The following transactions occurred during the 2020 fiscal year for the City of Evergreen. For budgetary purposes, the city reports encumbrances in the Expenditures section of its budgetary comparison schedule for the General Fund but excludes expenditures chargeable to a prior year’s appropriation.

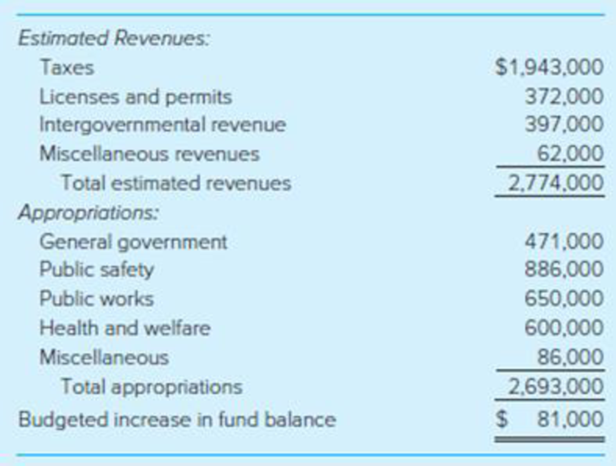

- 1. The budget prepared for the fiscal year 2020 was as follows:

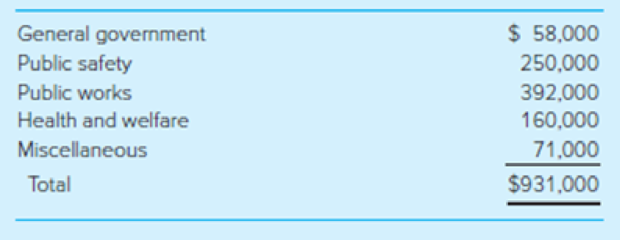

- 2. Encumbrances issued against the appropriations during the year were as follows:

- 3. The current year’s tax levy of $2,005,000 was recorded; uncollectibles were estimated as $65,000.

- 4. Tax collections of the current year’s levy totaled $1,459,000. The City also collected $132,000 in taxes from the prior year’s levy in the first 60 days after year end. (These delinquent collections had been anticipated prior to year-end.)

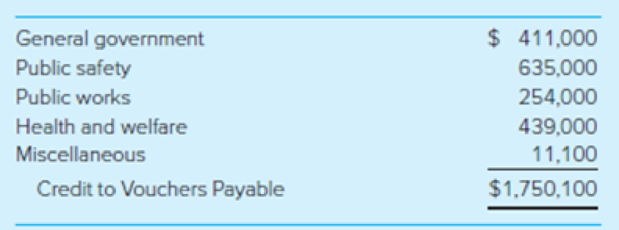

- 5. Personnel costs during the year were charged to the following appropriations in the amounts indicated. Encumbrances were not recorded for personnel costs. Because no liabilities currently exist for withholdings, you may ignore any FICA or federal or state income tax withholdings. (Expenditures charged to Miscellaneous should be treated as General Government expenses in the governmental activities general journal at the government-wide level.)

- 6. Invoices for all items ordered during the prior year were received and approved for payment in the amount of $14,470. Encumbrances had been recorded in the prior year for these items in the amount of $14,000. The amount chargeable to each year’s appropriations should be charged to the Public Safety appropriation.

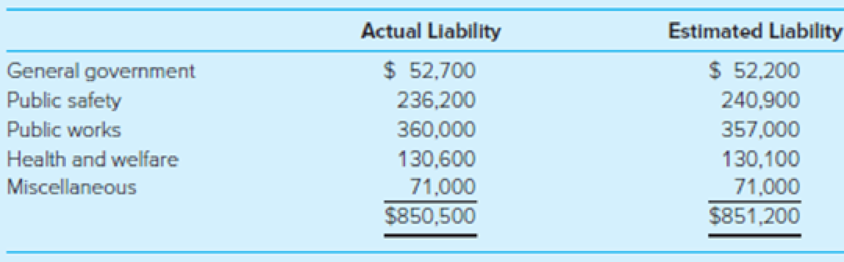

- 7. Invoices were received and approved for payment for items ordered in documents recorded as encumbrances in Transaction (2) of this problem. The following appropriations were affected.

- 8. Revenue other than taxes collected during the year consisted of licenses and permits, $373,000; intergovernmental revenue, $400,000; and $66,000 of miscellaneous revenues. For purposes of accounting for these revenues at the government-wide level, the intergovernmental revenues were operating grants and contributions for the Public Safety function. Miscellaneous revenues are not identifiable with any function and, therefore, are recorded as General Revenues at the government-wide level.

- 9. Payments on Vouchers Payable totaled $2,505,000.

Additional information follows: The General Fund Fund Balance—Unassigned account had a credit balance of $96,900 as of December 31, 2019; no entries have been made in the Fund Balance—Unassigned account during 2020.

Required

- a. Record the preceding transactions in general journal form for fiscal year 2020 in both the General Fund and governmental activities general journals.

- b. Prepare a budgetary comparison schedule for the General Fund of the City of Evergreen for the fiscal year ending December 31, 2020, as shown in Illustration 4-6. Do not prepare a government-wide statement of activities because other governmental funds would affect that statement.

a.

Journalize the given transactions for the fiscal year 2020 in General Fund and governmental activities general journals.

Explanation of Solution

General Fund: The chief operating fund of state and local government used to record the departmental operating activities and government support services is referred to as General Fund, or General Operating Fund, or General Revenue Fund. The activities recorded in General Funds are police, fire, public works, recreation, education, culture, social services, city office, finance, personnel, and data processing.

Journalize the given transactions for the fiscal year 2020 in General Fund and governmental activities general journals.

1.

Entry to record the budget:

| General Ledger | Subsidiary Ledger | |||||

| Debits | Credits | Debits | Credits | |||

| General Fund: | ||||||

| Estimated Revenues | $2,774,000 | |||||

| Budgetary Fund Balance | $81,000 | |||||

| Appropriations | 2,693,000 | |||||

| Estimated Revenues Ledger: | ||||||

| Taxes | $1,943,000 | |||||

| Licenses and Permits | 372,000 | |||||

| Internalgovernmental Revenue | 397,000 | |||||

| Miscellaneous Revenues | 62,000 | |||||

| Appropriations Ledger: | ||||||

| General Government | $471,000 | |||||

| Public Safety | 886,000 | |||||

| Public Works | 650,000 | |||||

| Health and Welfare | 600,000 | |||||

| Miscellaneous | 86,000 | |||||

Table (1)

2.

Entry to record the encumbrances against appropriations:

| General Ledger | Subsidiary Ledger | ||||

| Debits | Credits | Debits | Credits | ||

| General Fund: | |||||

| Encumbrances–2020 | $931,000 | ||||

| Encumbrances Outstanding–2020 | $931,000 | ||||

| Encumbrances Ledger: | |||||

| General Government | $58,000 | ||||

| Public Safety | 250,000 | ||||

| Public Works | 392,000 | ||||

| Health and Welfare | 160,000 | ||||

| Miscellaneous | 71,000 | ||||

Table (2)

3.

Entries to record property tax levy:

| General Ledger | Subsidiary Ledger | ||||

| Debits | Credits | Debits | Credits | ||

| General Fund: | |||||

| Taxes Receivable–Current | $2,005,000 | ||||

| Allowance for Uncollectible Current Taxes | $65,000 | ||||

| Revenues | 1,940,000 | ||||

| Revenues Ledger: | |||||

| Property Taxes | $1,940,000 | ||||

| Governmental Activities: | |||||

| Taxes Receivable–Current | $2,005,000 | ||||

| Allowance for Uncollectible Current Taxes | $65,000 | ||||

| General Revenues–Property Taxes | 1,940,000 | ||||

Table (3)

4.

Entry to record collection of delinquent taxes:

| General Ledger | Subsidiary Ledger | ||||

| Debits | Credits | Debits | Credits | ||

| General Fund and Governmental Activities: | |||||

| Cash | $1,591,000 | ||||

| Taxes Receivable–Delinquent | $132,000 | ||||

| Taxes Receivable–Current | 1,459,000 | ||||

Table (4)

5.

Entry to charge costs to appropriations:

| General Ledger | Subsidiary Ledger | |||||

| Debits | Credits | Debits | Credits | |||

| General Fund: | ||||||

| Expenditures | $1,750,100 | |||||

| Vouchers Payable | $1,750,100 | |||||

| Expenditures Ledger: | ||||||

| General Government | $411,000 | |||||

| Public Safety | 635,000 | |||||

| Public Works | 254,000 | |||||

| Health and Welfare | 439,000 | |||||

| Miscellaneous | 11,100 | |||||

| Governmental Activities: | ||||||

| Expenses–General Government | $422,100 | |||||

| Expenses–Public Safety | 635,000 | |||||

| Expenses–Public Works | 254,000 | |||||

| Expenses–Health and Welfare | 439,000 | |||||

| Vouchers Payable | $1,750,100 | |||||

Table (5)

6.

Entry for the receipt of invoice for the goods ordered in prior year and payment approval:

| General Ledger | Subsidiary Ledger | ||||

| Debits | Credits | Debits | Credits | ||

| General Fund: | |||||

| Encumbrances Outstanding–2019 | $14,000 | ||||

| Encumbrances–2019 | $14,000 | ||||

| Encumbrances Ledger–2019: | |||||

| Public Safety | $14,000 | ||||

| Expenditures–2019 | 14,000 | ||||

| Expenditures–2019 | 470 | ||||

| Vouchers Payable | 14,470 | ||||

| Expenditures Ledger–2020: | |||||

| Public Safety | $470 | ||||

| Expenditures Ledger–2019: | |||||

| Public Safety | 14,000 | ||||

| Governmental Activities: | |||||

| Expenses–Public Safety | 14,470 | ||||

| Vouchers Payable | 14,470 | ||||

Table (6)

7.

Entry for the receipt of invoice for the goods ordered in 2020:

| General Ledger | Subsidiary Ledger | ||||

| Debits | Credits | Debits | Credits | ||

| General Fund: | |||||

| Encumbrances Outstanding–2020 | $851,200 | ||||

| Encumbrances–2020 | $851,200 | ||||

| Encumbrances Ledger–2020: | |||||

| General Government | $52,200 | ||||

| Public Safety | 240,900 | ||||

| Public Works | 367,000 | ||||

| Health and Welfare | 130,100 | ||||

| Miscellaneous | 71,000 | ||||

| Expenditures–2020 | 850,500 | ||||

| Vouchers Payable | 850,500 | ||||

| Expenditures Ledger–2020: | |||||

| General Government | $52,700 | ||||

| Public Safety | 236,200 | ||||

| Public Works | 360,000 | ||||

| Health and Welfare | 130,600 | ||||

| Miscellaneous | 71,000 | ||||

| Governmental Activities: | |||||

| Expenses–General Government | 123,700 | ||||

| Expenses–Public Safety | 236,200 | ||||

| Expenses–Public Works | 360,000 | ||||

| Expenses–Health and Welfare | 130,600 | ||||

| Vouchers Payable | 850,500 | ||||

Table (7)

8.

Entry to record revenues collected:

| General Ledger | Subsidiary Ledger | ||||

| Debits | Credits | Debits | Credits | ||

| General Fund: | |||||

| Cash | $839,000 | ||||

| Revenues | $839,000 | ||||

| Revenues Ledger: | |||||

| Licenses and Permits | $373,000 | ||||

| Intergovernmental Revenue | 400,000 | ||||

| Miscellaneous Revenues | 66,000 | ||||

| Governmental Activities: | |||||

| Cash | |||||

| Program Revenues–General Government–Charges for Services | $373,000 | ||||

| Program Revenues–Public Safety–Operating Grants and Contributions | 400,000 | ||||

| General Revenues–Miscellaneous | 66,000 | ||||

Table (8)

9.

Entry to record the payment of vouchers:

| General Ledger | Subsidiary Ledger | ||||

| Debits | Credits | Debits | Credits | ||

| General Fund and Governmental Activities: | |||||

| Vouchers Payable | $2,505,000 | ||||

| Cash | $2,505,000 | ||||

Table (9)

b.

Prepare the budgetary comparison schedule for the General Fund of the City E for the year ending December 31, 2020.

Explanation of Solution

Budgetary comparison schedule: The schedule that shows the actual revenues, expenditures, outstanding encumbrances in comparison with the budgeted revenues, and appropriations as on a particular date, is referred to as budgetary comparison schedule.

Prepare the budgetary comparison schedule for the General Fund of the City E for the year ending December 31, 2020.

| City E | |||

| General Fund | |||

| Budgetary Comparison Schedule | |||

| For the Year Ended December 31, 2020 | |||

| Budgeted Amounts (Original and Final) | Actual Amounts | Variance with Final Budget Over (Under) | |

| Revenues: | |||

| Taxes | $1,943,000 | $1,940,000 | $(3,000) |

| Licenses and permits | 372,000 | 373,000 | 1,000 |

| Intergovernmental revenue | 397,000 | 400,000 | 3,000 |

| Miscellaneous revenues | 62,000 | 66,000 | 4,000 |

| Total Revenues | 2,774,000 | 2,779,000 | 5,000 |

| Expenditures and Encumbrances: | |||

| General government | $471,000 | 469,500 | (1,500) |

| Public safety | 886,000 | 880,770 | (5,230) |

| Public works | 650,000 | 649,000 | (1,000) |

| Health and welfare | 600,000 | 599,500 | (500) |

| Miscellaneous | 86,000 | 82,100 | (3,900) |

| Total Expenditures | 2,693,000 | 2,680,870 | (12,130) |

| Excess of Revenues over Expenditures | 81,000 | 98,130 | 17,130 |

| Increase in Encumbrances Outstanding | 0 | 65,800 | 65,800 |

| Increase in Fund Balances for Year | 81,000 | 163,930 | 82,930 |

| Fund Balances, January 1, 2020 | 96,900 | 96,900 | 0 |

| Fund Balances, December 31, 2020 | $177,900 | $260,830 | $82,930 |

Table (10)

Want to see more full solutions like this?

Chapter 4 Solutions

ACCT. FOR GOV.&NONPROF. ENTITIES>CUSTOM

- The following transactions relate to the General Fund of the City of Buffalo Falls for the year ended December 31, 2020: Beginning balances were: Cash, $99,000; Taxes Receivable, $198,500; Accounts Payable, $56,750; and Fund Balance, $240,750. The budget was passed. Estimated revenues amounted to $1,290,000 and appropriations totaled $1,286,200. All expenditures are classified as General Government. Property taxes were levied in the amount of $945,000. All of the taxes are expected to be collected before February 2021. Cash receipts totaled $915,000 for property taxes and $312,500 from other revenue. Contracts were issued for contracted services in the amount of $105,750. Contracted services were performed relating to $94,500 of the contracts with invoices amounting to $91,700. Other expenditures amounted to $990,500. Accounts payable were paid in the amount of $1,132,500. The books were closed. Required:a. Prepare journal entries for the above transactions.b. Prepare a Statement of…arrow_forwardThe following transactions relate to the General Fund of the City of Buffalo Falls for the year ended December 31, 2020: Beginning balances were: Cash, $94,000; Taxes Receivable, $191,000; Accounts Payable, $53,000; and Fund Balance, $232,000. The budget was passed. Estimated revenues amounted to $1,240,000 and appropriations totaled $1,237,200. All expenditures are classified as General Government. Property taxes were levied in the amount of $920,000. All of the taxes are expected to be collected before February 2021. Cash receipts totaled $890,000 for property taxes and $300,000 from other revenue. Contracts were issued for contracted services in the amount of $97,000. Contracted services were performed relating to $87,000 of the contracts with invoices amounting to $85,200. Other expenditures amounted to $968,000. Accounts payable were paid in the amount of $1,100,000. The books were closed. Required:a. Prepare journal entries for the above transactions.b. Prepare a Statement of…arrow_forwardExplain both in detailarrow_forward

- The City of Jonesboro engaged in the following transactions during the fiscal year ended September 30, 2018. Record the following transactions related to interfund transfers. Be sure to indicate in which fund the entry is being made. a. The city transferred $400,000 from the general fund to a debt service fund to make the interest payments due during the fiscal year. The payments due during the fiscal year were paid. The city also transferred $200,000 from the general fund to a debt service fund to advance-fund the $200,000 interest payment due October 15, 2019. b. The city transferred $75,000 from the Air Operations Special Revenue Fund to the general fund to close out the operations of that fund. c. The city transferred $150,000 from the general fund to the city’s Electric Utility Enterprise Fund to pay for the utilities used by the general and administrative offices during the year. d. The city transferred the required pension contribution of $2 million from the general fund to the…arrow_forwardThe following transactions related to the General Fund of the City of Buffalo Falls for the year ended December 31, 2020: 1. Beginning balances were: Cash, $100,000: Taxes Receivable, $200,000: Accounts Payable, $57,500: and Fund Balance, $242,500. 2. The budget was passed. Estimated revenues amounted to $1, 300,000 and appropriations totaled1,296,000. All expenditures are classified as General Government. 3. Property taxes were levied in the amount of $950,000. All of the taxes are expected to be collected before February 2021. 4. Cash receipts totaled $920,000 for property taxes and $315,000 from other revenue. 5. Contracts were issued for contracted services in the amount of $107,500. 6. Contracted services were performed relating to $96,000 of the contracts with invoices amounting to $93,000. 7. Other expenditures amounted to $995,000. 8. Accounts payable were paid in the amount of $1,140,000. 9. The books were closed. Required: c. Prepare a Balance Sheet for the General Fund…arrow_forwardThe board of commissioners of Perry City approved the city budget for the year starting July 1, 2019, which indicated estimated revenue of $1,000,000 and appropriations of $900,000. When the city CLOSES OUT the budget at the end of the fiscal year, the entry would include: O A) a debit to Budgetary Fund Balance - Unassigned in the amount of $100,000. B) a credit to Budgetary Fund Balance – Unassigned in the amount of $100,000. C) a debit to Appropriations in the amount of $900,000. D) a debit to Estimated Revenues in the amount of $1,000,000. E) both A. and C.arrow_forward

- The board of commissioners of the City of Hartmoore adopts a general fund budget for the year ending June 30, 2024. It includes revenues of $1,250,000, bond proceeds of $612,500; appropriations of $927,500, and operating transfers out of $525,000. Required: a. If this budget is formally integrated into the accounting records, what journal entry is required at the beginning of the year? b. If this budget is formally integrated into the accounting records, what later entry is required? Complete this question by entering your answers in the tabs below. Required A Required B If this budget is formally integrated into the accounting records, what journal entry is required at the beginning of the year? Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction listarrow_forwardKM County approves the operating budget for the General Fund for 2021 (1/1/21 to 12/31/21), providing for $1,000,000 in revenue and $900,000 in expenditures. What is the appropriate journal entry in the General Fund to record the budget given any difference between the approved revenues and expenditures is unassigned?arrow_forwardThe City of South Pittsburgh maintains its books so as to prepare fund accounting statements and records worksheet adjustments in order to prepare government-wide statements. Deferred inflows of resources—property taxes of $51,200 at the end of the previous fiscal year were recognized as property tax revenue in the current year’s Statement of Revenues, Expenditures, and Changes in Fund Balance. The City levied property taxes for the current fiscal year in the amount of $10,000,000. When making the entries, it was estimated that 2 percent of the taxes would not be collected. At year-end, $200,000 is thought to be uncollectible, $349,000 would likely be collected during the 60-day period after the end of the fiscal year, and $53,800 would be collected after that time. The City had recognized the maximum of property taxes allowable under modified accrual accounting. In addition to the expenditures recognized under modified accrual accounting, the City computed that $29,000 should be…arrow_forward

- ces Following are transactions and events of the General Fund of the City of Springfield for the fiscal year ended December 31, 2020. 1. Estimated revenues (legally budgeted) Property taxes Sales taxes Licenses and permits Miscellaneous 2. Appropriations: General government Culture and recreation Health and welfare. 3. Revenues received (cash) Property taxes Sales taxes Licenses and permits General government Culture and recreation Health and welfare. 5. Goods and services received (paid in cash) General government culture and recreation Health and welfare Miscellaneous 4. Encumbrances issued (includes salaries and other recurring items) Estimated $5,275,000 4,630,000 995,000 6. Budget revisions Estimated Revenues Appropriations Increase appropriations: General government $ 140,000 110,000 Culture and recreation. 7. Fund balance on January 1, 2020, was $753,000. There were no outstanding encumbrances at that date. a. Record the transactions using appropriate journal entries, b. Prepare…arrow_forwardAssume that the City of Pasco maintains its books and records in a manner that facilitates preparation of the fund financial statements. The city engaged in the following transactions related to its general fund during the current fiscal year. The city formally integrates the budget into the accounting records. The city does not maintain an inventory of supplies. All amounts are in thousands. Prepare, in summary form, the appropriate journal entries. (a) The city council approved a budget with revenues estimated to be $800 and expenditures of $785. (b) The city ordered supplies at an estimated cost of $25 and equipment at an estimated cost of $20. (c) The city incurred salaries and other operating expenses during the year totaling $730. The city paid for these items in cash. (d) The city received the supplies at an actual cost of $23. (e) The city collected revenues of $795.arrow_forwardIn 2019, a state government collected income taxes of $8,000,000 for the benefit of one of its cities that imposes an income tax on its residents. The state periodically remitted these collections to the city. The state should account for the $8,000,000 in the a. general fund. b. agency funds. c. internal service funds. d. special assessment funds.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education