results in savings in form of interest costs, as the working capital requirement falls.

b.

Answer to Problem 2P

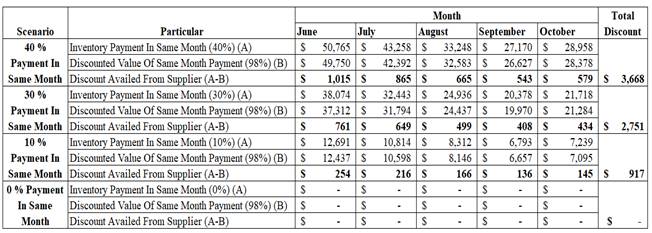

B’s view regarding the rising interest cost when the payment is made to supplier in the same month is correct, however, it is not feasible because the discount forgone is greater than rise in interest rate.

Explanation of Solution

Calculation of total interest cost under different scenarios.

It can be observed from above calculations that the cost of interest rises when payment is made in the same month, interest cost is lowest in the month when all the payments for procurement are made in the next month.

B’s view correct, however, it is not feasible to implement the same because in order to gain benefit of lower interest rate, discount of 2 % offered by the suppliers is forgone.

Total discount forgone under different option is :

Want to see more full solutions like this?

Chapter 4 Solutions

EBK 3N3-EBK: FINANCIAL ANALYSIS WITH MI

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning  Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning