Managerial Accounting: Creating Value in a Dynamic Business Environment

11th Edition

ISBN: 9781259569562

Author: Ronald W Hilton Proffesor Prof, David Platt

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 4, Problem 29P

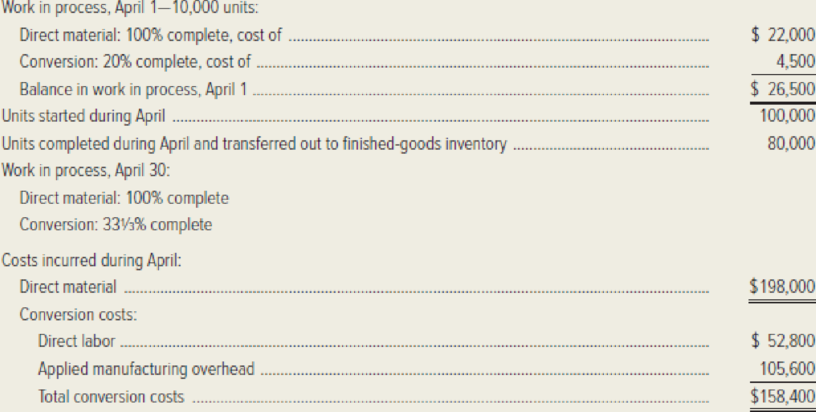

Moravia Company processes and packages cream cheese. The following data have been compiled for the month of April. Conversion activity occurs uniformly throughout the production process.

Required: Prepare schedules to accomplish each of the following process-costing steps for the month of April. Use the weighted-average method of

- 1. Analysis of physical flow of units.

- 2. Calculation of equivalent units.

- 3. Computation of unit costs.

- 4. Analysis of total costs.

- 5. Build a spreadsheet: Construct an Excel spreadsheet to solve all of the preceding requirements. Show how the solution will change if the following data change: the April 1 work-in-process costs were $66,000 for direct material and $18,000 for conversion.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Toodles Inc. had sales of $1,840,000. Cost of goods sold,administrative and selling expenses, and depreciation expenses were $1,180,000, $185,000 and $365,000 respectively. In addition, the company had an interest expense of $280,000 and a tax rate of 35 percent. (Ignore any tax loss carry-back or carry-forward provisions.)Arrange the financial information for Toodles Inc. in an income statement and compute its OCF?

Anti-Pandemic Pharma Co. Ltd. reports the following information in its income statement:

Sales = $5,250,000; Costs = $2,173,000; Other expenses = $187,400; Depreciation expense = $79,000; Interest expense= $53,555; Taxes = $76,000; Dividends = $69,000.

$136,700 worth of new shares were also issued during the year and long-term debt worth $65,300 was redeemed.

a) Compute the cash flow from assets

b) Compute the net change in working capital

Answer the questions in the attached image

Chapter 4 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

Ch. 4 - Explain the primary differences between job-order...Ch. 4 - List five types of manufacturing in which process...Ch. 4 - Prob. 3RQCh. 4 - What are the purposes of a product-costing system?Ch. 4 - Define the term equivalent unit and explain how...Ch. 4 - List and briefly describe the purpose of each of...Ch. 4 - Show how to prepare a journal entry to enter...Ch. 4 - Prob. 8RQCh. 4 - Prob. 9RQCh. 4 - Prob. 10RQ

Ch. 4 - How does process costing differ under normal or...Ch. 4 - How would the process-costing computations differ...Ch. 4 - Explain the concept of operation costing. How does...Ch. 4 - Prob. 14RQCh. 4 - In each case below, fill in the missing amount.Ch. 4 - Rainbow Glass Company manufactures decorative...Ch. 4 - Terra Energy Company refines a variety of...Ch. 4 - The Evanston plant of Fit-for-Life Foods...Ch. 4 - Idaho Lumber Company grows, harvests, and...Ch. 4 - Otsego Glass Company manufactures window glass for...Ch. 4 - Savannah Textiles Company manufactures a variety...Ch. 4 - The following data pertain to Tulsa Paperboard...Ch. 4 - The November production of MVPs Minnesota Division...Ch. 4 - Timing Technology, Inc. manufactures timing...Ch. 4 - Piscataway Plastics Company manufactures a highly...Ch. 4 - The following data pertain to the Vesuvius Tile...Ch. 4 - Triangle Fastener Corporation accumulates costs...Ch. 4 - Moravia Company processes and packages cream...Ch. 4 - Albany Company accumulates costs for its product...Ch. 4 - Goodson Corporation assembles various components...Ch. 4 - A-1 Products manufactures wooden furniture using...Ch. 4 - The following data pertain to the Hercules Tire...Ch. 4 - Scrooge and Zilch, a public accounting firm in...Ch. 4 - GroFast Company manufactures a high-quality...Ch. 4 - Plasto Corporation manufactures a variety of...Ch. 4 - (Contributed by Roland Minch.) Glass Glow Company...Ch. 4 - Orbital Industries of Canada, Inc. manufactures a...Ch. 4 - Laredo Leather Company manufactures high-quality...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Auditor should assess the likelihood of --------- when identifying potential criteria for the audit. material misstatement wrong answerarrow_forwardWhen information comes to the auditors' attention indicating that ----- may have occured, auditors should evaluate whether the possible effect is significant within the context of the audit objectives.arrow_forwardNeed help with this question solution general accountingarrow_forward

- Select the correct answerarrow_forwardWhat is a good response to this post? Hello everyone,The theory of facework is a beneficial instrument for preserving self-image and fostering mutual respect during exchanges. According to Nguyen-Phuong-Mai, Terlouw, and Pilot (2014), facework is the strategic approach individuals employ to validate their own identity while simultaneously considering the requirements of others. The necessity of these strategies has been evident to me during my nine years as a rideshare driver. I endeavor to understand the context and intentions of each passenger by dedicating sufficient time to attentive listening before disclosing undue personal information. This empathetic and respectful approach safeguards my identity and fosters trust, reducing the probability of rambling and mitigating the potential harm of receiving a poor rating.My experience in the restaurant industry, particularly at venues such as Tavern on the Green in New York City, has emphasized the significance of effective facework.…arrow_forwardCorrect answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY